In the ever-evolving world of investing, technology exchange-traded funds (ETFs) have emerged as powerful tools for investors seeking exposure to the transformative power of technological innovation. Particularly for options traders seeking to leverage price fluctuations, technology ETFs offer a diverse and liquid market with vast opportunities for profit maximization. This guide will delve into the intricacies of technology ETFs for options trading, providing a comprehensive understanding of their benefits, risks, strategies, and key considerations.

Image: www.alphaprofit.com

Understanding Technology ETFs

Technology ETFs are investment funds that track a basket of stocks or other securities within the technology industry. They offer investors diversified exposure to the growth potential of rapidly expanding sectors such as cloud computing, artificial intelligence, and biotechnology. By investing in a technology ETF, traders can gain instant access to a broad range of industry leaders and emerging disruptors, reducing individual stock risk and enhancing portfolio diversification.

Benefits of Using Technology ETFs for Options Trading

-

Diversification: Technology ETFs provide instant diversification, mitigating the risk associated with investing in a single company or sector. They spread investment across multiple stocks, reducing the impact of individual company performance or industry downturns.

-

Liquidity: Technology ETFs trade actively on major exchanges, ensuring high liquidity and ease of execution. This allows options traders to enter and exit positions quickly, capitalizing on market movements without sacrificing flexibility.

-

Leverage: Options trading allows investors to control significant exposure to underlying assets with limited capital investment. By leveraging ETFs, traders can magnify potential returns or hedge against portfolio risks.

Strategies for Trading Technology ETF Options

-

Trend Following: Identify the prevailing trend in the technology sector and trade options that align with that trend. Buy calls (betting on upward price movement) during uptrends and puts (betting on downward movement) during downtrends.

-

Volatility Trading: Trade options on ETFs with high implied volatility (IV). IV represents the market’s perception of future price volatility, and ETFs with high IV offer greater potential profits for options traders.

-

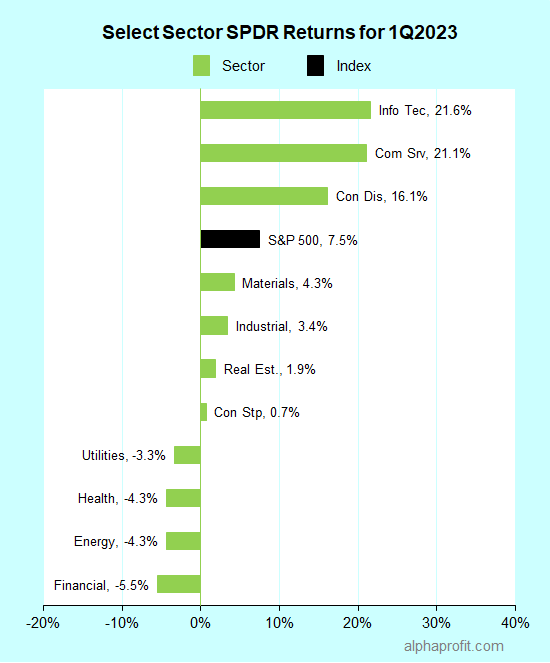

Sector Rotation: Monitor the performance of different technology sub-sectors and shift investments based on relative strength. This strategy involves buying options on ETFs representing outperforming sectors and selling options on underperformers.

-

Covered Calls: Sell covered calls against ETFs you own. This strategy generates income while providing limited downside protection. When the ETF price exceeds the call’s strike price, the trader retains the ETF and collects the premium.

Image: livewell.com

Risks and Considerations

-

Industry Risk: Technology ETFs are heavily exposed to the performance of the technology sector. A downturn in the industry could negatively impact the ETF’s value and its underlying option prices.

-

Concentration Risk: Some technology ETFs focus on a narrow segment of the industry, such as cloud computing or software development. This concentration increases exposure to specific technological advancements or setbacks.

-

Expense Ratio: ETFs charge management fees, known as expense ratios, which can erode investment returns over time. Choose ETFs with low expense ratios to minimize these costs.

Technology Etfs For Options Trading

Image: www.tradersdna.com

Conclusion

Technology ETFs provide a gateway for investors and options traders to capitalize on the growth and innovation of the technology sector. By understanding the benefits, strategies, and risks involved, traders can effectively harness the power of these ETFs to enhance their returns, manage risk, and navigate the ever-changing landscape of technology investing. Whether seeking diversification, leverage, or volatility trading opportunities, technology ETFs offer a compelling option for those looking to explore the limitless possibilities of the digital revolution.