**

Image: bitcointaxes.zendesk.com

**

Introduction

Options trading is a sophisticated investment strategy that can amplify both potential rewards and risks. If you’re a TurboTax user who dabbles in options, seamlessly importing your trades into the software is crucial for accurate tax filing. In this comprehensive guide, we’ll demystify the process of TurboTax options trading import, empowering you to breeze through tax season with confidence and precision. Let’s dive into the world of options trading, ensuring your taxes are filed with finesse.

Decoding Options Trading

Options contracts grant you the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset, like a stock or ETF, at a predetermined price (strike price) by a certain date (expiration date). The allure of options lies in their flexibility to hedge against risk, speculate on market movements, and generate income through premium collection.

TurboTax’s Options Trading Import

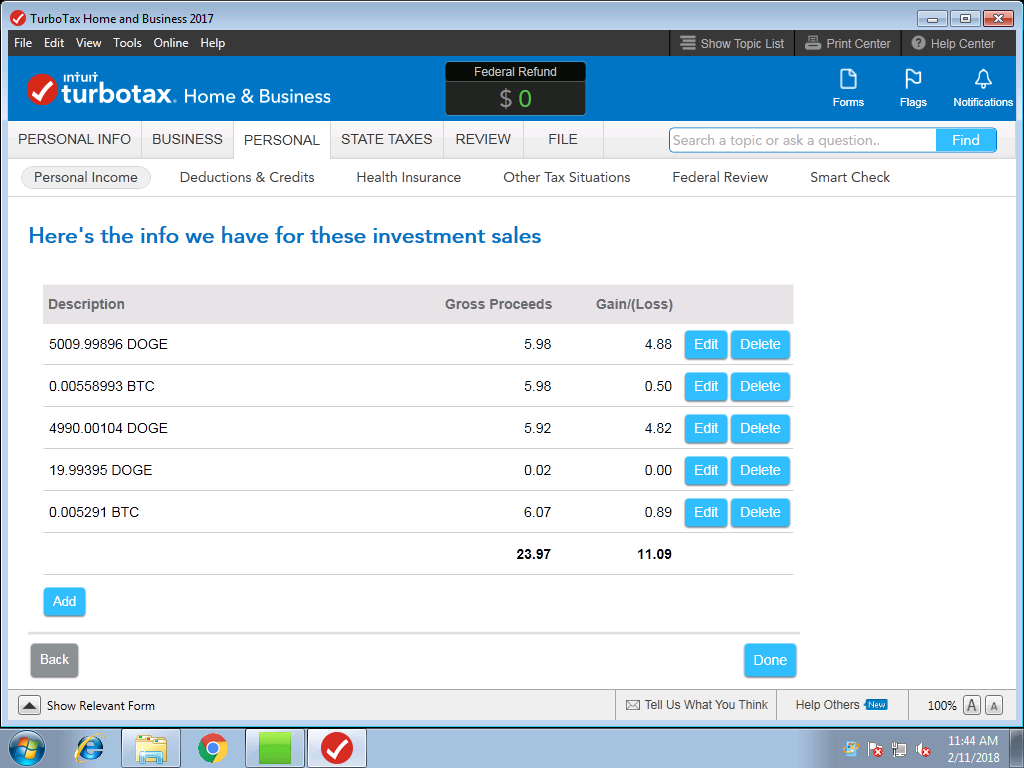

TurboTax seamlessly integrates with your brokerage accounts, making it a breeze to import your options trading history. To initiate the import, simply navigate to the “Investments” section within TurboTax. Select “Import,” choose your brokerage account, and follow the on-screen prompts. TurboTax will automatically fetch your trades, saving you countless hours of manual data entry.

Navigating the Options Import Process

Upon importing your options trades, TurboTax meticulously categorizes each transaction as either a sale, purchase, closing, or adjustment. This meticulous classification ensures highly accurate tax calculations, eliminating the risk of human error or misinterpretation. The import process also captures vital information, such as the underlying asset, strike price, expiration date, and premium paid or received. This comprehensive data collection empowers TurboTax to optimize your tax preparation, uncovering every deduction and credit you’re entitled to.

Unlocking the Power of Options

TurboTax’s options trading import feature transcends mere data transfer; it empowers you to make informed tax decisions. The software meticulously calculates gains or losses on closed options contracts and carries over open positions to the following year. This seamless integration ensures that your taxes are filed accurately, maximizing your deductions and minimizing your taxable income.

Expert Insights

Tax expert Mark Jenkins, CPA, emphasizes the importance of accuracy when importing options trades into TurboTax. “Meticulously review the imported data to ensure it aligns with your trading records. This preemptive measure can identify any potential errors, preventing costly mistakes during tax time.”

Conclusion

TurboTax options trading import is the epitome of convenience and accuracy. By harmonizing your trading history with the software’s robust tax calculations, you can rest assured that your taxes are prepared with pinpoint precision. Embrace the power of seamless data integration, making tax season a breeze while maximizing your tax savings. Remember, the key to tax filing success lies in organization and meticulous data handling. Go forth with confidence, dear trader, and may your tax preparation journey be fraught with ease and efficiency.

Image: emby.media

Turbotax Options Trading Import

Image: www.pinterest.com