In the vast realm of financial markets, options trading presents investors with a versatile tool to manage risk and potentially enhance returns. Options contracts, in essence, offer the right, but not the obligation, to buy (call) or sell (put) an underlying asset at a specified price on a predetermined date.

Image: tradebrains.in

Understanding the Difference Between Puts and Calls

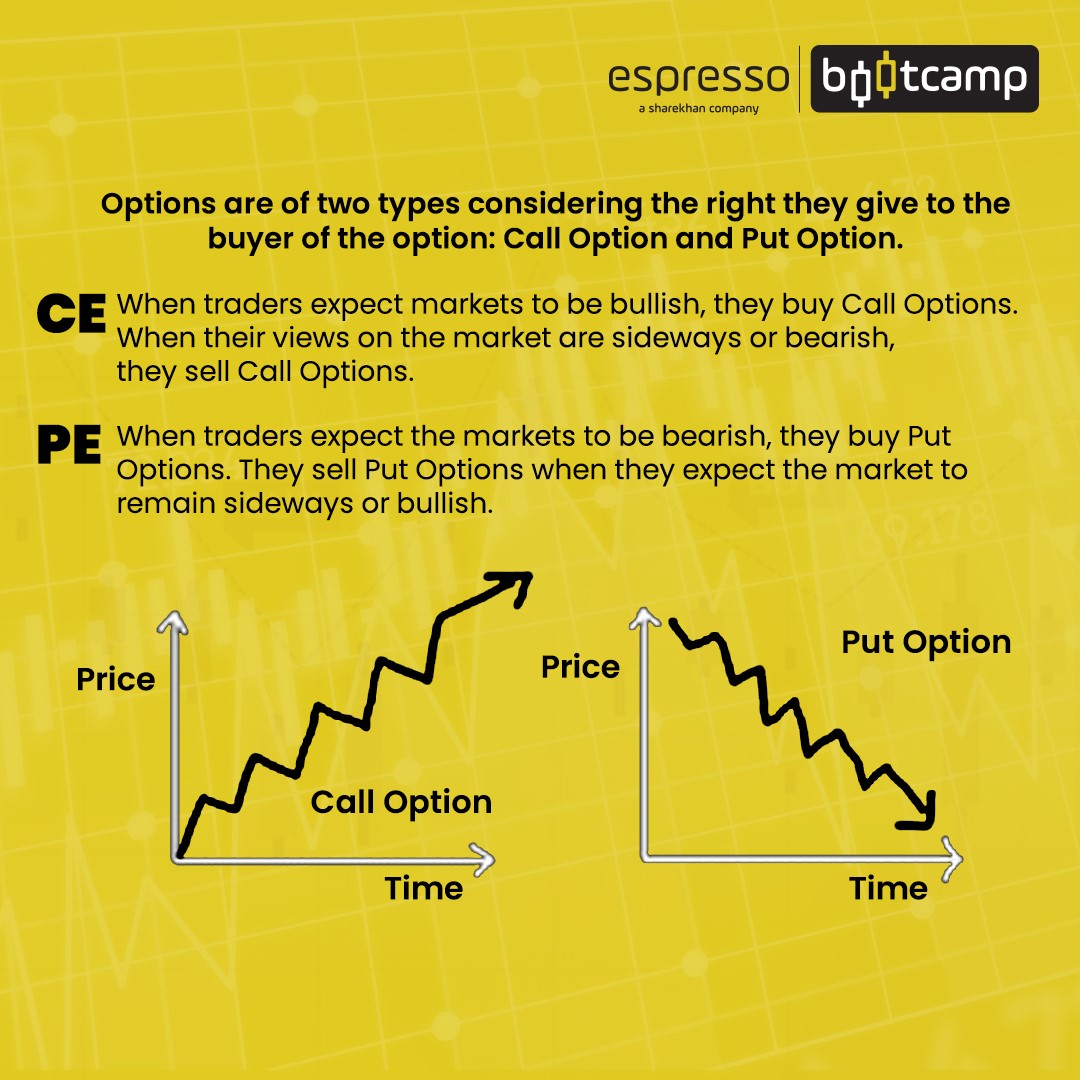

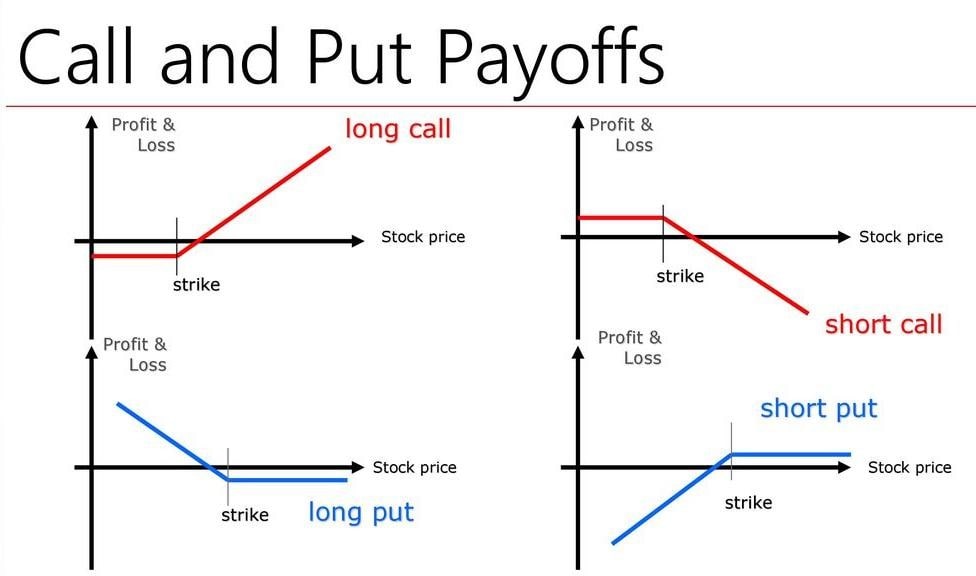

Call Options

Call options grant the holder the right to purchase an underlying asset at a “strike price” on or before a specified “expiration date.” Essentially, these contracts bestow upon the owner the potential to capitalize on a rise in the asset’s value.

Put Options

On the other hand, put options confer the right to sell an underlying asset at the strike price on or before the expiration date. These options provide investors with a hedge against a potential decline in the asset’s value, offering a form of downside protection.

Image: www.myespresso.com

The Dynamics of Options Trading

Options contracts can be immensely versatile, providing numerous strategies for investors. For instance, one could buy a call option to speculate on a stock’s appreciation or purchase a put option to protect against a stock’s decline. Additionally, options can also be sold to generate income or employed in more complex strategies.

Factors Influencing Option Prices

The pricing of options contracts is influenced by a multitude of factors, including the current price of the underlying asset, the strike price, time to expiration, and volatility. Understanding how these factors interplay is crucial for navigating the complexities of options trading.

Latest Trends and Developments

The options market is continuously evolving, with new trends and developments emerging. Technological advancements have facilitated electronic trading platforms, increasing accessibility and liquidity. Furthermore, the rise of retail investors has introduced new dynamics to the market.

Tips and Expert Advice for Options Trading

