Introduction

In the alluring world of finance, options trading often holds the promise of substantial returns, but it also conceals inherent risks that can lead to devastating losses. This comprehensive guide delves into the murky waters of options trading, exposing the perils that await unsuspecting investors who embark on this treacherous journey without adequate knowledge and preparation.

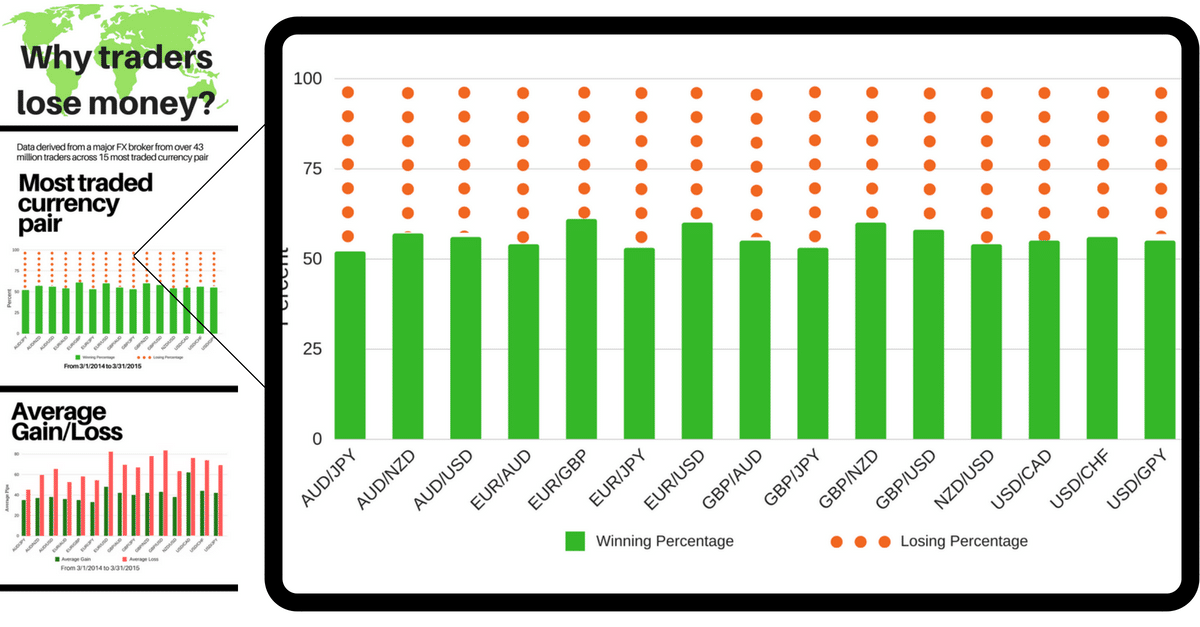

Image: learnpriceaction.com

Delving into the Labyrinth of Options Trading

Options contracts are financial instruments that grant the holder the right, but not the obligation, to buy or sell an underlying asset at a predetermined price on a specified date. They offer a myriad of strategies, from hedging against risk to speculating on price movements, but their complexities can ensnare even seasoned investors.

Misinterpreting the Greek letters that measure options’ sensitivity to changing market conditions, or failing to account for time decay, can result in catastrophic losses. The volatility inherent in options trading exacerbates these risks, making it a perilous game for those who lack a thorough understanding of the intricate dynamics involved.

Expert Insights: Navigating the Perilous Terrain

Renowned financial expert Warren Buffett cautions against options trading for the average investor, emphasizing that “options are not a lottery. They’re a way to transfer money from the impatient to the patient.” Indeed, patience and discipline are paramount in this realm, where quick profits often elude even the most skilled traders.

Industry veteran Mark Douglas echoes Buffett’s sentiments, asserting that “trading options without a sound understanding of risk management is akin to playing Russian roulette with your financial future.” Risk management strategies, such as setting stop-loss orders and diversifying investments, are indispensable tools for mitigating potential losses.

Realizing the Emotional Toll

Losses incurred in options trading can have a profound emotional impact. The rollercoaster of emotions experienced during market fluctuations can trigger feelings of anxiety, depression, and despair. It’s crucial to recognize the psychological toll that such losses can exact and to seek professional help if needed.

The allure of easy wealth can cloud judgment, leading investors to make impulsive decisions that amplify their losses. Discipline, patience, and a realistic assessment of the risks involved are essential for preserving both financial and emotional well-being.

Image: www.publish0x.com

Charting a Course to Avoid Financial Ruin

To venture into options trading with a semblance of prudence, aspiring investors should adhere to the following guidelines:

-

Educate Yourself Thoroughly: Master the intricacies of options trading before placing a single trade. Familiarize yourself with the different types of options, their strategies, and the associated risks.

-

Start Small and Gradually Scale Up: Begin with modest investments until you develop a proven track record. Gradually increase your capital allocation as you gain experience and confidence.

-

Manage Your Risk: Implement robust risk management strategies, including stop-loss orders, position sizing, and hedging techniques. Never risk more than you can afford to lose.

-

Seek Professional Guidance: Consult with experienced financial advisors who can provide personalized guidance and help you navigate the complexities of options trading.

-

Beware of Margin Trading: Margin trading magnifies both potential profits and losses. Exercise extreme caution when using margin and only do so with a thorough understanding of the risks involved.

Lose Money Options Trading

Image: bookpxako.blogspot.com

Conclusion

Options trading offers the potential for significant returns, but it comes with inherent risks that can cripple unprepared investors. Embarking on this perilous journey without adequate knowledge and preparation is akin to walking a tightrope over a bottomless abyss. Only by arming yourself with education, managing your risk, and seeking professional guidance can you navigate the treacherous waters of options trading and emerge with your financial future intact. Remember, the road to financial success is paved with patience, discipline, and a clear understanding of the potential pitfalls that lie ahead.