In the labyrinthine world of financial markets, options trading presents a unique crossroads where risk, reward, and precision intertwine. When options are trading at parity, an intriguing scenario unfolds, offering opportunities for astute investors. This article delves into the enigmatic realm of options trading at parity, empowering you with the knowledge to navigate this intricate landscape with confidence.

Image: fadukuvo.web.fc2.com

Unveiling the Enigma of Options at Parity

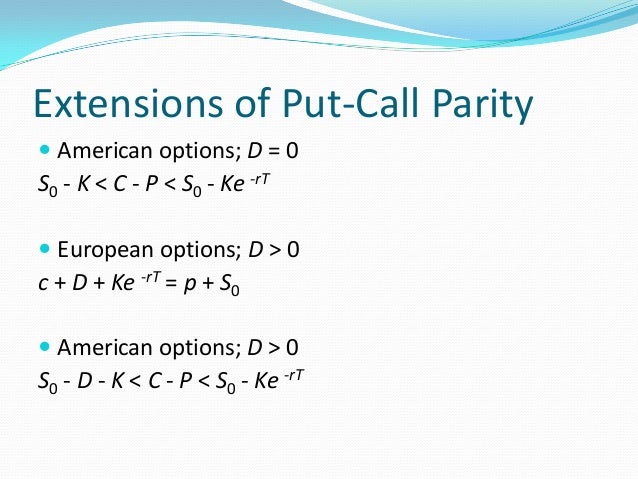

An option is a financial contract that confers the right, but not the obligation, to purchase (call option) or sell (put option) an underlying asset at a predetermined price on or before a specific expiration date. When an option’s market price aligns precisely with its intrinsic value, the option is said to be trading at parity.

Calculating intrinsic value is paramount in understanding options at parity. For call options, intrinsic value is the difference between the strike price and the current price of the underlying asset. Conversely, for put options, intrinsic value is calculated as the difference between the strike price and the current price of the underlying asset, minus the premium paid.

Exploring the Dynamics of Options Trading at Parity

Options trading at parity presents a delicate balance where time premium and intrinsic value converge. Time premium, an integral component of an option’s price, represents the value of the remaining time until expiration. At parity, the time premium of an option is zero, indicating that the market believes the option will expire worthless.

This dynamic creates a unique opportunity for investors. By carefully selecting options that are close to parity but have sufficient time to expiration, they can potentially capture gains from the passage of time. As the expiration date nears, the option’s time premium gradually diminishes, potentially translating into profits for the savvy investor.

Expert Insights and Tactical Strategies

Trading options at parity requires a keen understanding of technical analysis and a disciplined approach to risk management. Seasoned traders emphasize the importance of:

-

Technical Analysis: Scrutinizing charts and patterns helps traders identify potential trading opportunities. Indicators like support and resistance levels, moving averages, and Bollinger Bands provide valuable insights into the underlying asset’s price movements.

-

Risk Management: Prudent risk management practices are crucial. Establishing defined stop-loss levels safeguards against potential losses, while position sizing ensures that trades align with your financial objectives and risk tolerance.

-

Expiring Quickly: Options approaching their expiration date exhibit rapid time decay, potentially amplifying gains or losses. Traders must be cognizant of this time-sensitive nature and adjust their strategies accordingly.

![Put-Call Parity [Options Trading Strategies] - YouTube](https://i.ytimg.com/vi/YdtpeGc7eg4/maxresdefault.jpg)

Image: www.youtube.com

Options Trading At Parity

Image: www.12manage.com

Conclusion: Harnessing the Power of Options at Parity

Options trading at parity presents both opportunities and challenges for investors. By comprehending the intricate dynamics of this strategy, traders can unlock the potential of capturing profits from time premium erosion. However, it is paramount to approach this endeavor with a clear strategy, diligent risk management, and a comprehensive understanding of the underlying asset’s price movements. By adhering to these principles, you can harness the power of options trading at parity and enhance your journey toward financial empowerment.