Introduction

In the realm of investing, the allure of leverage beckons to both experienced traders and novices seeking to magnify their returns. Among the two prevalent leverage strategies – options and margin trading – lies a chasm of distinct advantages, risks, and complexities. This comprehensive guide aims to unravel the intricacies of each, empowering you to make informed decisions that align with your investment goals.

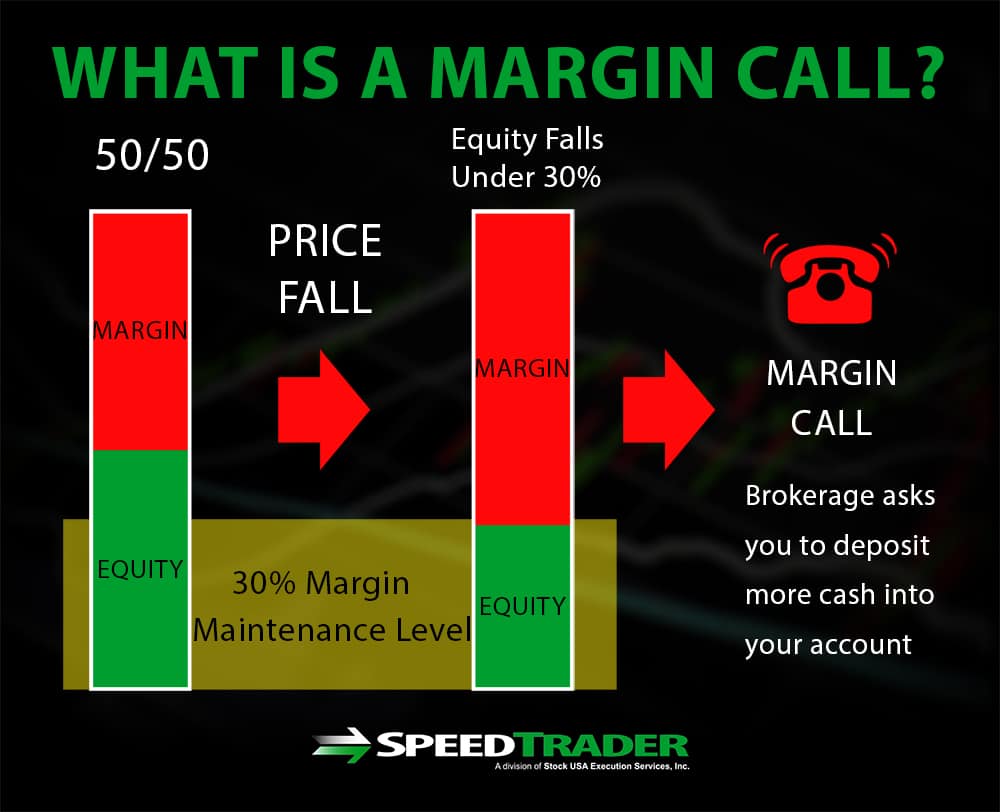

Image: speedtrader.com

Options: Capturing Potential Upside While Managing Risk

Options trading involves purchasing contracts that grant you the right, but not the obligation, to buy or sell an underlying asset at a predetermined price within a specified time frame. This versatile strategy offers a dual edge – the potential for substantial gains and limited downside risk.

Options contracts come in two primary forms: calls and puts. Call options confer the right to purchase an underlying asset, while put options provide the right to sell. The flexibility of options trading allows you to speculate on market movements, hedge existing positions, or generate income through premiums. However, options trading also entails a deep understanding of market dynamics, volatility, and risk management techniques.

Margin Trading: Enhancing Gains with Higher Risk

Margin trading, on the other hand, involves borrowing funds from a brokerage firm to amplify your buying power. This strategy magnifies both potential profits and losses, making it a double-edged sword.

When engaging in margin trading, you purchase more shares than you could afford with your own capital, leveraging the brokerage’s funds to increase your stake. While margin trading has the potential to accelerate your growth, it also exposes you to significant risks. Margin calls may occur when the value of your invested assets declines, forcing you to post additional funds or liquidate positions to cover losses.

The Risk Spectrum: Weighing the Pros and Cons

Options trading, while less risky than margin trading, still carries its own set of uncertainties. The value of options contracts fluctuates based on factors such as market volatility, time decay, and underlying asset performance. Miscalculations or market downturns can lead to significant losses.

Margin trading, with its amplified risk profile, poses a far greater threat to your financial stability. The potential for both profits and losses is magnified, making it a strategy more suited for experienced traders with high risk tolerance and advanced knowledge.

:max_bytes(150000):strip_icc()/margin-101-the-dangers-of-buying-stocks-on-margin-356328_V2-3a27513fade64c769d9abce43cec81f7.png)

Image: www.thebalancemoney.com

Expert Insights: Navigating the Complexities

“Options trading provides a sophisticated tool for managing risk and generating income. However, a thorough understanding of options pricing, Greeks, and market dynamics is paramount to success,” advises Dr. Emily Carter, a leading expert in options strategies.

“Margin trading offers a potent means to enhance returns, but it also comes with significant risks. Traders should carefully consider their risk appetite and the potential consequences of margin calls before engaging in this strategy,” cautions Professor David Baker, a renowned financial risk management expert.

Actionable Tips: Empowering Your Investment Decisions

-

Educate yourself thoroughly before embarking on either options or margin trading.

-

Understand the risks and rewards associated with each strategy.

-

Start with modest leverage and gradually increase it as you gain experience.

-

Use stop-loss orders and position size management techniques to mitigate losses.

-

Consult with a financial advisor or experienced trader for guidance and support.

Options Vs Margin Trading

https://youtube.com/watch?v=GsQ6tkeqFI8

Conclusion

Options and margin trading offer distinct paths to leverage, each with its own advantages and risks. Options trading provides a balanced approach, limiting downside risk while maintaining the potential for substantial gains. Margin trading, on the other hand, amplifies both profits and losses, making it a strategy best suited for experienced traders with a high-risk tolerance and advanced understanding. By carefully assessing your investment goals, risk appetite, and overall financial situation, you can harness the power of leverage effectively, unlocking the full spectrum of opportunities while navigating the inherent uncertainties of the financial markets.