Title: Mastering the Art of Options Trading: A Guide for Beginners

Image: www.myfinopedia.com

In the realm of finance, options trading can often seem like an enigmatic maze, a world of complex jargon and opaque strategies. But what if we could demystify it, unveil its inner workings, and make it accessible to everyone?

In this comprehensive guide, we embark on a journey to simplify the world of options trading. We will unravel its intricacies, decode its language, and provide you with a clear roadmap to navigate this financial labyrinth. Whether you’re a seasoned investor or a novice just starting out, we believe that every individual can unlock the potential of options trading.

Breaking Down the Essence of Options Trading

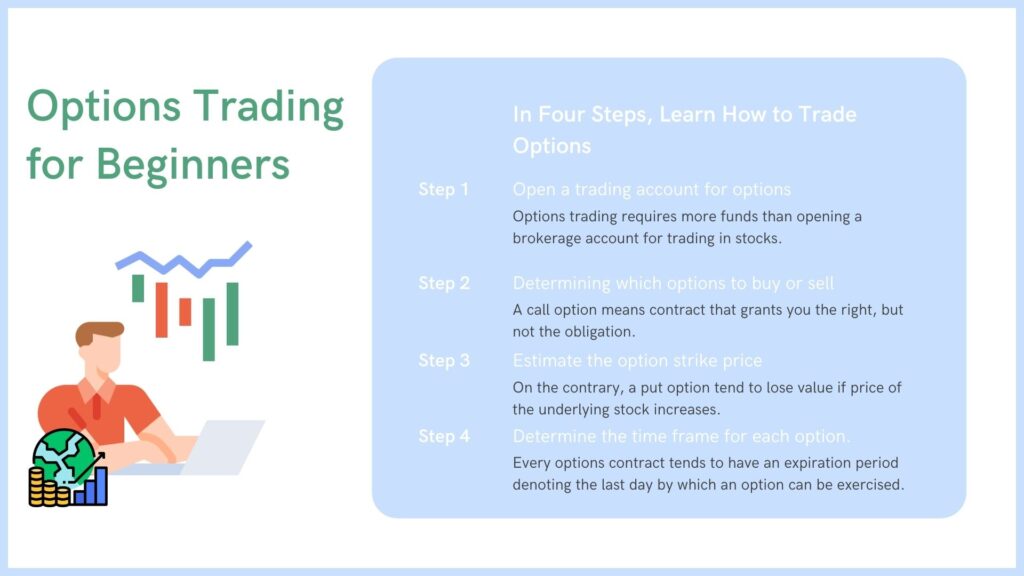

An option contract, in essence, is a financial instrument that grants you the right, but not the obligation, to buy or sell an underlying asset at a specified price on or before a predetermined date. This flexibility empowers you to seize opportunities or mitigate risks in the ever-changing financial markets.

Exploring the Types of Options Contracts

Options contracts come in two primary flavors: call options and put options. A call option grants you the right to buy an asset at a specified price, while a put option gives you the right to sell an asset at a specified price. This duality provides investors with the versatility to position themselves for potential gains or cushion against potential losses.

Image: www.thechartist.com.au

Understanding the Underlying Assets

Options contracts can be linked to a wide range of underlying assets, including stocks, bonds, commodities, and even indices. By selecting an appropriate underlying asset, you can tailor your options strategy to your specific investment goals and risk appetite.

Deciphering Key Option Terminologies

To navigate the world of options trading, it’s essential to grasp a few key terminologies. These include:

- Strike Price: The price at which you can exercise your right to buy or sell the underlying asset.

- Expiration Date: The date by which you must exercise your option or it expires.

- Premium: The cost of purchasing an option contract.

Identifying Trading Strategies for Success

Options traders employ a diverse range of strategies to maximize their returns. Here are a few common strategies to consider:

- Buying Options: Acquiring options in anticipation of a favorable price movement in the underlying asset.

- Selling Options: Granting others the right to buy or sell your underlying asset, collecting the premium in exchange.

- Covered Calls: Selling a call option while owning the underlying asset, generating income and limiting potential losses.

Unveiling the Risk Factors

Options trading, like any form of investing, carries inherent risks. Understanding these risks is imperative for informed decision-making. Common risks include:

- Time Decay: The value of an option contract gradually diminishes as the expiration date approaches.

- Volatility Risk: Fluctuations in the underlying asset’s price can impact the value of option contracts significantly.

- Leverage Risk: Options can amplify gains and losses, potentially exceeding the initial investment.

Tips for Minimizing Risk and Enhancing Returns

To mitigate risks and maximize returns, consider these practical tips:

- Proper Research: Thoroughly research the underlying asset and its historical price movements.

- Strategy Diversification: Spread your investments across multiple options strategies to reduce overall risk.

- Timely Trading: Monitor market conditions closely and adjust your trading strategies accordingly.

Making Options Trading Easy

Image: eaglesinvestors.com

Conclusion

Options trading can be a powerful tool for investors who seek robust returns and strategic risk management. By demystifying its complexities and providing actionable advice, this guide empowers you to navigate the world of options with confidence.

Embrace the learning curve, stay informed, and never hesitate to consult experts or reputable resources. As you gain experience, you will unlock the full potential of options trading and harness its transformative power in the financial markets.