Introduction

SPACs, or Special Purpose Acquisition Companies, have emerged as a popular investment instrument in recent years. They provide investors with the potential for high returns, but they also carry inherent risks. Understanding SPACs and their associated options trading strategies is essential for investors seeking to maximize their profits while mitigating risks. This comprehensive guide will delve into the intricacies of SPAC options trading, providing actionable insights and expert analysis to empower investors in making informed decisions.

Image: www.environmentaltradingedge.com

What are SPACs?

SPACs are shell companies formed with the sole purpose of raising capital through an initial public offering (IPO). The proceeds from the IPO are then used to acquire a private company, essentially taking it public through a reverse merger. Unlike traditional IPOs, SPACs often lack a specific business plan or operations, with the target company only being identified after the funds are raised.

SPAC Options Trading

Options are financial contracts that give buyers the right, but not the obligation, to buy or sell an underlying asset at a specified price on or before a particular date. In the context of SPACs, options can be used to speculate on the future performance of the target company or hedge against potential risks.

Types of SPAC Options

- Call Options: Grant the holder the right to buy a specific number of SPAC shares at a predetermined price, known as the strike price, on or before the expiration date. These options are often used when investors anticipate a gain in SPAC share value.

- Put Options: Provide the holder the right to sell a specific number of SPAC shares at a predetermined strike price on or before the expiration date. These options are typically used when investors expect a decline in SPAC share value or seek to protect their investment against downside risks.

Image: www.tradingview.com

Strategies for SPAC Options Trading

A variety of options trading strategies can be employed in the context of SPACs. Some common approaches include:

- Long Calls: Buying call options with a strike price above the current SPAC share price, anticipating an increase in share value.

- Short Puts: Selling put options with a strike price below the current SPAC share price, anticipating a rise in share value or hedging against a potential decline.

- Collar Strategy: Combining the purchase of a call option with the sale of a put option at a higher strike price, creating a capped return but protecting against downside risks.

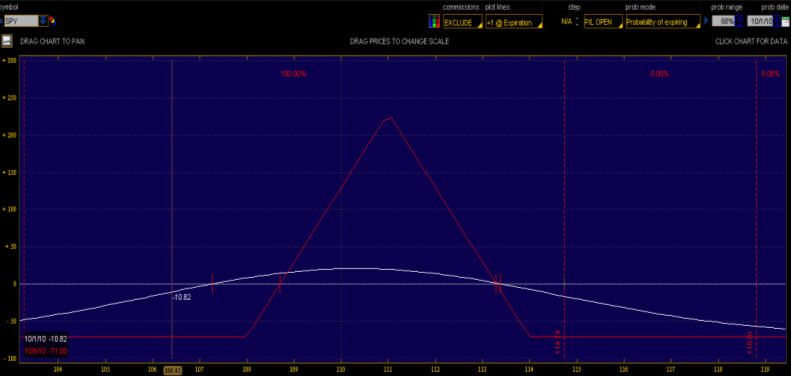

- Spread Strategies: Involving the simultaneous purchase and sale of options at different strike prices with the same expiration date, aiming to generate returns from price fluctuations within a defined range.

Understanding SPAC Option Risks

SPAC options trading involves several inherent risks that investors must be aware of:

- High Volatility: SPAC share prices can exhibit significant volatility, particularly around the time of a merger announcement. This can lead to substantial losses for options buyers if the underlying share price deviates significantly from the strike price.

- Limited Liquidity: SPAC options may have limited liquidity, making it challenging to execute trades quickly and efficiently. The bid-ask spread, the difference between the highest bid and lowest ask prices, can also be wide, resulting in potential losses or missed opportunities.

- Dilution Risk: Investors should carefully consider the potential for dilution when exercising SPAC options. If the target company issues new shares as part of the merger agreement, the value of existing shares, including those acquired through options, could be diluted.

Tips for Successful SPAC Options Trading

To enhance your chances of success in SPAC options trading, consider the following tips:

- Conduct Thorough Research: Understand the target company’s business model, financial projections, and market competitive landscape.

- Identify Suitable Options: Choose options based on your risk appetite, investment goals, and the expected performance of the SPAC and target company.

- Manage Your Risk: Employ proper risk management strategies, such as diversifying your portfolio or hedging with opposing positions.

- Monitor Market Conditions: Stay informed of market trends, news, and announcements that may impact SPAC share prices and options premiums.

- Seek Professional Advice: Consider consulting with a financial advisor or registered investment professional for personalized guidance and support.

Spaq Options Trading

Image: www.marketoracle.co.uk

Conclusion

SPAC options trading can be a lucrative investment strategy for those who possess a thorough understanding of SPACs, options markets, and risk management. By employing informed decision-making and implementing suitable strategies, investors can leverage SPAC options to generate potential returns while mitigating risks. Remember, it’s crucial to conduct thorough research, stay informed of market conditions, and seek professional guidance when necessary to enhance your chances of success in this dynamic and ever-evolving field.