Unlocking the Potential in Option Trading

In the realm of finance, options emerge as versatile tools that amplify trading opportunities. Among the myriad options strategies, APUT stands out as a fascinating technique that harnesses the power of options to generate potential profits. APUT, or Above Parity Unsecured Turbo, is a sophisticated strategy that combines aspects of option trading and leverage to enhance yield potential. By exploring the depths of APUT, traders can unravel new possibilities and broaden their horizons within the intricate world of options trading.

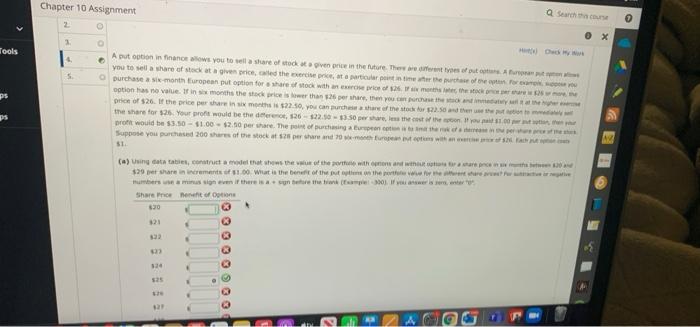

Image: www.chegg.com

Decoding APUT: Structure and Mechanics

APUT, in its essence, is an advanced options strategy that amalgamates a short strangle and a diagonal spread. The short strangle entails selling both a call and a put option with the same expiration date but dissimilar strike prices. Simultaneously, the diagonal spread encompasses buying an at-the-money call option with a nearer expiration date and selling an out-of-the-money call option with a further expiration date. This intricate combination necessitates a high degree of trading acumen and judicious risk management.

The APUT strategy is predicated upon the anticipation that the underlying asset’s price will remain comparatively stable within a specified trading range. Hence, the trader capitalizes on the time decay of options premiums rather than significant price fluctuations. As options approach their expiration, their premiums naturally diminish, creating the potential for generating profits. By adeptly navigating the nuances of APUT, traders can seek to capitalize on this inherent time value erosion.

Profit Dynamics: Unraveling the Potential

The APUT strategy harbors the potential for maximizing gains when the underlying asset’s price oscillates within a narrow range. The time decay of the short strangle generates the primary source of income, supplemented by the potential profits from the diagonal spread. Traders can capture profits as long as the underlying asset’s price remains bounded within the strike prices of the short strangle. This dynamic highlights the importance of selecting an appropriate strike range based on the anticipated price volatility of the underlying asset.

Risk Considerations: Navigating the Challenges

While APUT presents tantalizing opportunities for profit, it is imperative to acknowledge the inherent risks associated with this strategy. Unbridled volatility in the underlying asset’s price can wreak havoc on APUT’s profitability. Should the price surge beyond the anticipated trading range, the trader incurs losses on the short strangle. Conversely, a precipitous decline can lead to losses on the diagonal spread. Therefore, meticulous risk management and thorough analysis of historical volatility patterns are paramount for mitigating potential financial setbacks.

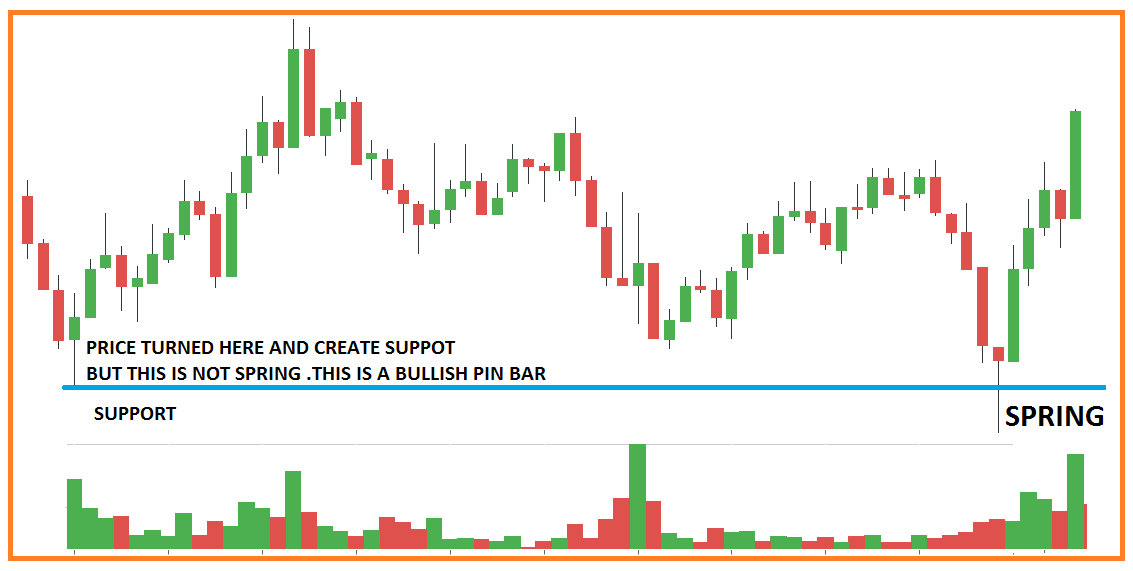

Image: www.fidelity.com

Suitability and Prerequisites: Unlocking Eligibility

APUT, by virtue of its intricate nature, is not a strategy suited for all traders. It demands a profound understanding of options trading dynamics, comprehensive risk management techniques, and a discerning eye for identifying opportune trading environments. Traders venturing into APUT must possess sufficient capital to cover potential losses and exhibit a temperament that embraces calculated risk-taking.

What Is Aput In Option Trading

Image: dotnettutorials.net

Conclusion: Unveiling Opportunities, Embracing Risks

APUT, as a sophisticated options strategy, unveils a realm of opportunities for astute traders. It empowers traders to exploit time decay and harness the potential for generating profits within a defined trading range. Nevertheless, it is imperative to approach APUT with a judicious mindset, fully cognizant of the inherent risks. Traders who meticulously manage their risk exposure and possess a deep understanding of options trading can unlock the potential rewards that APUT has to offer.