Introduction: Embark on a Journey into the Realm of Possibilities

In the ever-evolving financial landscape, where opportunities intertwine with risks, options trading emerges as a potent force. Its allure lies in its ability to amplify both gains and losses, captivating the imaginations of traders seeking to navigate market complexities with enhanced leverage and flexibility. However, venturing into this realm requires a balanced understanding of its inherent advantages and disadvantages, so as to avoid the pitfalls that may accompany the pursuit of financial success.

Image: www.animalia-life.club

Section 1: Unveiling the Advantages of Options Trading

Options trading presents traders with a vast array of advantages that have propelled its popularity within the realm of financial markets. Among these, the potential for substantial returns stands as a primary attraction. Options contracts allow traders to leverage small initial investments into sizeable gains, a characteristic that has endeared them to those with moderate capital yet ambitious aspirations.

Flexibility and adaptability are hallmarks of options trading, empowering traders to customize their strategies based on their unique risk tolerance and investment objectives. Options contracts offer a diverse range of underlying assets, from stocks and indices to commodities and currencies, granting traders the freedom to pursue opportunities across various market sectors.

Moreover, options trading provides traders with the ability to hedge against downside risks, acting as a protective shield in volatile market conditions. By strategically utilizing options contracts, traders can limit their potential losses while preserving the opportunity for gains.

Section 2: Recognizing the Drawbacks and Risks

While options trading holds immense allure, it is imperative to acknowledge the inherent risks associated with this endeavor. Foremost among these is the potential for substantial losses. The leveraged nature of options contracts can exacerbate losses, particularly for inexperienced traders who may not fully grasp the nuances of these financial instruments.

Options trading also demands a heightened level of market knowledge and analytical acumen. Traders must possess a thorough understanding of the underlying assets and the factors that influence their price movements. Without this deep-seated understanding, traders may find themselves navigating treacherous waters, increasing their susceptibility to costly mistakes.

Furthermore, options trading entails strict adherence to time constraints. Options contracts have predetermined expiration dates, and failure to execute or liquidate them before this deadline results in their expiry worthless. This time-sensitive aspect requires constant vigilance and timely decision-making, adding another layer of complexity to the trading process.

Section 3: Essential Strategies for Success in Options Trading

Venturing into options trading is not without its challenges, yet with a judicious approach and adherence to proven strategies, traders can improve their chances of success. One fundamental strategy lies in the mastery of fundamental and technical analysis. By meticulously researching the underlying assets and analyzing their historical price movements, traders gain invaluable insights into the factors driving their behavior. Such insights empower them to make informed decisions regarding the selection of options contracts and the implementation of trading strategies.

Prudence dictates that traders exercise discipline in their risk management practices. Establishing clear profit targets and stop-loss levels is paramount to safeguard against excessive losses. Additionally, diversifying one’s trading portfolio across various underlying assets and options strategies provides a buffer against market fluctuations, reducing the impact of adverse price movements in any given sector.

Seasoned traders often advocate for the adoption of paper trading as a valuable tool for honing skills and testing strategies without the risk of financial loss. Paper trading simulators provide a realistic environment for traders to experiment with different approaches, refine their techniques, and gain confidence before venturing into live trading.

Image: www.youtube.com

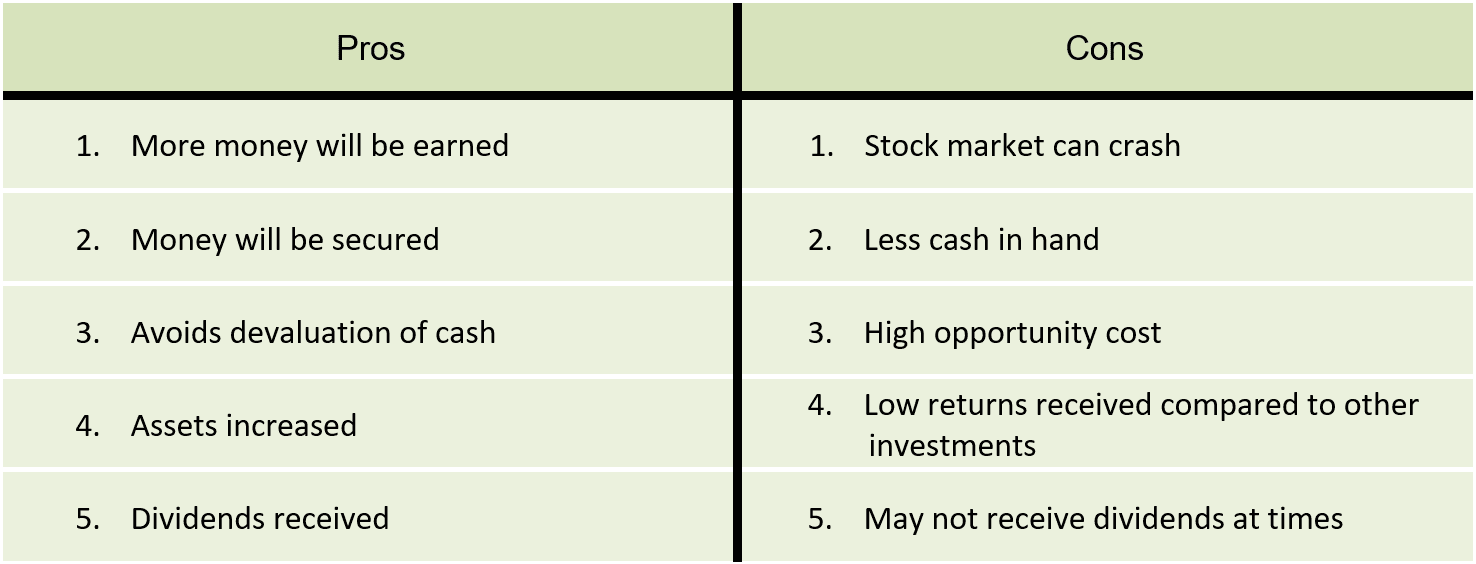

Options Trading Pros And Cons

Image: ofpfunding.com

Conclusion: A Call to Empowered Options Trading

Options trading, with its alluring potential for gains and inherent risks, offers traders a dynamic avenue for financial growth. Embracing a balanced understanding of the advantages and risks associated with this endeavor is crucial for navigating its complexities successfully. By adopting proven strategies, exercising sound risk management practices, and continuously seeking knowledge, traders can harness the power of options trading to unlock new opportunities while mitigating potential pitfalls.

Remember, options trading is not a spectator sport. It requires active participation, continuous learning, and the ability to make decisive yet measured decisions. Armed with this comprehensive guide, you are well-equipped to begin your journey into the realm of options trading, where informed risk-taking and astute strategy converge to create a path towards financial empowerment and success.