The world of financial markets offers a multitude of investment avenues, each with its unique characteristics and risk-reward profiles. Among the popular trading strategies, intraday trading and option trading stand out as distinct options that cater to different investment goals and methodologies. Let’s dive into the key differences between these two approaches.

Image: thomaskq.medium.com

Intraday Trading: A Thrilling Pursuit

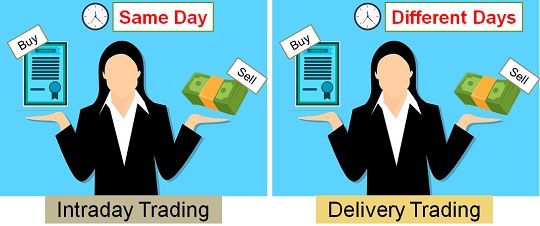

Intraday trading is a fast-paced trading style where traders buy and sell stocks, commodities, or other financial instruments within a single trading day. The primary objective is to capitalize on short-term price fluctuations throughout the day, without holding positions overnight. This strategy demands a high level of market knowledge, technical analysis skills, and risk tolerance.

Key Features of Intraday Trading:

- Intraday Positions: All positions are closed before the market closes for the day.

- Time Frame: Trades are typically executed within minutes or hours.

- Scalping: Intraday traders often engage in scalping, aiming for small profits from multiple trades.

- High Volatility: Leverage and short-term trading can amplify volatility, leading to both substantial gains and significant losses.

Option Trading: Exploring Calculated Risks

Option trading involves the use of financial contracts that give traders the right, but not the obligation, to buy or sell an underlying asset at a predetermined price and date. Unlike intraday trading, options offer the potential for limited risk and defined returns, making them suitable for both speculative and hedging strategies.

Key Features of Option Trading:

- Options Contracts: Traders buy or sell options contracts, which represent the right to buy (call) or sell (put) a specific asset.

- Expiration Dates: Options have specific expiration dates, determining the time frame for exercising the contract.

- Premium Payments: The buyer of an option pays a premium to the seller, representing the cost of the contract.

- Limited Risk: The maximum loss for an option buyer is the premium paid, while the potential rewards can be significant.

Comparative Analysis: Unveiling the Pros and Cons

|Parameter|Intraday Trading|Option Trading|

|:-|:-|:-|

|Risk Profile|High|Low to Moderate|

|Time Commitment:|High|Moderate|

|Trading Frequency:|Multiple trades per day|Infrequent trades|

|Profit Potential:|High, but capped by day’s volatility|Moderate, theoretically unlimited|

|Skill Level:|Requires advanced trading expertise|Suitable for novice to experienced traders|

|Market Conditions:|Volatile markets preferred|Less dependent on market volatility|

|Flexibility:|Trades must be closed within the trading day|Options offer flexibility with expiration dates|

|Capital Requirements:|Can be highly capital intensive|Lower capital requirements compared to intraday trading|

Image: keydifferences.com

Tips for Success in Intraday and Option Trading

Intraday Trading:

- Master technical analysis techniques and understand market trends.

- Identify high-liquidity stocks with ample price volatility.

- Use stop-loss orders to manage risk and prevent extensive losses.

- Start with small trades and gradually increase position size as experience grows.

Option Trading:

- Understand the dynamics of option pricing and implied volatility.

- Choose options with appropriate expiration dates and strike prices that align with trading goals and risk tolerance.

- Use options strategies to mitigate risk and enhance profit potential.

- Research underlying assets and monitor market conditions closely.

Frequently Asked Questions (FAQ)

Q: Which trading style is more profitable?

A: Both intraday trading and option trading offer profit potential, but the suitability depends on individual risk appetite, skill level, and market conditions.

Q: What is the minimum capital required for each strategy?

A: Intraday trading typically requires higher capital to cover intraday price fluctuations, while option trading can be initiated with lower capital as a trader can limit risk by choosing specific option strategies.

Q: Can I trade both intraday and options simultaneously?

A: Yes, it is possible to engage in both trading styles simultaneously, but it requires a diversified approach to risk management and a thorough understanding of both markets.

Difference Between Intraday And Option Trading

Conclusion

Whether it’s the thrill of intraday trading or the calculated approach of option trading, understanding the key differences between these strategies is crucial for informed decision-making. By delving into the intricacies of each approach, traders can select the one that aligns best with their investment objectives and risk tolerance. Remember, every investor’s journey is unique, and exploring the vast array of financial markets offers ample opportunities for growth and success. Tell us, which trading style resonates with you and why?