Embarking on Your Options Trading Journey

Options trading holds immense potential for savvy investors seeking to navigate the financial markets with both precision and calculated risk. As a seasoned trader, my early ventures into this realm were marked by both exhilarating triumphs and humbling setbacks. These experiences instilled in me the profound importance of meticulous planning and unwavering discipline in the pursuit of options trading success.

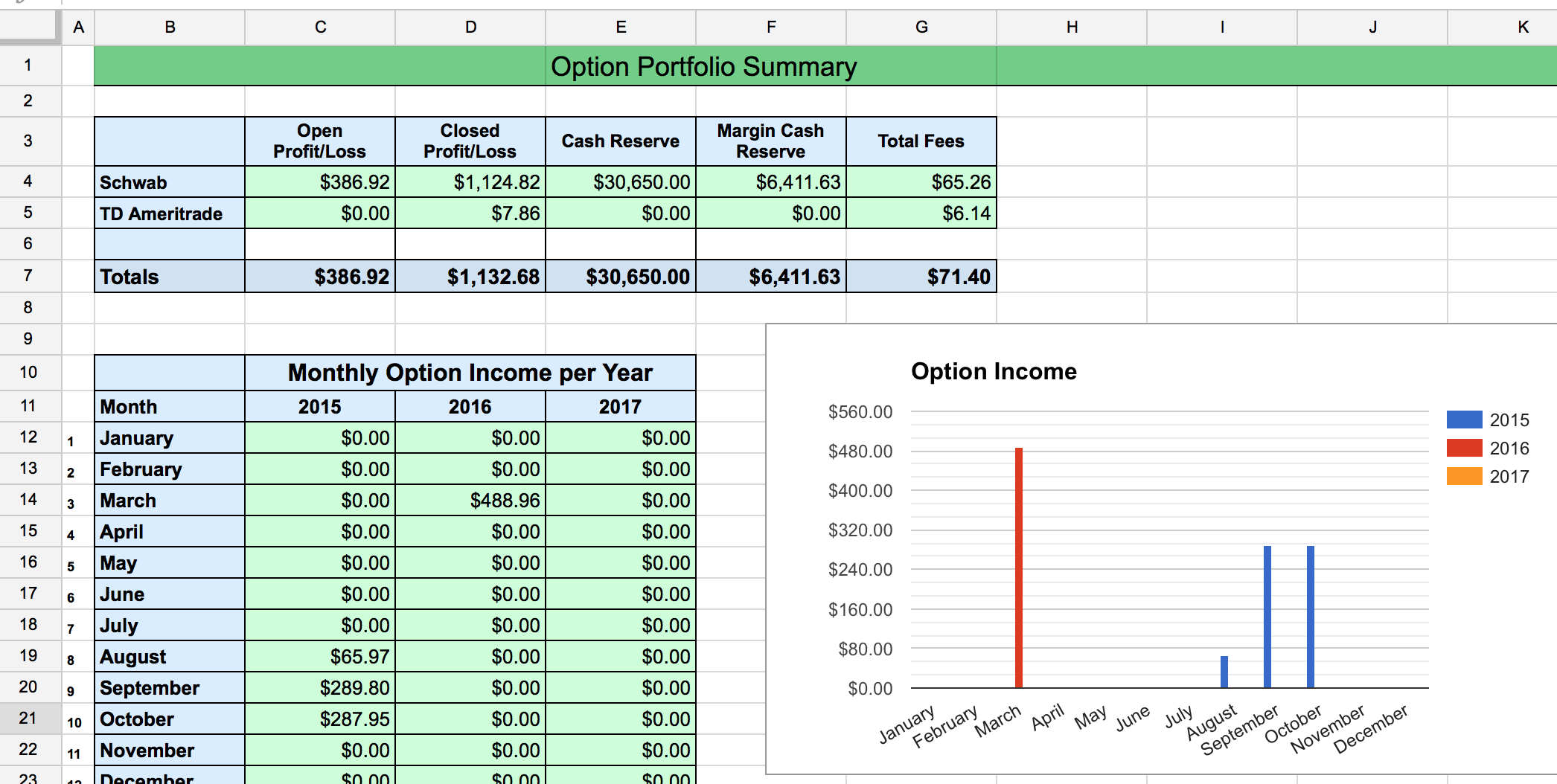

Image: db-excel.com

Crafting Your Trading Plan

A comprehensive trading plan serves as your blueprint for navigating the complexities of options trading. It encapsulates your objectives, risk tolerance, trading strategy, and predefined entry and exit points. By carefully outlining these essential elements, you establish a structured framework for decision-making, reducing impulsive trades driven by emotions or external noise.

1. Define Your Trading Objectives

The cornerstone of your trading plan lies in identifying your specific objectives. Are you seeking short-term gains, steady income generation, or long-term wealth accumulation? Your goals will inform your overall trading strategy and influence your choice of options contracts.

2. Assess Your Risk Tolerance

Determining your risk tolerance is paramount in options trading. Do you prefer the potential for significant returns but can withstand the volatility that comes with it? Or would you rather favor more conservative strategies with diminished upside potential? Understanding your risk appetite will guide your position sizing and stop-loss placement.

