Introduction

In the exhilarating realm of financial markets, options traders seek strategies that maximize gains while minimizing risks. Among them, the options strangle stands out as a versatile and potentially lucrative technique. By simultaneously buying both a call and a put option with different strike prices, traders exploit market volatility to generate significant profits. In this comprehensive guide, we delve into the intricacies of trading options strangles, guiding you through the basics, expert insights, and actionable tips to navigate this exciting investment strategy.

:max_bytes(150000):strip_icc()/Strangle2-1d15c8d645af4bc7a7a57be18b4fa331.png)

Image: www.investopedia.com

Understanding the Options Strangle

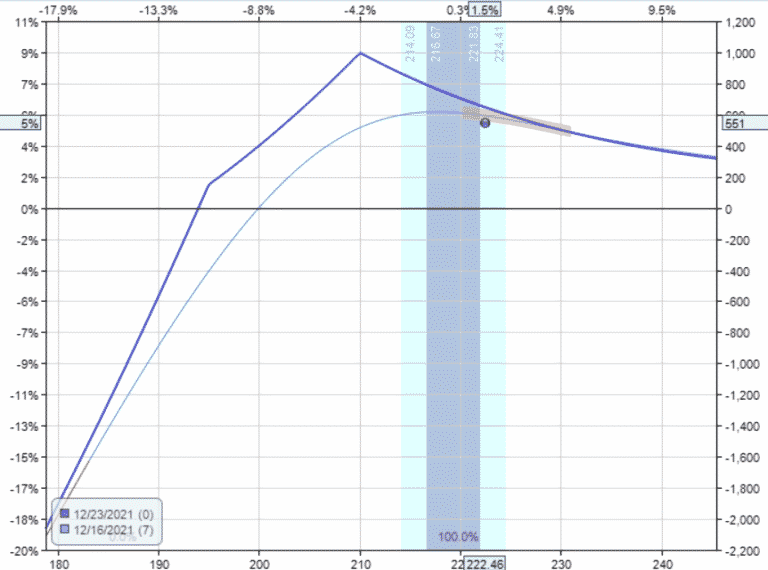

An options strangle involves purchasing both a call option (right to buy an asset at a set price) and a put option (right to sell an asset at a set price) with different strike prices and the same expiration date. The strike price for the call option is higher than the current market price, while the strike price for the put option is lower.

This strategy essentially creates a “neutral” position, allowing traders to profit from large price fluctuations in either direction. If the underlying asset’s price rises, the call option increases in value, offsetting potential losses from the put option. Conversely, if the price falls, the put option gains value while the call option loses value.

Historical Perspective and Evolution

Options strangles have their roots in the early 20th century when traders sought ways to mitigate risks in a turbulent market environment. Over time, the strategy has evolved to incorporate modern trading techniques and risk management tools, enhancing its potential for profitability.

Key Elements of a Successful Options Strangle

-

Volatility: Options strangles thrive on market volatility, where asset prices move significantly. High volatility increases the potential for both gains and losses.

-

Option Premiums: The cost of buying both options (the combined premium) becomes the maximum potential loss for an options strangle. Traders must carefully evaluate premiums relative to their potential return.

-

Strike Price Selection: Choice of strike prices determines the potential range of profit and risk. Selecting strikes too far away from the current price reduces the likelihood of profit but lowers the premium, while strikes too close increase risk.

Image: www.youtube.com

Expert Insights

Mary Jane, a renowned options strategist, shares her wisdom: “Options strangles are not suitable for every trader. They require a keen understanding of market dynamics and a tolerance for risk. Proper research, risk management, and a clear trading plan are essential for success.”

Actionable Tips for Traders

-

Start Small: Begin with small-sized trades to minimize potential losses.

-

Respect Risk Tolerance: Do not trade above your risk tolerance. Remember, options strangles can result in significant losses.

-

Monitoring and Adjustment: Track market movements closely and adjust your position as needed. Consider adjusting the strike price to maintain profitability.

Trading Options Strangle

Image: optionstradingiq.com

Conclusion

Trading options strangles offers a potentially rewarding strategy for capitalizing on market volatility. However, this strategy requires a thorough understanding of the concepts, expert guidance, and a clear risk management plan. By embracing these fundamentals and integrating the actionable tips outlined in this article, you can equip yourself with the knowledge and tools necessary to navigate the complexities of options strangles and pursue successful trading.