Introduction

Image: spac.guide

The world of finance is constantly evolving, and the emergence of special purpose acquisition companies (SPACs) has created a unique and lucrative opportunity for investors. SPACs have become a popular vehicle for companies to go public without the traditional initial public offering (IPO) process, offering both potential upside and downside risks. Options trading provides investors with an effective way to navigate the SPAC market, allowing them to hedge their risk and enhance their potential returns.

In this comprehensive guide, we will delve into the world of SPAC options trading, explaining basic concepts, exploring strategies, and providing valuable insights. By the end of this article, you will have a solid understanding of how to harness the power of SPAC options to maximize your investment opportunities.

Understanding SPAC Options

SPAC options are contracts that grant the buyer the right, but not the obligation, to buy or sell a security at a specified price on or before a certain date. SPAC options can be classified into two main types:

- Call options: Gives the buyer the right to buy a specified number of shares of the underlying SPAC at a specified price (strike price) on or before a certain date (expiration date).

- Put options: Gives the buyer the right to sell a specified number of shares of the underlying SPAC at a specified price (strike price) on or before a certain date (expiration date).

The price of SPAC options is influenced by various factors, including the underlying SPAC’s performance, market volatility, interest rates, and time to expiration.

Benefits of SPAC Options Trading

- Leverage: Options allow investors to control a greater number of shares than their initial investment would permit, potentially enhancing their returns.

- Hedging: Options can be used to hedge against downside risk by allowing investors to sell their SPAC shares if the price falls below a certain level.

- Income Generation: Options can be used to generate income by selling call options and collecting premiums.

- Flexibility: Options provide investors with the flexibility to adjust their positions as market conditions change.

Strategies for SPAC Options Trading

- Covered Call Strategy: Selling call options against SPAC shares that you own, generating income while limiting potential upside.

- Protective Put Strategy: Buying put options to protect against potential downside risk, ensuring a floor price for your SPAC shares.

- Collar Strategy: Combining a covered call strategy with a protective put strategy, further limiting risk while generating income.

- Iron Condor Strategy: Selling both call and put options at different strike prices to create a range-bound trade, profiting from limited price movements.

Conclusion

SPAC options trading provides investors with a range of opportunities to enhance their returns and manage risk. By understanding the basics, exploring strategies, and leveraging the flexibility of options, you can navigate the SPAC market and capitalize on its potential for substantial gains. Remember, options trading carries both potential rewards and risks, so it is crucial to conduct thorough research and consult with a financial advisor before making any investment decisions.

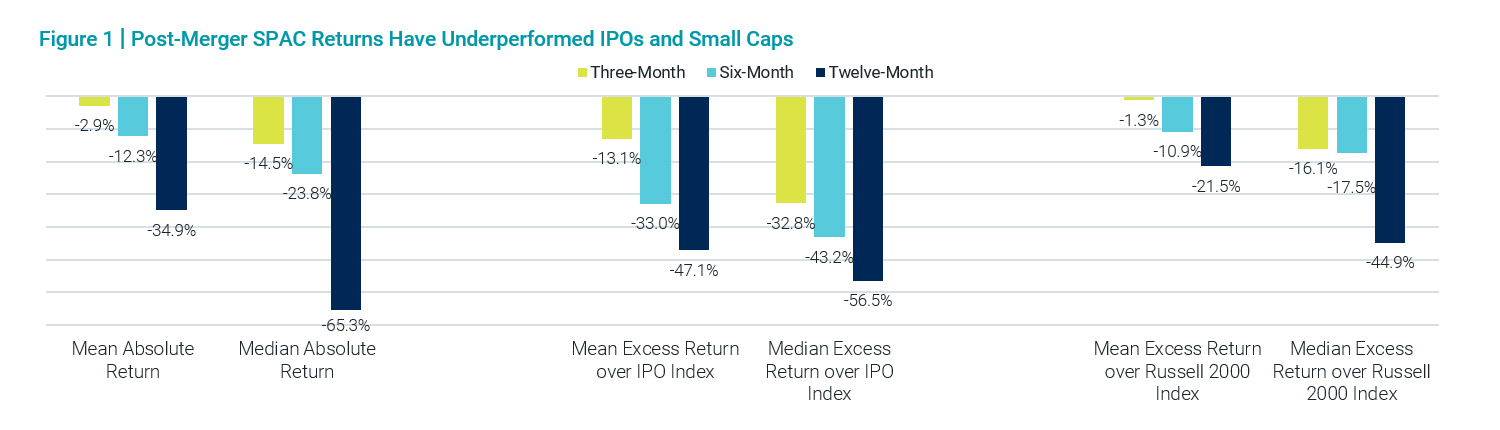

Image: www.perigonwealth.com

Spac Options Trading

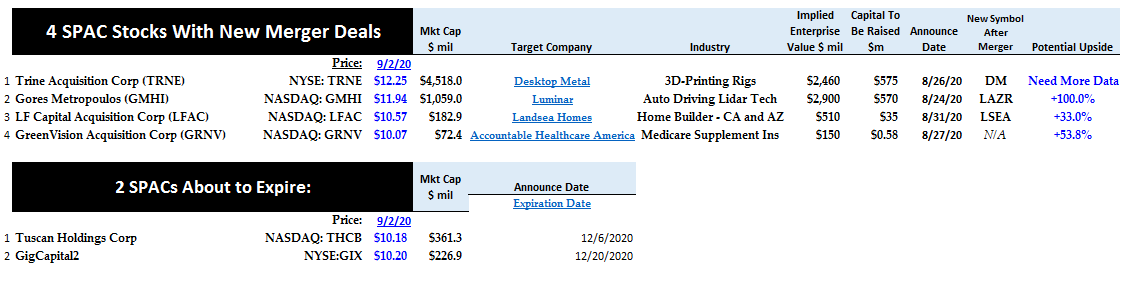

Image: investorplace.com