Introduction

In the rapidly evolving world of finance, options trading has emerged as a sophisticated tool that allows investors to navigate market fluctuations and hedge against potential risks. At the heart of this intricate trading strategy lies specialized technology, designed to empower traders with real-time analytics, intuitive interfaces, and automated execution capabilities. This article delves into the intriguing realm of options trading technology, shedding light on its key components, real-world applications, and the transformative impact it has brought to the investment landscape.

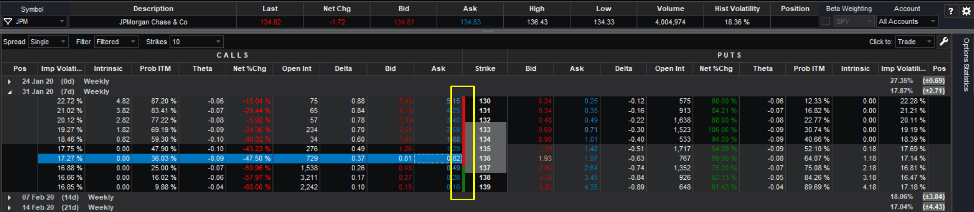

Image: www.tradestation.io

Understanding Options Trading Technology

Options trading, in its essence, involves the exchange of contracts that grant the buyer the right (but not the obligation) to buy or sell an underlying asset at a specified price within a predetermined time frame. Options trading technology serves as the backbone of this complex process, automating the intricacies of contract creation, trade execution, and risk management. It comprises a suite of software and hardware systems that seamlessly connect various market participants, ensuring efficient and transparent transactions.

Types of Options Trading Technology Platforms

Options trading technology is available in diverse forms, each catering to the specific needs of individual traders. Popular platforms include:

-

Desktop Trading Platforms: Installed on a computer, desktop platforms offer a comprehensive trading experience with customizable charts, real-time data, and advanced risk management tools.

-

Web-Based Trading Platforms: Accessed via a web browser, these platforms provide convenience and accessibility, allowing traders to execute trades from any location with an internet connection.

-

Mobile Trading Platforms: Designed for smartphones and tablets, mobile platforms offer traders the flexibility to monitor markets and trade on the go.

Essential Components of Options Trading Technology

The core components of options trading technology include:

-

Order Entry and Management: Sophisticated systems that enable traders to create, modify, and cancel orders in a fast and efficient manner.

-

Real-Time Data Feeds: Seamless access to real-time market data, including bid-ask prices, volatility, and Greeks, to facilitate informed decision-making.

-

Risk Management Tools: Comprehensive tools that allow traders to monitor and manage their risk exposure, such as position-sizing calculators, stop-loss orders, and margin alerts.

-

Trade Execution: Automated systems that execute trades in real-time at the most favorable prices, ensuring order completion with speed and precision.

Image: brokerchooser.com

Real-World Applications of Options Trading Technology

Options trading technology has revolutionized the way traders approach market opportunities and risk management:

-

Market Analysis: Real-time data and analytical tools assist traders in comprehending market movements, identifying trends, and recognizing trading opportunities.

-

Hedging Strategies: Options trading technology facilitates the formulation of complex hedging strategies by enabling traders to pair options contracts with underlying assets or other securities to mitigate potential losses.

-

Volatility Trading: Through the integration of volatility indicators, options trading technology empowers traders to capitalize on market volatility by executing short-term options trading strategies.

Impact of Options Trading Technology on the Investment Landscape

Options trading technology has profoundly transformed the investment landscape:

-

Lower Entry Barriers: User-friendly platforms and affordable pricing models have made options trading more accessible to retail investors and traders.

-

Enhanced Transparency: Electronically executed trades and real-time data feeds enhance market transparency and price discovery.

-

Increased Market Liquidity: Options trading technology has increased market liquidity by facilitating faster trade execution and reducing friction.

Options Trading Technology

Image: boomingbulls.com

Conclusion

Options trading technology has emerged as a game-changer in the world of finance, empowering traders with unparalleled tools and capabilities. Through comprehensive platforms, sophisticated components, and diverse applications, options trading technology has revolutionized the way investors navigate market opportunities and manage risks. As the investment landscape continues to evolve, the role of technology in options trading is poised to expand further, offering traders with even more sophisticated tools and innovative strategies to maximize their potential.