Trading options has intrigued me for years, and one strategy that always caught my attention was delta options trading. I was drawn to the allure of leveraging delta values to potentially generate significant profits. My curiosity led me on a journey to delve deeply into the world of delta options, unraveling its complexities while exploring its potential.

Image: optionalpha.com

In this comprehensive guide, I endeavor to shed light on the enigmatic world of delta options trading, empowering you with the knowledge to make informed decisions. Let’s embark on this enriching journey together, exploring the intricacies of this exciting trading strategy.

Understanding Delta: The Key to Success

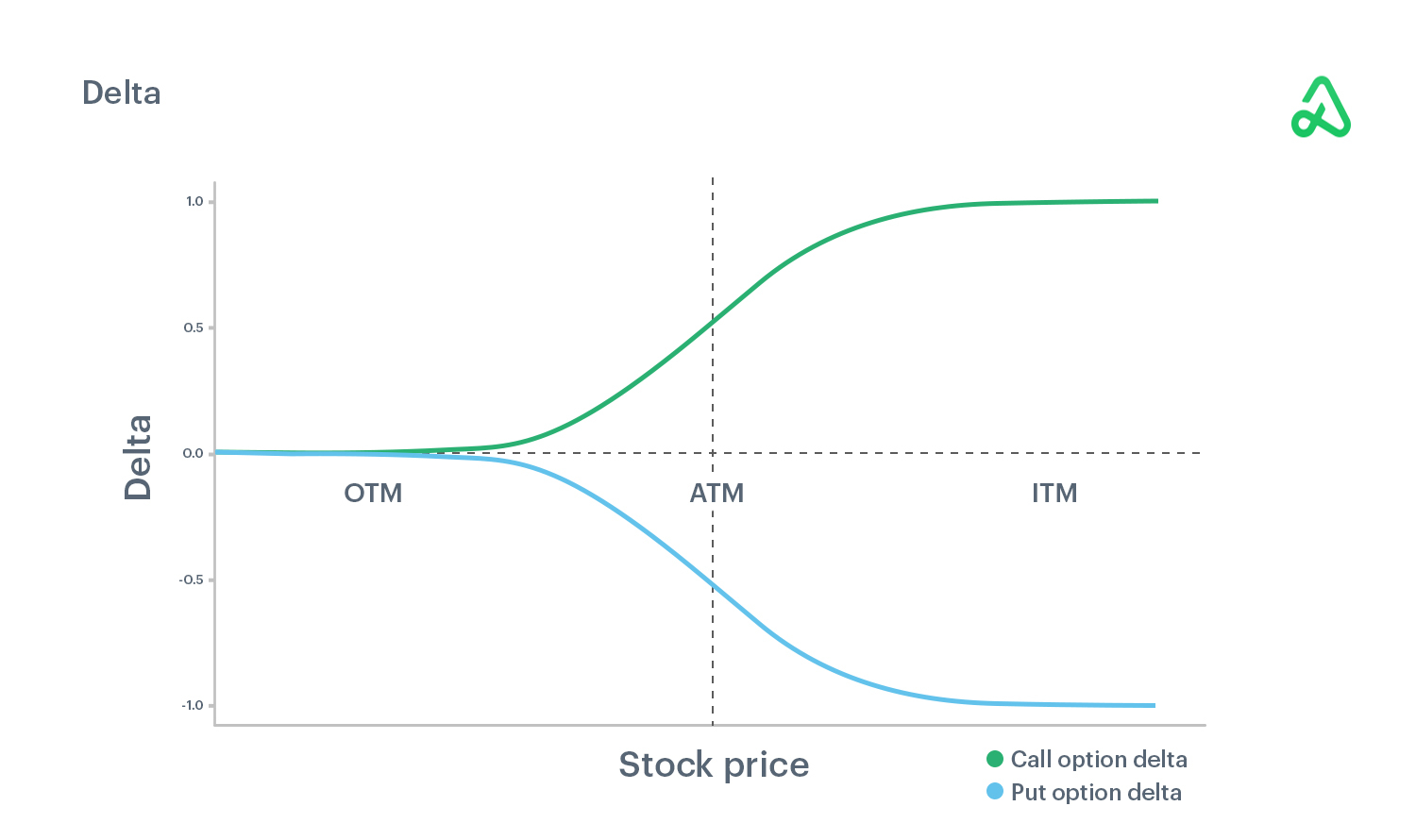

Delta serves as the cornerstone of delta options trading. It represents the rate of change in an option’s price relative to the underlying asset’s price. Understanding and effectively utilizing delta is paramount to achieving success in this strategy. Higher delta values, typically ranging between 0.5 and 1.0, indicate greater sensitivity of the option’s price to changes in the underlying asset’s price. Traders can capitalize on this sensitivity to capture potential gains.

Traders can strategically buy or sell delta options, depending on their market outlook. Buying a delta option grants the right to purchase (in the case of a call option) or sell (in the case of a put option) the underlying asset at a predetermined price, known as the strike price. Conversely, selling a delta option involves the obligation to fulfill the purchase or sale of the underlying asset should the option be exercised.

The Art of Delta Neutral Trading: Minimizing Risk, Maximizing Gains

Delta neutral trading is a sophisticated strategy employed by experienced traders to mitigate risk while enhancing profit potential. By establishing positions with opposing but equal delta values, traders aim for delta neutrality. This allows them to capitalize on the movements of the underlying asset, irrespective of direction. If the asset price increases, the positive delta position benefits, while the negative delta position offsets those gains, resulting in minimal net exposure.

Conversely, when the asset price declines, the negative delta position gains value while the positive delta position mitigates losses. This ingenious strategy enables traders to generate consistent returns even in volatile market conditions. However, it demands a high level of precision and risk management skills to execute effectively.

Expert Advice: Tips to Elevate Your Delta Options Trading

From my years of experience in delta options trading, I’ve gleaned invaluable insights that have shaped my approach to this dynamic strategy. Here are some expert tips to help you navigate the market with greater confidence:

- Choose Liquid Options: Opt for options with high trading volumes to ensure quick entry and exit from positions, reducing the risk of slippage.

- Manage Risk Prudently: Employ proper risk management techniques, including setting stop-loss orders and limiting trade sizes, to protect your capital and avoid excessive losses.

- Monitor Market Trends: Stay abreast of market news, economic data, and technical indicators to make informed trading decisions and adjust your strategies accordingly.

Image: www.rockwelltrading.com

Frequently Asked Questions: Unraveling Common Delta Options Queries

To further enhance your understanding of delta options trading, let’s delve into some commonly asked questions:

- What is the difference between call and put options? Call options grant the right to buy, while put options provide the right to sell the underlying asset at the strike price.

- How do I determine the intrinsic value of an option? Subtract the strike price from the current price of the underlying asset for a call option; for a put option, subtract the current price of the underlying asset from the strike price.

- What factors affect the price of an option? The underlying asset’s price, time to expiration, volatility, and interest rates play crucial roles.

Making Money Trading Delta Options

Image: tradingstrategyguides.com

Conclusion: Embracing Delta Options Trading for Success

Venturing into the realm of delta options trading requires a deep understanding of the concepts, strategies, and risk management techniques involved. By mastering these intricacies and leveraging the insights provided in this guide, you can unlock the potential for substantial gains while navigating the ever-evolving financial markets.

The key to successful delta options trading lies in continuous learning, strategic thinking, and meticulous risk management. As you embark on this exciting journey, remember to exercise caution, stay informed, and embrace the opportunities that delta options trading presents. Are you ready to explore the world of delta options trading and seize its profit-making potential?