As an avid options trader, I’ve often grappled with the complexities of technical analysis. One indicator that has consistently proven its worth is the Relative Strength Index (RSI). It empowers traders with valuable insights into market trends and potential trading opportunities.

Image: forextraininggroup.com

Understanding the RSI

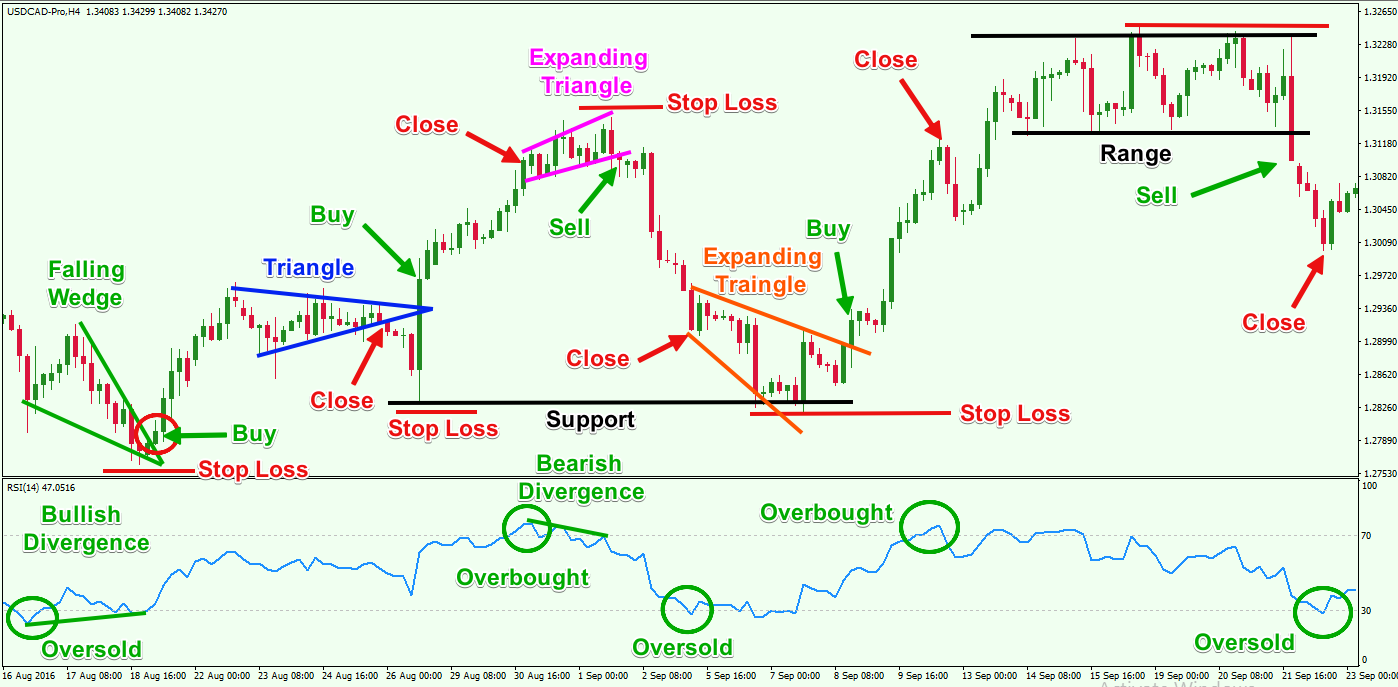

The RSI is a momentum oscillator that measures the speed and magnitude of price changes. It ranges from 0 to 100, with values below 30 indicating oversold conditions and values above 70 suggesting overbought scenarios. By analyzing these values, traders can gauge market sentiment and identify potential reversals.

Interpreting RSI Values

When the RSI dips below 30, it signifies an oversold market. In such situations, traders may consider buying options, anticipating a price rebound. Conversely, when the RSI surpasses 70, it implies an overbought market. Traders might then explore selling options, betting on a price decline.

Applying RSI Values in Options Trading

Incorporating RSI values into options trading strategies enhances decision-making by providing valuable insights. Here’s how you can leverage them:

Image: tutorialtrading101.blogspot.com

1. Identifying Oversold and Overbought Conditions

RSI values help traders identify extreme market conditions, such as oversold or overbought scenarios. Oversold conditions signal potential buying opportunities, while overbought conditions hint at possible selling opportunities.

2. Confirming Trends

When the RSI value aligns with the prevailing trend, it strengthens the reliability of the trend. For instance, a rising RSI accompanied by an uptrend suggests continued price increases. Similarly, a falling RSI alongside a downtrend indicates persistent price declines.

3. Divergence Trading

Divergence occurs when the RSI value diverges from the price action. A positive divergence, where the RSI rises while the price falls, indicates a potential bullish reversal. Conversely, a negative divergence, characterized by a falling RSI while the price rises, foreshadows a possible bearish reversal.

Tips and Expert Advice for Options Traders

Based on my experience, here are some tips and expert advice for applying RSI values in options trading:

1. Avoid Trading at RSI Extremes

While extreme RSI values signal potential trading opportunities, it’s prudent to exercise caution. Avoid trading at very high (over 90) or very low (under 10) RSI values, as these conditions tend to be volatile and unreliable.

2. Combine with Other Indicators

RSI should not be used in isolation but paired with other technical indicators for a more comprehensive analysis. Consider using trend indicators like moving averages or support and resistance levels to corroborate the RSI signals.

FAQs on RSI Values for Options Trading

- Q: Can RSI be used for any option strategy?

A: RSI is versatile and applicable to any option strategy, including bull calls, bear puts, and neutral strategies.

- Q: How often should I update my RSI values?

A: Regularly update RSI values every few minutes or hours to stay in sync with the latest market conditions.

Rsi Values For Options Trading

Image: blog.iqoption.com

Conclusion

Harnessing RSI values in options trading empowers traders with a powerful tool for identifying potential trading opportunities. By understanding the significance of different RSI levels, traders can make informed decisions and increase the likelihood of successful trades. Remember, technical analysis is an imperfect science, and RSI values should be used in conjunction with other indicators and sound trading principles.

Are you intrigued by the prospect of unlocking the power of RSI values in your options trading ventures? Share your thoughts and experiences below, and let us explore this topic further.