Successful options trading requires not only a deep understanding of the mechanics but also the ability to navigate market uncertainties. Here are some valuable tips and expert advice:

Choose Options that Suit Your Risk Tolerance

Options carry varying degrees of risk, depending on the underlying asset, strike price, and time to expiration. Carefully evaluate your financial situation and risk tolerance before committing to any trades.

Understand Leverage and Potential Losses

Options possess the potential to amplify both gains and losses. It is essential to be fully aware of the leverage inherent in options and the possibility of substantial losses, up to and including the entire invested capital.

Frequently Asked Questions (FAQs)

Q: What is a call option?

A: A call option grants the holder the right to buy an underlying asset at a specified strike price on or before a predetermined date.

Q: What is a put option?

A: A put option provides the holder with the right to sell an underlying asset at a strike price on or before the expiration date.

Q: What factors influence option prices?

A: Key factors shaping option prices include the current asset price, strike price, time to expiration, and volatility.

Q: How risky is options trading?

A: Options trading involves varying levels of risk, depending on the specific options contract and market conditions. It is crucial to assess one’s risk tolerance before engaging in trades.

Conclusion

Options trading offers a diverse array of opportunities for investors seeking to manage risk, enhance returns, or speculate on market movements. By thoroughly understanding the complexities of options and utilizing sound strategies, investors can harness the potential benefits of this dynamic market while mitigating risks.

Options Trading Put Vs Call

Image: libertex.com

Call to Action

Whether you are a seasoned options trader or just beginning your journey, we encourage you to delve deeper into the intricacies of this fascinating market. Let us know if you have any further questions or would like to engage in further discussions regarding options trading.