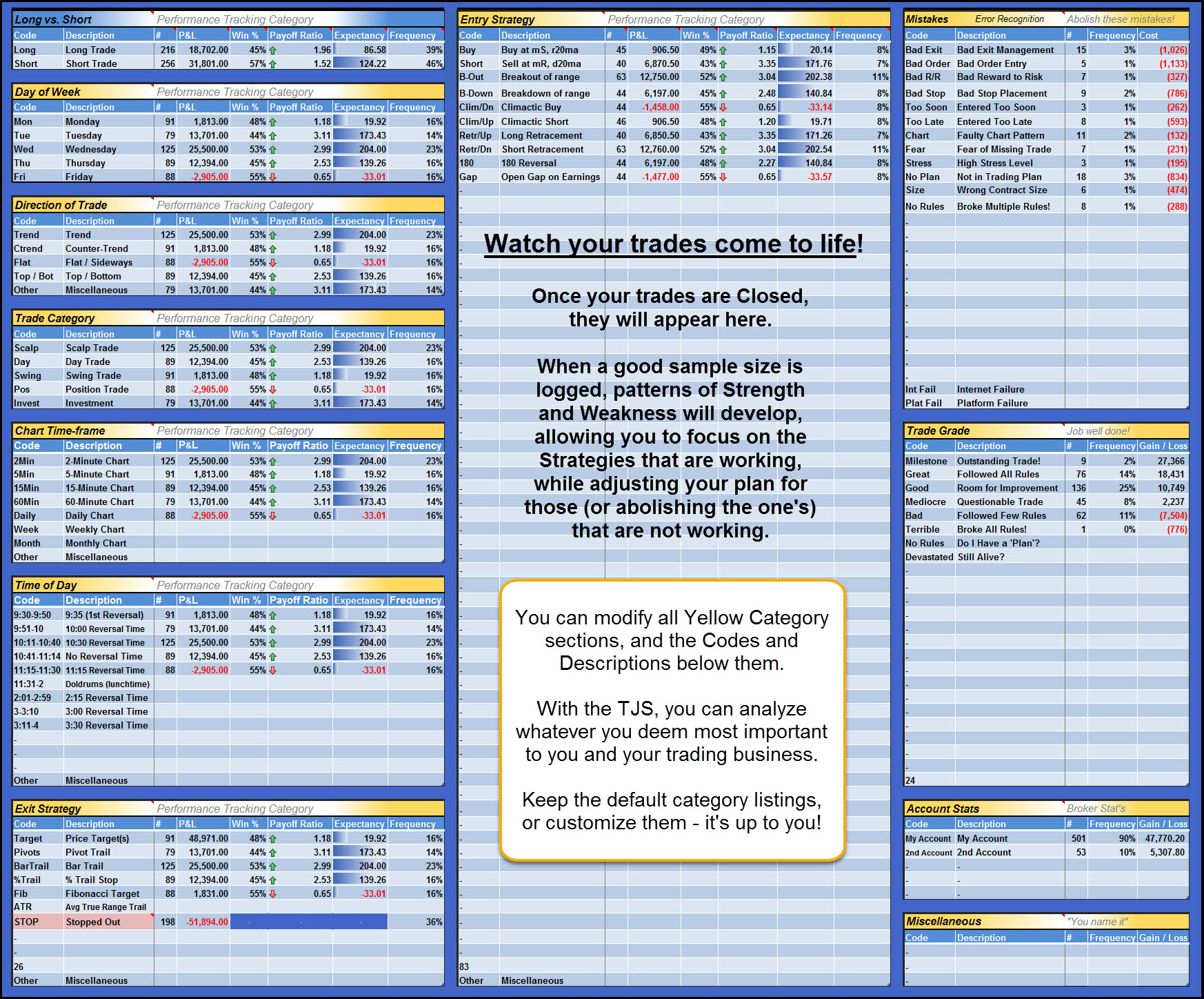

Image: www.twoinvesting.com

3. Develop a Trading Strategy

The heart of your trading plan lies in your chosen trading strategy. Research various options strategies, such as covered calls, cash-secured puts, or iron condors, and select those that align with your objectives and risk tolerance. Thoroughly understand the mechanics and nuances of each strategy before implementing them.

4. Set Entry and Exit Points

Precision in trade execution is crucial. Define predefined entry and exit points based on technical analysis, market conditions, or specific events. Stick to your plan meticulously, avoiding emotional reactions that could lead to impulsive exits or unscheduled entries.

Staying Abreast of the Options Trading Landscape

Options trading is an ever-evolving field, with new developments and market trends emerging constantly. Stay informed by monitoring reputable news sources, participating in trading forums, and engaging with social media platforms dedicated to options trading. This constant knowledge acquisition will help you adapt your trading plan to changing market dynamics.

Expert Tips for Enhanced Trading Performance

From my experience and interactions with seasoned traders, I have gleaned invaluable insights that can bolster your options trading.

- Conduct thorough due diligence: Before executing any trade, meticulously research the underlying asset, market sentiment, and potential catalysts or risks.

- Monitor market conditions: Keep a close eye on the overall market environment, economic news, and industry-specific events that may impact your positions.

- Stay disciplined: Adhere strictly to your trading plan, avoiding emotional decision-making or impulsive actions.

