As a budding trader navigating the labyrinth of global currency markets, my initial encounters with foreign exchange (FX) options were nothing short of bewildering. The complexity and volatility of these financial instruments seemed insurmountable until I discovered the transformative power of electronic trading.

Image: flextrade.com

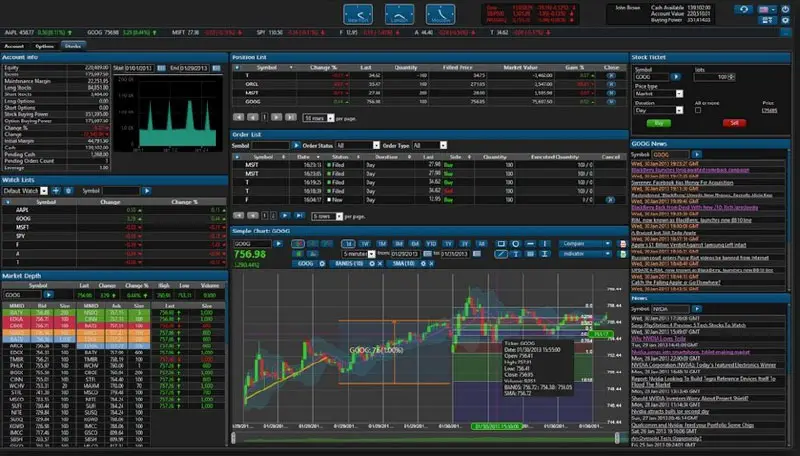

Electronic trading in FX options has revolutionized the way currencies are exchanged. By automating the execution of trades through advanced trading platforms, the once-onerous task of finding counterparties and negotiating terms has been streamlined, unlocking a world of opportunities for traders of all levels.

The Mechanics of Electronic FX Options Trading

FX options are financial contracts that provide traders with the right but not the obligation to buy or sell a specified amount of currency at a predetermined price on a future date. Electronic trading platforms facilitate the trading of these contracts in a transparent and efficient manner.

When you place an order on an electronic FX options trading platform, the system matches your request with a counterparty who holds the opposite position. The trade is then executed instantly, eliminating the need for manual negotiation and the potential for delays.

Benefits of Electronic FX Options Trading

- Increased efficiency: Automation eliminates manual processes, speeding up trade execution and reducing errors.

- Enhanced transparency: Electronic platforms provide real-time pricing and trade information, ensuring transparency and fair trading practices.

- Improved liquidity: By connecting traders from around the world, electronic platforms create a more liquid market, offering better prices and reduced trading costs.

Latest Trends and Developments in Electronic FX Options Trading

The electronic FX options trading landscape is constantly evolving, driven by technological advancements and regulatory initiatives. One notable trend is the increasing popularity of algorithmic trading, where computer programs automatically execute trades based on predefined rules.

Regulators are also playing an active role in shaping the electronic FX options market. They are implementing measures to enhance transparency, mitigate risks, and protect investors. These initiatives are fostering a more stable and secure trading environment.

Image: a-defense.blogspot.com

Tips and Expert Advice for Electronic FX Options Trading

To succeed in electronic FX options trading, it is essential to follow a disciplined approach and seek guidance from experienced traders:

- Understand the risks: FX options carry potential losses as well as gains. It is crucial to understand the risks involved and trade within your risk tolerance.

- Control your emotions: Emotional decision-making can lead to poor trades. Maintain a冷静and objective approach to avoid costly mistakes.

- Stay updated: Keep abreast of market news, economic data, and regulatory changes that may impact FX options prices.

FAQ on Electronic FX Options Trading

Q: What is the minimum investment required for electronic FX options trading?

A: The minimum investment varies depending on the trading platform and the specific option contract. However, it is generally possible to start trading with a relatively small amount of capital.

Q: How do electronic platforms mitigate counterparty risk?

A: Electronic platforms implement risk management protocols, such as margin requirements and clearing mechanisms, to minimize the risk of counterparty default.

Q: Are there any regulatory bodies that oversee electronic FX options trading?

A: Yes, regulatory bodies in various jurisdictions oversee electronic FX options trading to ensure market integrity and protect investors.

Fx Options Electronic Trading

Conclusion and Call to Action

Electronic FX options trading has revolutionized the currency markets, providing traders with a powerful tool to manage currency risk and capitalize on market opportunities. By embracing electronic trading platforms, you can access the global FX market like never before.

Are you ready to unlock the potential of electronic FX options trading? Start your journey today and experience the efficiency, transparency, and profitability of this transformative trading tool.