Introduction to Put Options

Welcome to the realm of stock options trading, where the potential for profit and risk lie in equal measure. Today, we delve into the intricacies of put options, an essential tool for mitigating risk and unlocking new trading strategies.

Image: www.smioptions.com

Imagine you own shares of a promising stock. However, the market takes an unexpected downturn, threatening your investment’s value. Enter put options, a powerful financial instrument that grants you the right to sell a specific number of shares at a designated price within a set period. By acquiring a put option, you effectively hedge against the stock’s depreciation. If the stock’s value falls below the strike price (the predetermined price), you can exercise the option to sell your shares at that price, limiting your losses.

Benefits of Put Options

- Risk Management: Put options provide an indispensable safety net, protecting your portfolio from market downturns.

- Income Generation: By selling (or “writing”) put options, you can generate income regardless of the stock’s performance.

- Market Neutrality: Put options are not only effective during market declines; they can also benefit from market volatility and sideways moves.

- Leverage: Options offer a leveraged way to participate in the market, potentially amplifying gains or losses.

Understanding Put Option Strategies

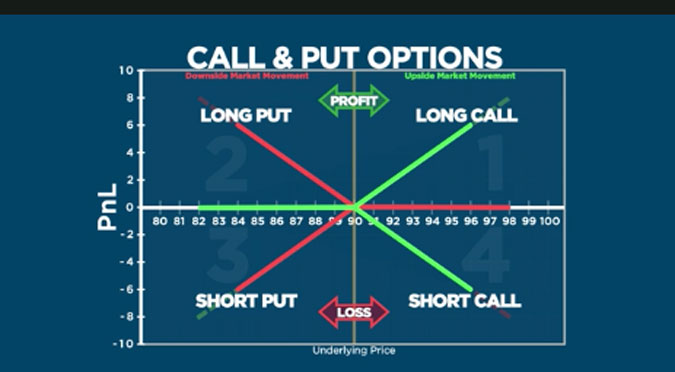

- Long Put: Buying a put option allows you to profit from a stock’s decline.

- Short Put (Sold Option): Selling (writing) a put option generates income in return for taking on the obligation to buy the underlying shares if they fall below the strike price.

- Put Spread: Combining a long and a short put with different strike prices and/or expiration dates creates complex risk-reward profiles.

- Iron Condor: A neutral strategy involving the combination of bullish and bearish put and call spreads.

Tips and Expert Advice for Successful Put Option Trading

- Know Your Risk Tolerance: Options trading can be risky. Determine your comfort level with potential losses before executing any trades.

- Thoroughly Research: Understand the company, market conditions, and potential risks associated with the underlying stock.

- Choose Liquidity: Trade options with high trading volumes to ensure prompt execution and fair pricing.

- Consider Time Decay: Option premiums erode over time. Factor in time decay when holding positions.

- Monitor Market Volatility: Higher volatility affects option premiums significantly, both positively and negatively.

- Seek Professional Guidance: If you’re a beginner or need personalized advice, consider consulting a financial advisor.

Image: libertex.com

FAQs on Put Options

Q: What is the difference between buying and selling put options?

A: Buying a put option gives you the right to sell shares, while selling a put option obligates you to buy shares if the strike price is reached.

Q: Can I lose more than my initial investment in put option trading?

A: Yes, if you buy a long put and the stock price rises, you can lose your entire investment. However, you cannot lose more than the premium you receive when selling a put option.

Q: What is a good strategy for beginners?

A: A covered put, where you already own the underlying shares, and selling cash-secured puts are beginner-friendly strategies.

How To Do Stock Options Put Trading

Image: mapsandmasters.com

Conclusion

Stock options put trading can be a rewarding yet complex endeavor. By mastering the concepts and strategies presented in this article, you’ll be well-equipped to navigate the world of put options. Remember, knowledge, research, and risk management are key to unlocking the full potential of this powerful trading instrument.

Are you excited to explore the world of stock options put trading? Embark on this journey with confidence, and let the market be your canvas for financial success.