- Practice risk management: Implement robust stop-loss orders and position sizing strategies to minimize potential losses.

- Embrace a learning mindset: Continuously seek opportunities to expand your knowledge, attend webinars, or consult with experienced traders.

FAQs for Navigating Options Trading

Q: What are the different types of options contracts?

A: There are two primary types of options contracts: calls and puts. Calls grant the holder the right to buy an underlying asset at a specific price on or before a set date. Puts give the holder the right to sell an underlying asset at a specific price on or before a set date.

Q: How do you calculate profit or loss in options trading?

A: Calculating profit or loss in options trading involves considering factors such as the premium paid, the intrinsic value of the contract, and the potential for price fluctuations in the underlying asset. Consult reliable sources or trading platforms for detailed explanations and formulas.

Trading Plan For Options

Image: thewaverlyfl.com

Conclusion

Developing and adhering to a comprehensive trading plan is the key to unlocking success in the exciting world of options trading. By defining your objectives, assessing your risk tolerance, crafting a trading strategy, and staying informed, you can mitigate risks, enhance your decision-making, and increase your chances of achieving your financial goals.

Are you ready to embark on your options trading journey? The path is not without its challenges, but with careful planning, strategic execution, and an unwavering commitment to learning, you can navigate the markets with confidence and reap the rewards that options trading has to offer.