Introduction to Backtesting

In the bustling world of financial markets, traders incessantly seek an edge to elevate their strategies. Backtesting is an invaluable tool that empowers them to meticulously evaluate the performance of trading systems before committing real capital. By simulating historical market conditions and executing trades retrospectively, traders can gain deep insights into the profitability, risk metrics, and robustness of their approaches.

Image: www.mql5.com

Equity options, with their versatile nature and diverse risk-reward profiles, provide an alluring battleground for backtesting. The data open interest platform serves as a treasure trove of information, enabling traders to delve into the depths of market sentiment and activity. By exploiting this platform, traders can discern the strategies employed by market participants and identify potential opportunities and pitfalls.

Deciphering Open Interest

Open interest refers to the total number of outstanding contracts for a specific option at a given point in time. It is a crucial indicator of market sentiment and provides valuable insights into the behaviour of option traders. Options with high open interest suggest heightened trading activity, while those with low open interest may indicate a lack of investor interest or conviction.

The age composition of open interest further enriches the analysis. Short-term options (i.e., those expiring within a few days or weeks) tend to be influenced by traders seeking speculative returns or hedging their positions. On the other hand, long-term options often reflect institutional views and longer-term market outlooks. By assessing the age distribution of open interest, traders can gain a better understanding of the market climate and the prevailing sentiment.

Backtesting Equity Options Strategies

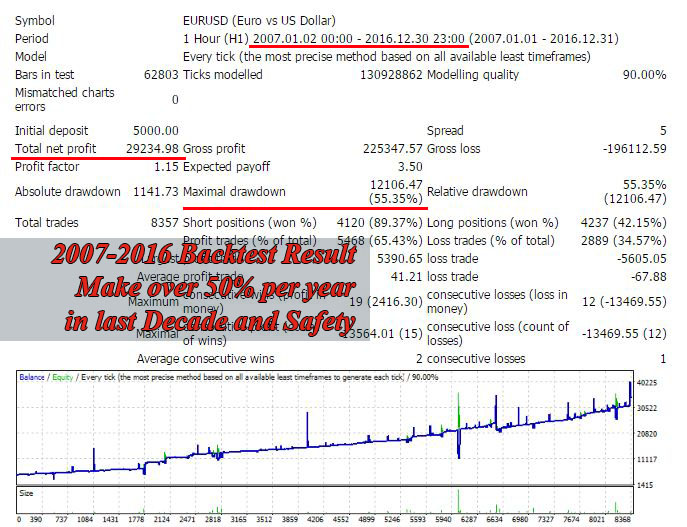

Arming oneself with an arsenal of equity options data, traders can meticulously backtest their strategies. By plugging the data into a backtesting engine or software, they can replicate historical market conditions and simulate trades based on their predetermined rules. This process yields metrics such as return on investment, win rate, average holding period, and maximum drawdown.

Backtesting allows traders to fine-tune their strategies, optimising parameters and evaluating their performance under varying market conditions. It enables them to identify the strengths and weaknesses of their approaches, allowing them to refine their decision-making and improve their risk management practices.

Latest Trends and Developments

The world of financial trading is constantly evolving, with technological advancements and market dynamics shaping the landscape. Backtesting practices have not escaped this transformative evolution.

Artificial intelligence (AI) and machine learning (ML) algorithms are increasingly used to enhance backtesting capabilities. These techniques automate the analysis of vast data sets, identifying patterns and correlations that may not be immediately apparent to human traders. By leveraging AI and ML, traders can improve the accuracy and objectivity of their backtesting results.

Social media and online forums have also emerged as valuable sources of information for traders. These platforms provide access to real-time market chatter, expert insights, and diverse perspectives, enriching the backtesting process and fostering a sense of community among traders.

Image: sanzprophet.com

Tips and Expert Advice

To harness the full potential of backtesting, it is essential to follow a disciplined approach and seek expert advice. Seasoned traders recommend the following tips:

- Define clear goals and objectives: Determine what you want to achieve through backtesting, be it validating a trading hypothesis or optimising an existing strategy.

- Select high-quality data: Ensure the backtesting data is reliable and comprehensive, capturing all relevant market information.

- Test under realistic conditions: Simulate market conditions as accurately as possible, considering factors such as slippage, commissions, and volatility levels.

- Monitor and adjust: Backtesting is an iterative process. Monitor the results closely and make adjustments to your strategy based on the insights gained.

FAQs

Q: What is the importance of data quality in backtesting?

A: High-quality data ensures that the backtesting results are reliable and representative of real-world conditions.

Q: Can backtesting guarantee trading success?

A: Backtesting provides valuable insights but does not guarantee future performance. Market dynamics are complex, and unexpected events can occur.

Q: How often should I backtest my strategies?

A: Regularly backtest your strategies as market conditions change, and you refine your trading approaches.

Backtest Trading Strategies Using Equity Options Data Open Interest Platform

Conclusion

Backtesting trading strategies using equity options data open interest platform empowers traders to refine their approaches, mitigate risk, and enhance their profitability. By understanding the nuances of open interest, leveraging the latest technologies, and seeking expert advice, traders can make informed decisions and navigate the ever-changing market landscape with confidence.

Are you eager to delve deeper into the world of backtesting trading strategies using equity options data? Let us know your thoughts and questions.