Embark on a journey into the realm of options trading, where time holds a dualistic power over your investments. It can be a formidable foe, eroding the value of your contracts, or a cunning ally, granting you strategic advantages. In this comprehensive analysis, we delve into the intricacies of options trading decay curve percentages, empowering you with the knowledge to navigate the complexities of this dynamic market.

Image: camupay.web.fc2.com

Defining Options and Time Decay

Options are financial contracts that grant the buyer the right, but not the obligation, to buy (call option) or sell (put option) a particular asset (usually a stock) at a specified price (strike price) by a predetermined date (expiration date). One of the key factors influencing the value of options is time decay, which refers to the progressive loss of value as expiration nears.

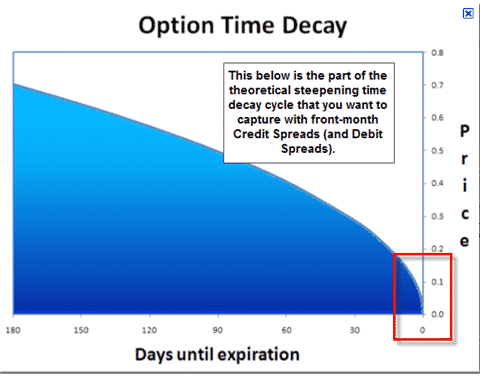

The Decay Curve

As an option approaches its expiration, its value decays at an accelerating rate due to two primary factors:

- Theta Decay: Represents the intrinsic loss in value as time passes. It is the highest at the beginning of an option’s life and gradually decreases as expiration approaches.

- Vega Decay: Reflects the declining sensitivity of an option’s price to changes in implied volatility. When volatility rises, Vega decay offsets some of the Theta decay.

Factors Affecting Decay Curve Percentages

The rate of decay is influenced by several variables, including:

- Time to Expiration: The shorter the time remaining until expiration, the more rapid the decay.

- Volatility: Higher volatility leads to faster decay, particularly in the early stages of an option’s life.

- Moneyness: At-the-money (ATM) options, where the strike price is close to the underlying asset’s price, experience the steepest decay.

Image: optionstradingiq.com

Consequences of Decay Curve Percentages

Understanding decay curve percentages is crucial for options traders as it impacts their trading strategies:

- Short-Term Traders: Options with shorter durations experience significant decay, making them unsuitable for sustained holdings.

- Long-Term Traders: Buying long-dated options can mitigate decay, but it comes with the risk of the asset price moving against the desired direction.

- Volatility Arbitrage: Trading strategies involving options with different volatility profiles can exploit decay curves to generate profits.

Optimizing Trading Strategies

To minimize the impact of decay curve percentages and maximize trading potential, consider these strategies:

- Trade Closer to Expiration: For short-term trades, consider using options with shorter durations to reduce decay.

- Use Out-of-the-Money Options: Buying OTM options can reduce decay while maintaining exposure to potential price movements.

- Monitor Volatility: Keep a close eye on implied volatility, as it directly affects Vega decay.

- Rollover Options: If the underlying asset is moving in the desired direction, consider rolling over options to longer-dated or higher-strike-price contracts.

Options Trading Decay Curve Percentages

Image: optionstradingiq.com

Conclusion

Options trading decay curve percentages are a fundamental aspect of understanding the dynamics of this complex market. By comprehending the factors that influence decay and implementing appropriate trading strategies, you can navigate the challenges and exploit the opportunities presented by time decay. Remember, knowledge is power, and in the realm of options trading, mastering the nuances of decay curve percentages will propel you towards informed decision-making and unlock the path to successful investing.