Embrace Financial Empowerment: Navigating the Complexities of Options Trading and Index Funds

Image: www.daytradetheworld.com

A Journey of Investment Literacy

In the ever-evolving world of finance, deciphering investment choices can feel like navigating a treacherous labyrinth. Among the myriad options lie two distinct paths: options trading and index funds. Each approach carries its unique set of risks and rewards, leaving many investors grappling with questions and uncertainty. In this comprehensive guide, we will unravel the complexities of options trading versus index funds, empowering you to make informed decisions toward your financial aspirations. Join us on this enlightening journey as we demystify the maze and pave the way toward investment literacy.

Options Trading: The Path of Potential and Pitfalls

Options trading, a sophisticated investment strategy, grants you the right—but not the obligation—to buy or sell an underlying asset at a predetermined price (strike price) within a specified time frame (expiration date). This realm of trading carries the potential for amplified returns, yet it also comes with inherent risks that can magnify losses. Mastering options trading requires a deep understanding of market dynamics, risk management techniques, and the ability to strategize under pressure.

Unveiling the Mechanics of Options Trading

Options contracts are characterized by two key components: the underlying asset and the option premium. The underlying asset can be a stock, bond, commodity, or index, while the option premium represents the price you pay to secure the right to buy or sell. Depending on your investment objectives, you can choose between two primary types of options: calls (the right to buy) and puts (the right to sell).

Image: www.paisabazaar.com

Navigating the Risks of Options Trading

While options trading offers the allure of substantial profits, it is not without its perils. The primary risk associated with options trading is the potential for significant losses. Unlike index funds, where your losses are limited to the amount invested, options contracts can result in unlimited losses if market conditions move against you. Understanding risk management strategies such as stop-loss orders and option spreads is paramount to mitigate potential losses.

Index Funds: A Journey of Diversification and Simplicity

Index funds, on the other hand, offer a more straightforward approach to investing. These passively managed funds track a specific market index, such as the S&P 500 or the Nasdaq Composite Index, providing investors with exposure to a broad range of stocks within that index. Index funds are known for their diversification, lower costs, and long-term growth potential.

Understanding the Mechanics of Index Funds

Index funds are designed to mirror the performance of a particular market index. Fund managers buy and hold the same stocks in the same proportions as the index they track. By investing in an index fund, you gain instant diversification, reducing your risk compared to holding individual stocks. Additionally, index funds typically have lower management fees than actively managed funds, benefiting investors over the long term.

Reaping the Benefits of Index Funds

Index funds have gained immense popularity among investors seeking a low-maintenance, cost-effective investment strategy. The primary benefits of index funds include:

- Diversification: Index funds provide instant exposure to a wide range of stocks, reducing the risk associated with any one particular company.

- Lower Costs: Compared to actively managed funds, index funds have lower management fees, translating into higher returns for investors over time.

- Simplicity: Index funds offer a straightforward approach to investing, appealing to both novice and experienced investors alike.

Making the Choice: A Tale of Risk and Reward

The choice between options trading and index funds hinges on your individual investment goals, risk tolerance, and time horizon. If you are comfortable with higher levels of risk and have the expertise to navigate market complexities, options trading may offer the potential for amplified returns. However, if you seek diversification, simplicity, and long-term growth with lower risk, index funds may be a more suitable choice.

Embracing Options Trading with Caution

Options trading can be a powerful tool for experienced investors seeking higher returns. However, it is imperative to possess a thorough understanding of market dynamics, risk management strategies, and the underlying assets. Without proper knowledge and risk mitigation techniques, options trading can lead to substantial losses.

Choosing Index Funds for Peace of Mind

Index funds are an excellent choice for investors seeking a diversified, low-maintenance, and cost-effective investment strategy. Their inherent diversification reduces risk, making them suitable for a broad range of investors, including beginners and those approaching retirement. However, it is important to remember that index funds are not immune to market downturns and returns may vary depending on the index they track.

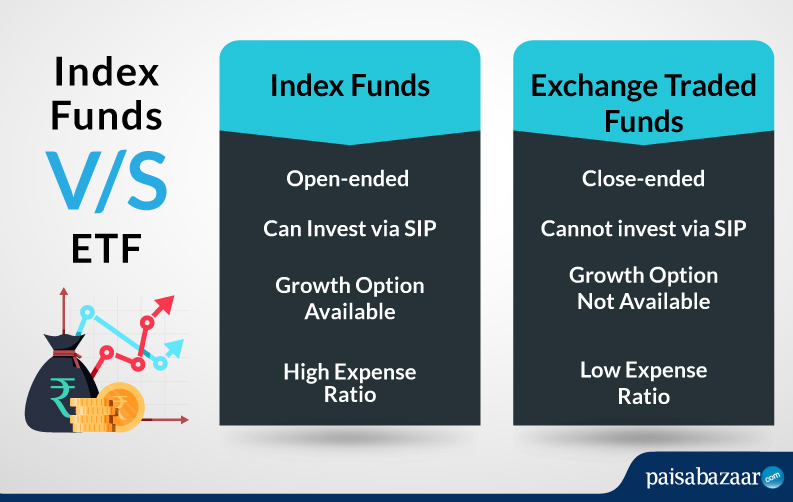

Options Trading Vs Index Fund

Image: www.pinterest.com

Conclusion: A Path toward Informed Investment

Investing should be an empowering journey, not a perilous maze. By understanding the complexities of options trading and index funds, you can make informed decisions aligned with your financial aspirations. Remember, the path you choose will depend on your individual circumstances and investment goals. Embrace this newfound knowledge, consult with financial professionals if needed, and embark on a journey toward financial literacy and investment success.