Imagine this: You’re sitting at your computer, watching the market fluctuate, and you sense a shift. You see an opportunity, a chance to capitalize on the momentum of a stock or the anticipation of an event. But instead of simply buying or selling the stock directly, you have another tool at your disposal: options.

Image: niyudideh.web.fc2.com

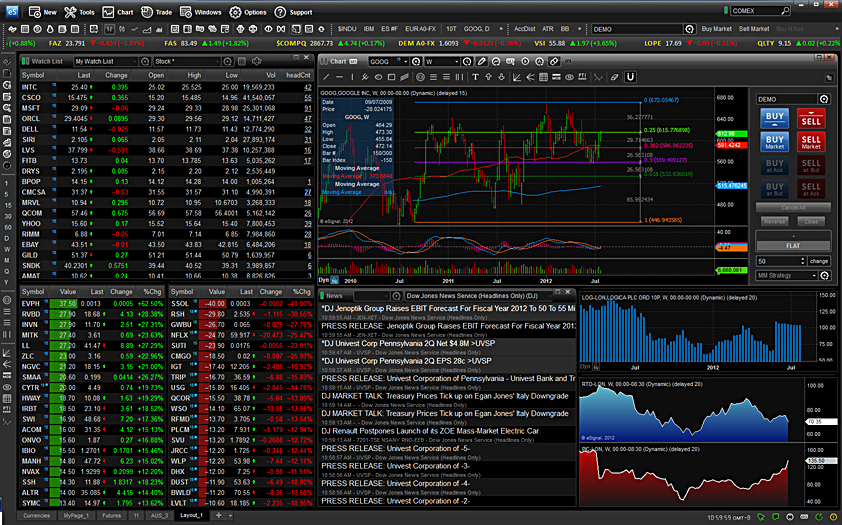

Options trading isn’t for the faint of heart. It offers the potential for high returns, but also carries significant risk. To navigate this world, you need the right tools and knowledge. This guide delves into the fascinating world of options trading platforms, exploring their features, benefits, and the strategies you can employ to maximize your potential.

Understanding Options and Platforms

Options contracts are essentially agreements that give you the right, but not the obligation, to buy or sell an underlying asset at a predetermined price (the strike price) on or before a specific date (the expiration date). This unique structure allows for a wide range of strategies, from hedging your existing portfolio to generating income or making highly leveraged bets.

Options trading platforms serve as your bridge to this dynamic world. They provide you with the tools to:

- Access real-time market data: Track price quotes, options chains, and other crucial information to make informed decisions.

- Execute trades swiftly: Place, modify, and cancel orders with a few clicks, maximizing your speed and efficiency.

- Visualize your trades: Analyze profit and loss scenarios using interactive tools and charts, providing deeper insight into your positions.

- Manage your risk: Set risk limits, monitor stop-loss orders, and utilize margin accounts, providing control over your potential losses.

- Access educational resources: Many platforms offer tutorials, articles, and webinars to help you learn and hone your options trading skills.

Choosing the Right Platform for Your Needs

Navigating the options trading platform landscape can be overwhelming. It’s crucial to select a platform that aligns with your trading style, experience level, and investment goals. Consider these factors:

- Ease of use: Look for platforms with intuitive design, clear layout, and user-friendly interfaces. Beginners might prefer platforms with educational resources and guided tutorials.

- Trade execution speed: Platforms with fast order execution are crucial for nimble traders who capitalize on fleeting market opportunities.

- Research tools: Platforms with robust research features, including market analysis tools, financial data, and historical charting, can support well-informed trading decisions.

- Mobile app functionality: Access your trading account on the go with a comprehensive and responsive mobile app for managing positions and staying updated on market movements.

- Cost and fees: Compare commissions, transaction costs, data fees, and other platform expenses to choose a platform that fits your budget.

Exploring Popular Options Trading Platforms

Several prominent platforms cater to a diverse range of traders, each with its own strengths and specializations.

- TD Ameritrade Thinkorswim: Known for its advanced charting tools, customizable platforms, and extensive paper trading functionality, Thinkorswim is a favorite among experienced options traders.

- Interactive Brokers: This platform offers deep liquidity, access to global markets, and sophisticated order types, making it ideal for active and high-volume traders.

- *ETRADE*: ETRADE appeals to a wide range of investors with its user-friendly interface, robust research features, and commission-free stock and ETF trades.

- Schwab: With its focus on education and research, Schwab offers a comprehensive platform with educational resources, tools to build and manage portfolios, and a vast selection of investment products.

Image: www.forexcrunch.com

Key Concepts for Successful Options Trading

Options trading offers a world of possibilities, but it’s essential to first master some fundamental concepts to navigate this complex realm.

- Call options: Call options give you the right to buy an asset at the strike price. They are beneficial if you believe the underlying asset will rise in value.

- Put options: Put options grant you the right to sell an asset at the strike price. They are profitable if you anticipate a decline in the underlying asset’s value.

- Premium: This is the price you pay to acquire an options contract. It reflects the market’s perception of the contract’s potential value.

- Expiration date: The deadline by which you must exercise your right to buy or sell the underlying asset.

- Intrinsic value: The difference between the underlying asset’s market price and the strike price.

- Extrinsic value: This value is based on factors like volatility, time to expiration, and interest rates.

- Covered calls: A strategy where you sell a call option on a stock you already own. It generates income but limits your potential upside.

- Protective puts: This strategy involves buying a put option to protect your stock portfolio from downside risk.

- Straddles: Combining a call and a put option with the same strike price and expiration date to profit from high volatility.

Strategies for Navigating the Options Market

- Bullish strategies: These strategies profit if the underlying asset’s price rises. Examples include buying call options, covered calls, and bullish vertical spreads.

- Bearish strategies: Designed to benefit from a decline in the underlying asset’s price. Common examples include buying put options, selling covered puts, and bearish vertical spreads.

- Neutral strategies: These strategies profit from volatility regardless of the underlying asset’s direction. Examples include straddles, strangles, and calendar spreads.

Expert Insights and Actionable Tips

1. Start with Education: Before you even consider placing trades, dedicate time to learning the basics of options trading. Online resources, courses, and books offer valuable insights to build a solid foundation.

2. Paper Trade First: Master your skills by practicing trading with virtual money on a paper trading platform. This way, you can experiment with different strategies and refine your approach before risking real capital.

3. Define your Risk Tolerance: Options trading can be highly volatile, so it’s crucial to define your risk tolerance and stick to it. Never invest more than you can afford to lose.

4. Leverage Risk Management Tools: Make use of stop-loss orders, margin accounts, and other tools designed to limit your potential losses.

Option Trading Platform

Conclusion

Options trading presents a complex but rewarding opportunity to enhance your investment strategy. By understanding the fundamentals of options, selecting the right platform, and practicing risk management, you can navigate this dynamic world and unlock its potential to achieve your financial goals. Remember, education, patience, and discipline are crucial for success.

This guide provides a strong foundation for your options trading journey. Now, it’s your turn to take the first step. Explore the available options trading platforms, choose one that aligns with your needs, and begin your exploration into the world of options. With dedication and a solid trading plan, you can turn opportunities into tangible results.