Are you tired of relying on outdated, unreliable methods for backtesting trading strategies? Embrace the future of options data by incorporating the groundbreaking Open Interest platform into your workflow. In this comprehensive guide, we’ll delve into the revolutionary world of options data open interest analysis and demonstrate how it can empower you with actionable insights to enhance your trading strategies.

Image: www.youtube.com

Demystifying Options Data Open Interest: A Gateway to Informed Trading

Options data, particularly the open interest, offers a treasure trove of information for discerning traders. Open interest embodies the number of open contracts for a specific options contract, signaling the market’s speculative sentiment and trading activity levels. By analyzing this data, you gain a panoramic view of market positioning, potential price movements, and underlying supply and demand dynamics.

Mastering the Art of Backtesting Trading Strategies with Options Data

Traditional backtesting methods, while valuable, often fall short in capturing the nuanced complexities of options markets. Incorporating options data open interest into your backtesting framework adds a new dimension, allowing you to evaluate strategies with unprecedented accuracy and depth. By factoring in open interest data, you can:

- Gauge Market Sentiment: Assess the collective sentiment of market participants towards a particular stock or asset, helping you make informed decisions about market direction.

- Identify Trading Opportunities: Spot potential turning points and trade signals by analyzing changes in open interest alongside other technical indicators.

- Measure Liquidity: Quantify the liquidity of options contracts, ensuring you have realistic expectations for trade execution and slippage.

- Fine-tune Parameters: Optimize your strategy parameters based on the behavior of open interest over historical data, maximizing profitability and risk management.

Unlocking the Power of Options Data: A Step-by-Step Approach

Embarking on the journey of options data open interest analysis is a rewarding endeavor, but it requires a structured approach:

- Access Real-Time Data: Subscribe to a reputable data provider that offers comprehensive and reliable options data, including open interest.

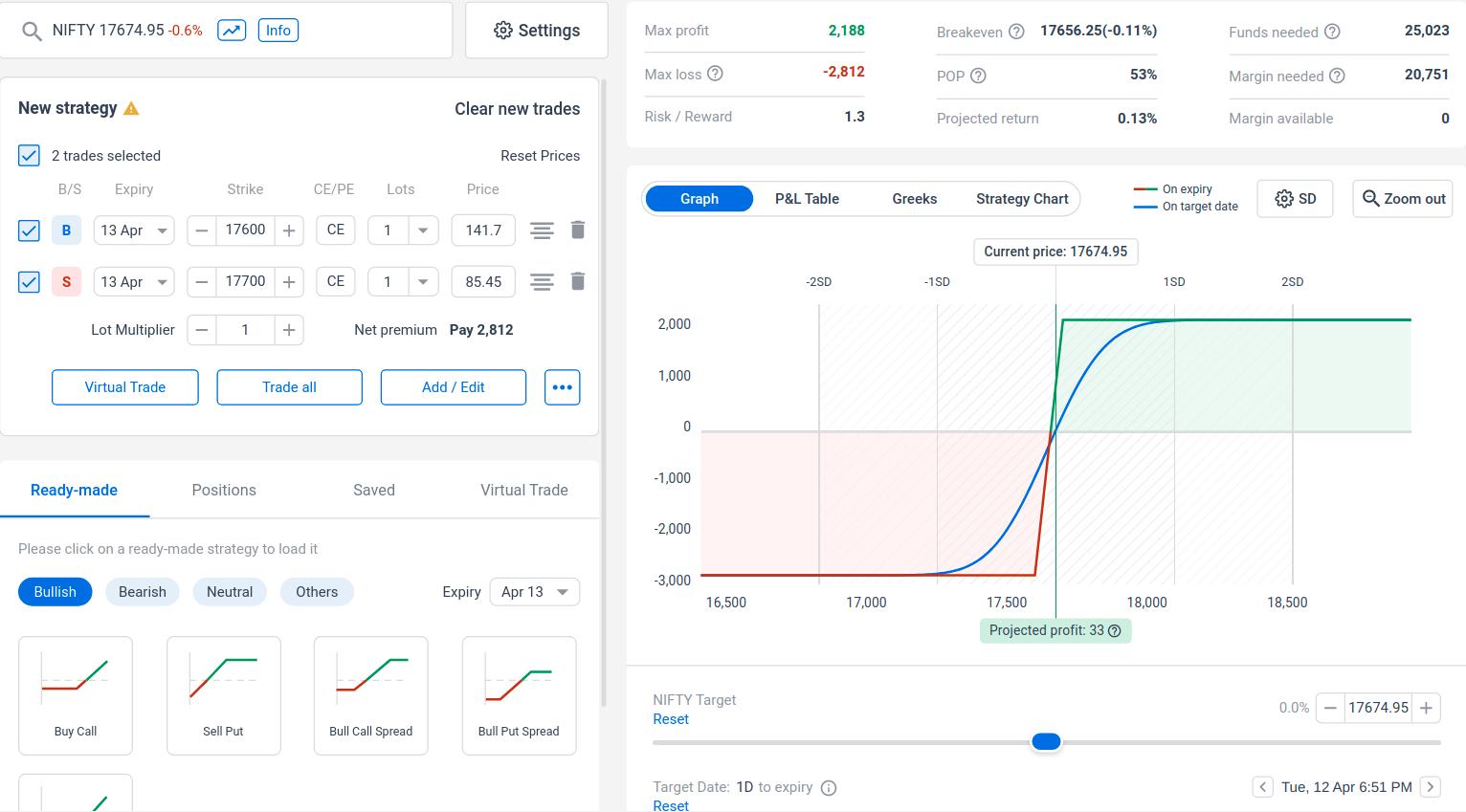

- Choose a Backtesting Platform: Select a backtesting software that seamlessly integrates options data and provides advanced charting tools.

- Define Your Strategy: Clearly outline the trading strategy you intend to backtest, including entry and exit signals, risk management parameters, and position sizing.

- Gather Historical Data: Acquire historical options data for the desired time period and underlying assets.

- Analyze Open Interest: Incorporate open interest data into your backtesting process by plotting it against price charts, technical indicators, and other relevant metrics.

- Interpret the Results: Carefully review the backtest results, paying attention to key metrics such as return on investment, risk-adjusted returns, and Sharpe ratio.

Image: stewdiostix.blogspot.com

Case Study: Enhancing a MACD Trading Strategy with Open Interest

Let’s illustrate the transformative power of options data open interest with a practical example. Consider a MACD (Moving Average Convergence Divergence) trading strategy, which involves buying (or going long) when the MACD line crosses above the signal line and selling (or going short) when the MACD line crosses below the signal line.

By incorporating open interest data into the backtest, we can observe that:

- Positive Open Interest Confirmation: When the MACD crossover coincides with a significant increase in open interest, the likelihood of a sustained trend increases, boosting our confidence in the trade.

- Negative Open Interest Divergence: If the MACD crossover occurs against a backdrop of flat or declining open interest, it suggests a lack of market conviction, increasing the risk of false signals.

Armed with this knowledge, we can refine our MACD strategy to focus on trades where open interest aligns with the MACD crossover. This simple yet powerful adjustment enhances our strategy’s accuracy and profitability.

Backtest Trading Strategies Using Options Data Open Interest Platform

Conclusion: Empowering You with the Edge in Options Trading

Integrating options data open interest into your backtesting strategies unlocks a world of possibilities, providing you with a profound understanding of market sentiment and trading dynamics. By leveraging this powerful data source, you can optimize your trading strategies, minimize風險, and gain a competitive edge in the ever-evolving options market. Embrace the power of options data open interest and elevate your trading to new heights.