Introduction

In the ever-evolving financial landscape, SPACs (Special Purpose Acquisition Companies) have emerged as a game-changer for both investors and entrepreneurs. And with the introduction of SPAC options, a new dimension of possibilities has opened up in the realm of alternative investing. If you’re ready to venture into the exciting world of SPAC options trading, this guide will equip you with the knowledge and strategies needed to make informed decisions that could enhance your financial well-being.

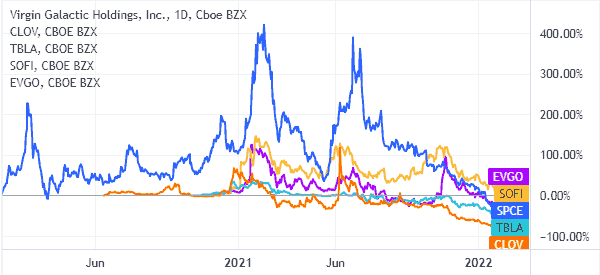

Image: www.daytradetheworld.com

Understanding SPACs and SPAC Options

A SPAC, also known as a “blank-check company,” is a shell company listed on a stock exchange with the sole purpose of acquiring a private company and taking it public. SPACs typically raise funds through an Initial Public Offering (IPO) and have a limited time frame, usually within two years, to find a target company. Once a target is identified, the SPAC merges with the company, making it publicly traded.

SPAC options function similarly to traditional stock options, granting the holder the right to buy or sell a specific number of shares at a predetermined price within a set timeframe. However, SPAC options offer unique advantages. Unlike stock options, SPAC options have a longer expiration period, giving investors more time to realize potential gains. They also provide a means to capitalize on the potential merger target announcement, as the stock price often surges in anticipation of the deal.

Navigating SPAC Option Trading

1. Understand Different Option Types

SPAC options fall into two main categories: “calls” and “puts.” Call options give you the right to buy shares, while put options give you the right to sell. Each type of option has its own strategies and risk-reward profile, so it’s crucial to understand the implications before making a trade.

Image: www.reddit.com

2. Research Potential Target

The key to successful SPAC option trading lies in thoroughly researching the potential target companies. Look for industry trends, management experience, and economic indicators that can impact the target’s future performance. The more information you have, the more confident your decisions will be.

3. Evaluate the SPAC Structure

Scrutinize the SPAC’s management team, fees, and timeline. The quality of the SPAC’s leadership and the terms of the deal can significantly influence the outcome of the investment.

4. Consider Timing

The timing of your SPAC option trades is vital. Options have a limited lifespan, so it’s crucial to enter and exit the trade at the right time to optimize your returns. Factors such as the merger announcement, market conditions, and economic events all play a role in optimal timing.

5. Manage Risk

Like all investments, SPAC option trading carries inherent risks. It’s essential to manage these risks by understanding the potential downside, setting stop-loss orders, and diversifying your portfolio.

Spac Option Trading

Image: darrowwealthmanagement.com

Conclusion

SPAC options trading presents a compelling opportunity for investors to potentially enhance their financial returns. By embracing the knowledge shared in this guide, you can embark on this exciting journey with a solid foundation and the potential to reap the rewards that informed decision-making can bring. Remember, as with any investment, conduct thorough research, consider your risk tolerance, and seek guidance from experienced professionals when needed. The world of SPAC options awaits your exploration. Seize the opportunities and navigate the challenges with confidence and a deep understanding of the market’s dynamics.