Introduction

Image: www.optiontradingtips.com

For those seeking lucrative financial ventures, the Nifty Index Option Trading offers a compelling landscape filled with promising opportunities. As a prominent financial instrument, Nifty options present traders with the potential to leverage index movements and make calculated bets on price fluctuations. This guide delves into the intricate details of Nifty Index Option Trading, deciphering its fundamentals, strategies, and market nuances to empower traders in navigating this realm with confidence.

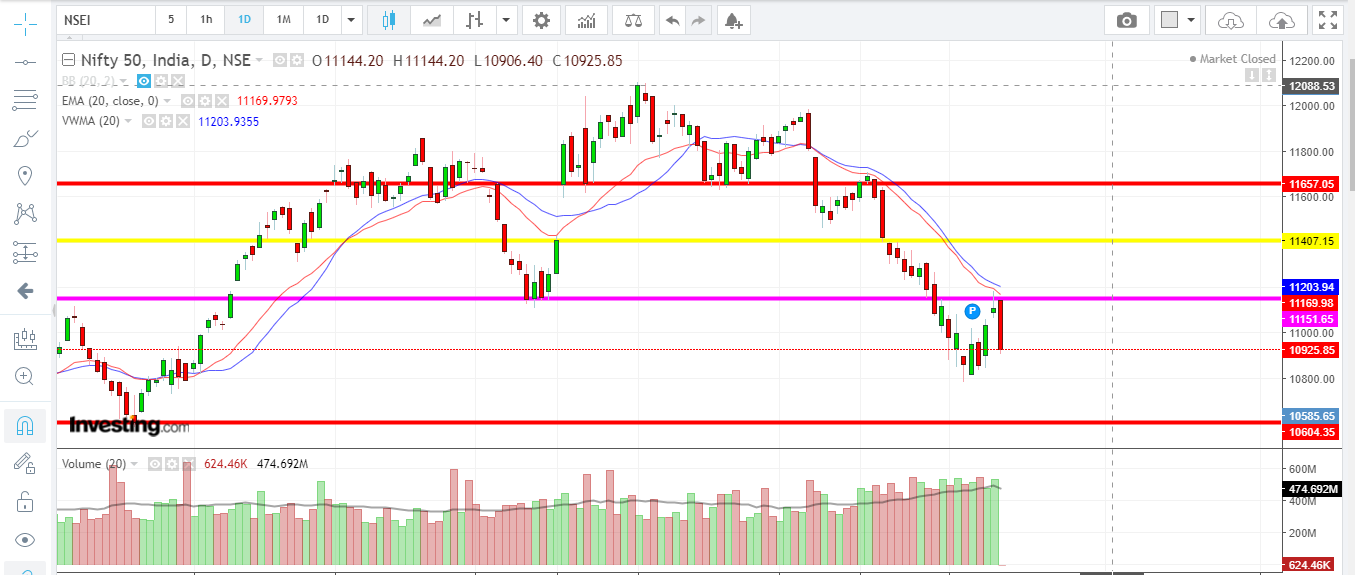

Understanding Nifty Index Options

Nifty Index Options are financial contracts derived from the Nifty 50 index, a benchmark that gauges the performance of the top 50 listed companies on the National Stock Exchange (NSE) of India. These options grant traders the right, but not the obligation, to buy (call) or sell (put) Nifty futures contracts at a predetermined price (strike price) on or before a specific date (expiration date). By astutely understanding market dynamics and utilizing these options, traders can devise strategic plays to capitalize on bullish or bearish market sentiments.

Mechanism of Nifty Index Option Trading

Nifty Index Option Trading centers around the concept of time decay, which refers to the erosion of option premium value as the expiration date draws near. Traders can capitalize on this time decay by either buying or selling options based on their predictions of price movements. If correctly anticipated, buying a call option (for bullish bets) or a put option (for bearish bets) can yield substantial profits as the option’s intrinsic value increases to outpace the premium’s time decay.

Strategies for Nifty Index Option Trading

The realm of Nifty Index Option Trading unfolds a diverse array of strategies, each tailored to specific market conditions and risk appetites. Some widely employed strategies include straddles, strangles, butterflies, and condors, which provide varying degrees of risk and reward profiles. By meticulously analyzing market trends and applying suitable strategies, traders can increase their chances of successful trades.

Recent Advancements in Nifty Index Option Trading

The advent of technology has ushered in transformative advancements in Nifty Index Option Trading. Electronic trading platforms facilitate seamless order execution and market monitoring, while algorithmic trading leverages computational power to execute trades swiftly and efficiently. These advancements empower traders with enhanced precision and responsiveness, sharpening their competitive edge.

Conclusion

Nifty Index Option Trading presents a dynamic and potentially rewarding arena for traders seeking financial gains. By mastering the fundamentals, implementing astute strategies, and adapting to market advancements, traders can unlock the full potential of this instrument. As traders navigate the intricacies of this market with prudence and determination, the path toward profitability becomes more accessible. Remember, like any financial endeavor, understanding the risks involved is paramount, and seeking professional guidance when necessary is always advisable.

Image: mavink.com

Nifty Index Option Trading

Image: tradebrains.in