Introduction

In the realm of options trading, strangles are a powerful strategy that capitalizes on anticipated volatility. Strangles involve simultaneously buying a call option and a put option with the same expiration date but different strike prices. This strategy allows traders to profit from significant price fluctuations in either direction while limiting their potential losses.

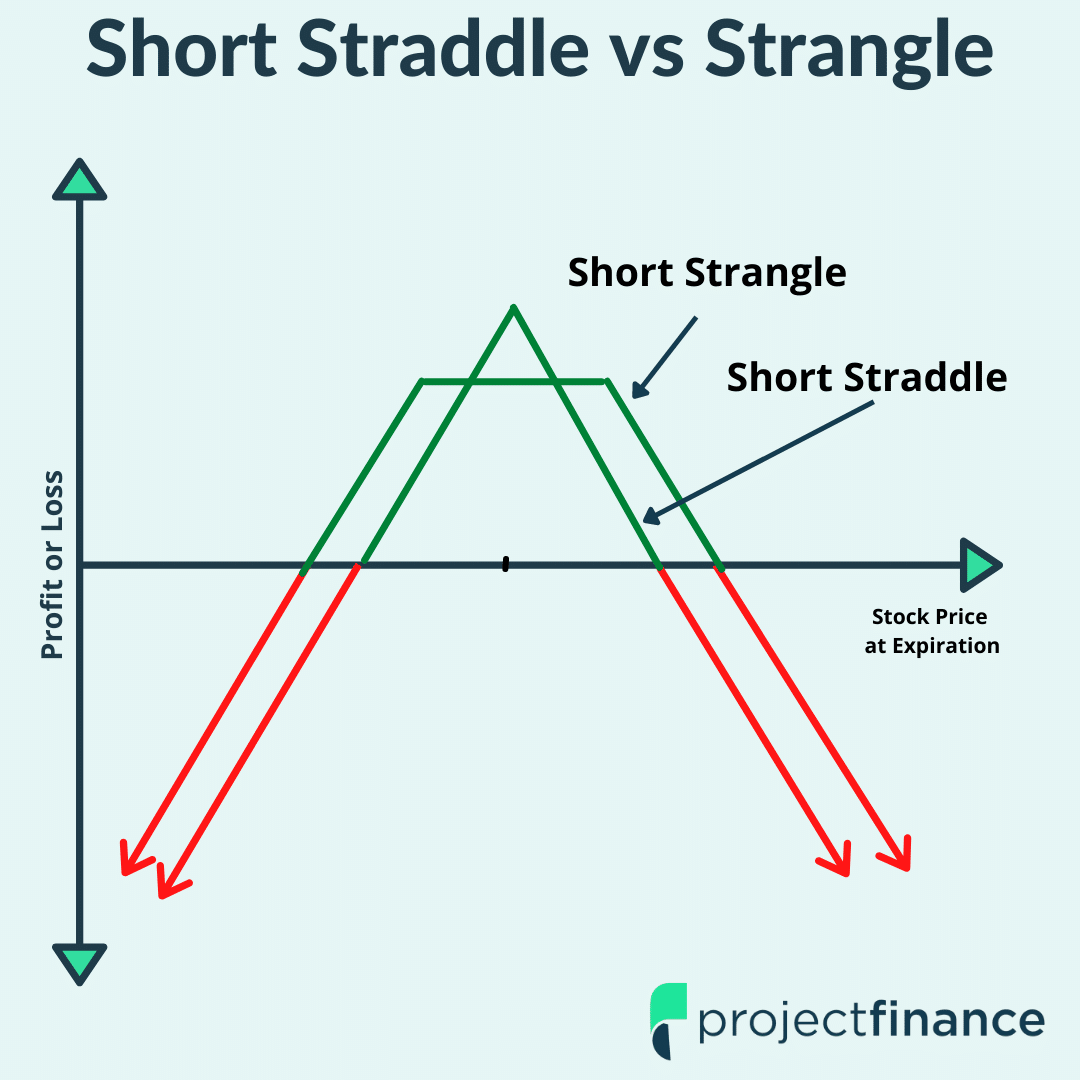

Image: www.projectfinance.com

Understanding strangles requires a grasp of basic options concepts. Options are contracts that grant the buyer the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset at a specified price (strike price) on or before a certain date (expiration date). Traders typically buy options when they expect the underlying asset’s price to move in their favor, and their profit or loss depends on the accuracy of their prediction.

Anatomy of a Strangle Trade

Strangles are created by purchasing a call option at a strike price above the current market price and a put option at a strike price below the current market price. The difference between the two strike prices is known as the “width” of the strangle. The wider the width, the greater the trader’s potential profit but also the higher the premium (cost) to enter the trade.

Example:

- Underlying asset: AAPL (Apple stock)

- Current market price: $120

- Call option: AAPL 125 Call (strike price = $125)

- Put option: AAPL 115 Put (strike price = $115)

- Width of the strangle: $10

Profit Potential and Risk Management

The ideal outcome for a strangle trade is for the underlying asset’s price to experience a significant move outside the range defined by the strike prices of the call and put options. If the price moves above the call option’s strike price, the trader can exercise the call to buy the underlying asset at a lower price than the current market value. Similarly, if the price falls below the put option’s strike price, the trader can exercise the put to sell the underlying asset at a higher price than the current market value.

However, strangles can also result in losses if the price of the underlying asset remains within the range of the strike prices. In such scenarios, both the call and put options will expire worthless, leading to a loss of the premium paid to enter the trade. Therefore, it’s crucial for traders to carefully consider the potential risks and reward potential before executing a strangle trade.

Image: www.youtube.com

Choosing the Right Strangle Width

The width of the strangle directly impacts the premium and potential profit. A wider strangle provides higher profit potential but at a higher cost. Conversely, a narrower strangle will have a lower premium and potential profit but also a lower risk.

Traders need to strike a balance between potential profit and risk by choosing an appropriate width. Factors to consider include the volatility of the underlying asset, the time to expiration, and the trader’s risk tolerance.

Timing Your Strangle Trade

Strangles are most effective in markets with high volatility or anticipated volatility spikes. Traders should monitor indicators like the CBOE Volatility Index (VIX) or historical volatility to identify potential opportunities.

Time to expiration is another crucial factor. Longer-term strangles provide more time for the underlying asset’s price to move in the desired direction, but they also come with higher premiums. Conversely, short-term strangles have lower premiums but a shorter window for potential price moves.

Monitoring and Adjusting Your Trade

After entering a strangle trade, traders should closely monitor the underlying asset’s price and the value of their options positions. If the price moves favorably, they may consider holding onto the options or even adding to their position. Conversely, if the price moves against them, they may decide to sell one or both options to limit their losses.

Adjusting strangle trades involves modifying the strike prices or expiration dates of the options. This can be done to increase potential profit, reduce risk, or change the focus of the strategy based on new market conditions.

Strangles Trading Options

:max_bytes(150000):strip_icc()/Strangle2-1d15c8d645af4bc7a7a57be18b4fa331.png)

Image: www.investopedia.com

Conclusion

Strangles are a powerful options strategy that allows traders to profit from volatility. By understanding the concepts, choosing the right strangle width, timing the trade effectively, and monitoring and adjusting the position as needed, traders can improve their chances of success with this strategy. However, it’s important to remember that options trading involves inherent risks, and traders should always assess their financial situation and risk tolerance before making any trades.