Embarking on the journey of options trading can be both exhilarating and daunting, especially for those navigating its complexities for the first time. Among the plethora of strategies that populate this dynamic realm, the long straddle stands out as a versatile tool, empowering traders to navigate market uncertainty with precision. This comprehensive guide will illuminate the intricacies of the long straddle strategy, providing a roadmap for informed decision-making and potential profit maximization.

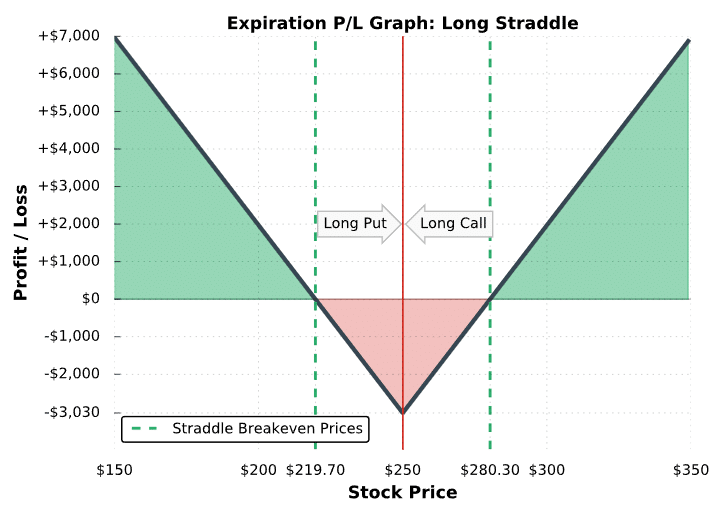

Image: www.projectfinance.com

Unveiling the Long Straddle: A Definition

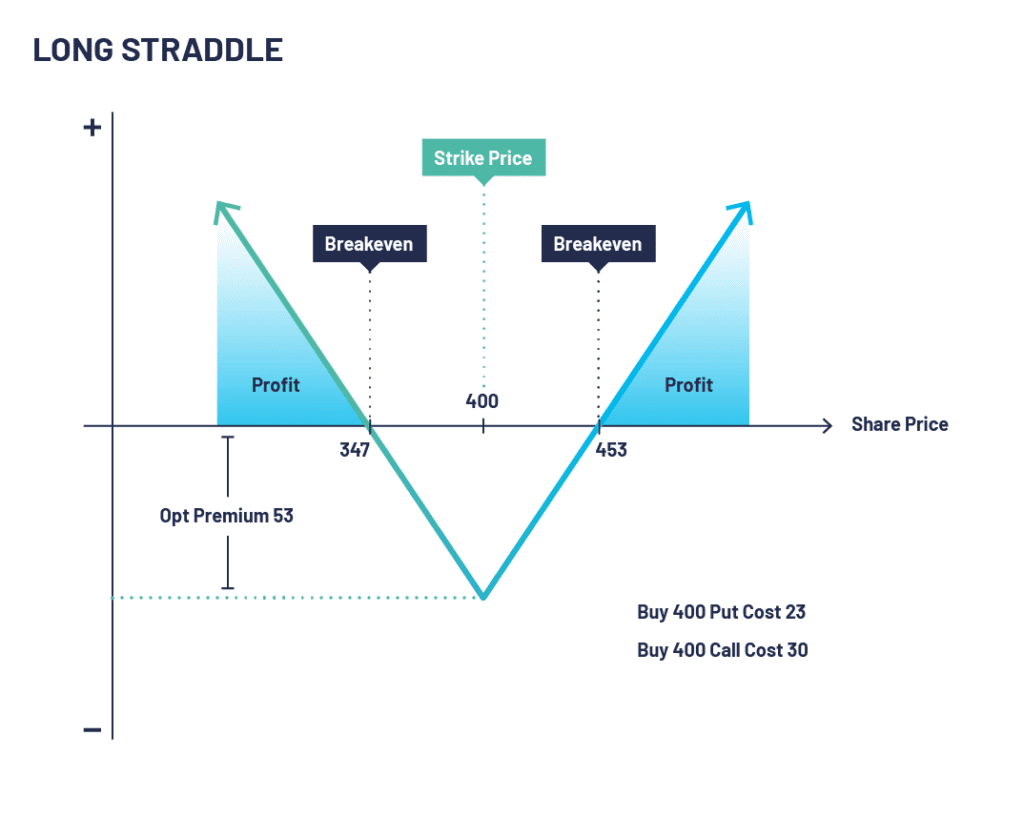

Picture a scenario where市场volatility is high, and the future trajectory of an underlying asset remains shrouded in uncertainty. Enter the long straddle strategy, a tactic that involves simultaneously purchasing both a call and a put option with the same strike price and expiration date. By doing so, traders effectively create a range-bound bet, profiting handsomely should the asset’s price fluctuate significantly within that range.

Anatomy of a Long Straddle

The long straddle’s composition is straightforward yet effective. The call option grants the holder the right, but not the obligation, to purchase the underlying asset at the predetermined strike price on or before the expiration date. Conversely, the put option bestows the right to sell the asset at the strike price. When combined, these options create a protective barrier, shielding the trader from adverse price movements beyond the specified range.

Navigating the Long Straddle’s Nuances

Mastering the long straddle requires an understanding of its key characteristics. Firstly, it flourishes in high-volatility environments, where the underlying asset’s price is likely to gyrate within the strike price range. Secondly, it mitigates downside risk, as the put option provides a safety net against significant price declines. Thirdly, it is a time-sensitive strategy, meaning its value will erode as expiration approaches.

Image: optionsdesk.com

Insights from the Experts: Maximizing Long Straddle Potential

Harnessing the wisdom of seasoned veterans can elevate your long straddle execution. Seasoned traders emphasize identifying assets with elevated implied volatility, judiciously selecting strike prices that align with anticipated price movements, and meticulously managing risk through proper position sizing. Discipline and a keen eye for market dynamics are the cornerstones of successful long straddle implementation.

Options Trading Strategies Long Straddle

Image: www.warriortrading.com

Conclusion: Embracing the Long Straddle’s Power

The long straddle strategy presents a valuable tool for options traders seeking to capitalize on market volatility. Its ability to mitigate risk while offering profit potential makes it an attractive choice for those seeking a balanced approach. By embracing the principles outlined in this guide and seeking expert guidance, traders can harness the potential of the long straddle, navigating market uncertainty with confidence and maximizing their chances of financial success.