Introduction:

Image: www.asktraders.com

In the ever-evolving world of investing, mastering options trading can open doors to lucrative opportunities. DWAC (Digital World Acquisition Corp.) options have emerged as a compelling investment vehicle, offering traders the chance to capitalize on potential price movements and potentially enhance their returns. Embark on a journey into the realm of DWAC options trading, where we will unveil its complexities, delve into expert insights, and arm you with valuable strategies to make well-informed decisions.

Comprehending DWAC Options Trading:

Options provide traders the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset, in this case, DWAC shares, at a predetermined price (strike price) on or before a specified expiration date. These versatile instruments enable investors to speculate on potential price fluctuations, hedge against downside risks, and generate income through option premiums.

Understanding the DWAC Stock:

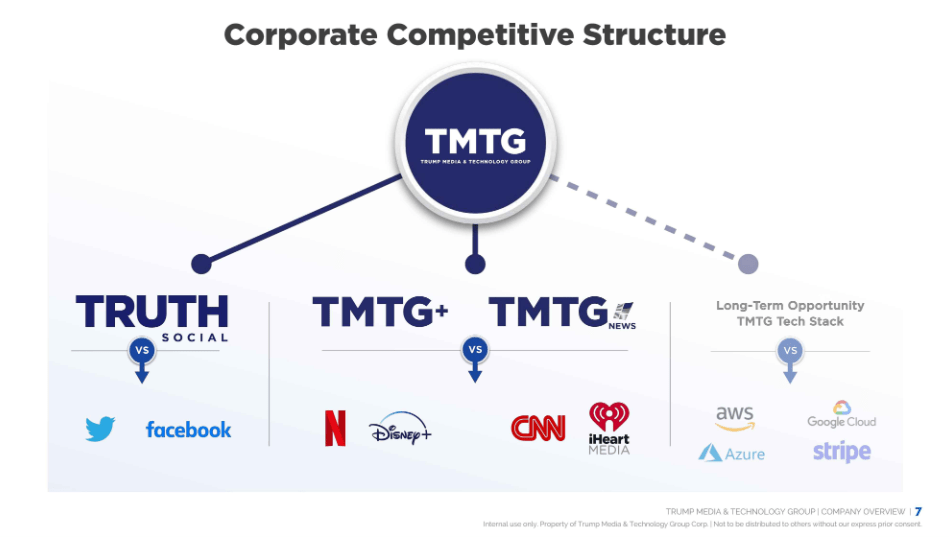

DWAC made headlines with its merger with Trump Media & Technology Group, propelling its stock into the limelight. The company operates a social media platform and streaming service, seeking to appeal to conservatives and those seeking alternative media sources. As a special purpose acquisition company (SPAC), DWAC raised capital through an initial public offering (IPO) with the intent of merging with a private target company, subject to shareholder approval. This has fueled investor interest and led to significant price volatility, making DWAC options an intriguing trading opportunity.

Benefits and Risks of DWAC Options Trading:

Options trading offers distinct advantages that attract many traders. They provide the ability to:

• Leverage Price Movements: Trade on market expectations, potentially amplifying gains.

• Manage Risk: Hedge against potential losses on underlying stock positions.

• Enhance Returns: Generate income through option premiums or by utilizing various trading strategies.

However, options trading also carries inherent risks. It is crucial to thoroughly comprehend the underlying principles, market dynamics, and your own risk tolerance before engaging. Potential risks include:

• Complexity: Options contracts can be more difficult to comprehend compared to investing in stocks.

• Loss Potential: Options buyers can lose the premium paid, while sellers face the risk of significant losses if the underlying asset moves against the predicted direction.

• Expiration: Options have a limited lifespan, potentially limiting profit opportunities.

Strategies for Trading DWAC Options:

Seasoned traders employ a range of strategies to harness the potential of DWAC options trading. Here are a few commonly used approaches:

• Buy Call Options: This bullish strategy involves purchasing a call option when traders anticipate an increase in the underlying stock price. Potential profits are unlimited, while losses are capped at the premium paid.

• Sell Call Options: A neutral or bearish strategy where the trader sells a call option, anticipating a stable or declining stock price. Limited profits but a premium is received at the sale.

• Buy Put Options: A bearish strategy where traders buy a put option, profiting from a decline in the underlying stock price. Losses are limited to the premium paid.

• Sell Put Options: This neutral or bullish strategy involves selling a put option, anticipating a stable or rising stock price. Limited profits but a premium is received at the sale.

Expert Insights and Practical Tips:

To enhance your DWAC options trading journey, seek guidance from renowned experts in the field. Consult financial advisors and research reputable sources to fully grasp market dynamics and trading techniques.

Embrace the following tips to optimize your trading:

• Understand the Risk: First and foremost, comprehend the associated risks before venturing into options trading.

• Research, Research, Research: Thoroughly research the underlying asset and market conditions to make informed decisions.

• Start Cautiously: Begin with small trades to build confidence and gain experience.

• Set Realistic Expectations: Options trading involves potential rewards, but also inherent risks. Avoid chasing excessive profits.

Conclusion:

Navigating the realm of DWAC options trading requires a blend of knowledge, strategy, and cautious risk-taking. By equipping yourself with the insights and strategies outlined in this comprehensive guide, you can harness the power of options trading and make well-informed decisions. Remember to embrace continuous learning, seek expert guidance when necessary, and always trade responsibly. May your journey into the world of DWAC options trading be marked by success and fulfillment.

Image: ockrdrnvknoa.blogspot.com

Dwac Options Trading

Image: www.youtube.com