An Introduction to the Fascinating World of Public Options

Public options trading has been making waves lately, capturing the interest of investors seeking opportunities beyond traditional financial markets. It’s a realm where financial instruments representing public companies can be bought and sold, providing both potential profits and risks.

Image: www.fool.com

Options are contracts that provide buyers with the right, but not the obligation, to buy or sell an underlying asset at a specified price within a defined period. In the context of public options trading, these assets are shares of publicly traded companies. Unlike traditional stock purchases, options trading offers flexibility and leverage, making it an attractive option for both seasoned investors and those seeking diversification.

Delving into the Mechanics of Public Options Trading

What are the Types of Options?

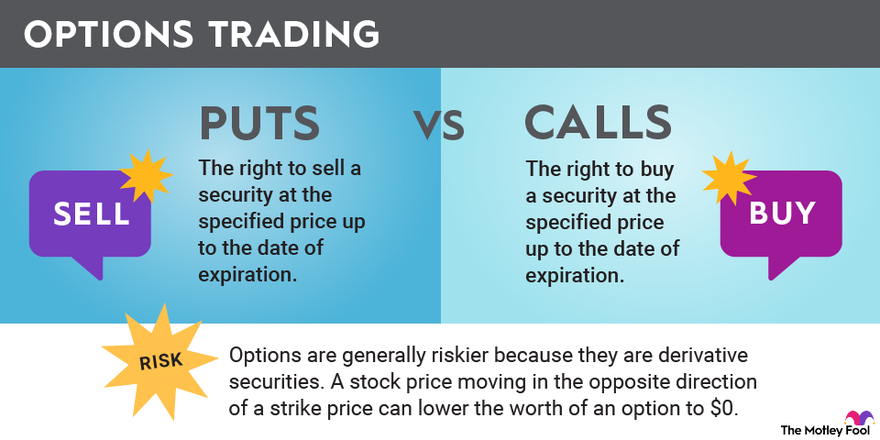

There are two main types of options in public options trading:

- Call options: Give the buyer the right to buy an underlying asset at a specified price (the strike price) on or before a specific date (the expiration date).

- Put options: Give the buyer the right to sell an underlying asset at a specified price (the strike price) on or before a specific date (the expiration date).

Understanding the Key Terms

To navigate public options trading effectively, it’s essential to grasp the following key terms:

- Option premium: The price an investor pays to purchase an option contract.

- Strike price: The predetermined price at which the buyer has the right to buy or sell the underlying asset.

- Expiration date: The last day on which the buyer can exercise their right to buy or sell the underlying asset.

- In-the-money: An option is said to be “in-the-money” if it would result in a profit if exercised immediately.

- Out-of-the-money: An option is said to be “out-of-the-money” if it would result in a loss if exercised immediately.

Image: finance.yahoo.com

The Evolving Landscape of Public Options Trading

The public options trading realm is constantly evolving, driven by technological advancements and regulatory changes. Some of the latest trends include:

- Rise of electronic trading platforms: Electronic platforms have made option trading more accessible and efficient for individual investors.

- Growing popularity of mobile trading: Mobile trading apps allow investors to trade options from anywhere with an internet connection.

- Increased regulatory scrutiny: The popularity of public options trading has led to increased regulatory focus on ensuring market transparency and investor protection.

Tips for Navigating Public Options Trading

Embrace Education and Due Diligence

Entering the public options trading arena requires a solid understanding of the concepts, risks, and strategies involved. Conduct thorough research, consult with financial professionals, and explore educational resources to build your knowledge and make informed decisions.

Start Small and Diversify

Begin with small trades to minimize potential losses. Diversify your options trading portfolio by selecting options on different underlying assets with varying expiration dates and strike prices. This approach helps spread risk and enhance your chances of success.

FAQs on Public Options Trading

Q: Is public options trading suitable for beginners?

A: While options trading offers opportunities, it carries inherent risks. Beginners should approach it with caution, gaining a thorough understanding of the concepts before making trades.

Q: What are the advantages of trading public options?

A: Public options trading offers flexibility, leverage, and the potential for both income and capital gains. It allows investors to capitalize on market fluctuations and speculate on future price movements.

Q: What are the risks associated with public options trading?

A: Public options trading involves significant risks, including the potential for substantial losses. Options premiums can expire worthless, and market volatility can unpredictably affect option prices.

Public Options Trading

Image: xtremetrading.net

Conclusion

Public options trading presents an enticing opportunity for investors seeking to navigate the financial markets beyond traditional stock investment. However, it’s imperative to approach this realm with a solid understanding of the concepts, risks, and strategies involved. By embracing education, starting small, and diversifying your portfolio, you can harness the potential of public options trading while mitigating potential pitfalls.

Are you ready to delve into the captivating world of public options trading? Share your thoughts, questions, and experiences in the comments section below.