In the realm of day trading options, time is not just an ally but an enigmatic adversary. Its inexorable passage wreaks havoc on option premiums, diminishing their value with each passing tick. This phenomenon, known as time decay, stands as a constant threat, eroding traders’ profits and testing their resilience. Understanding time decay is not merely an academic exercise but an essential survival skill for any aspiring day trader.

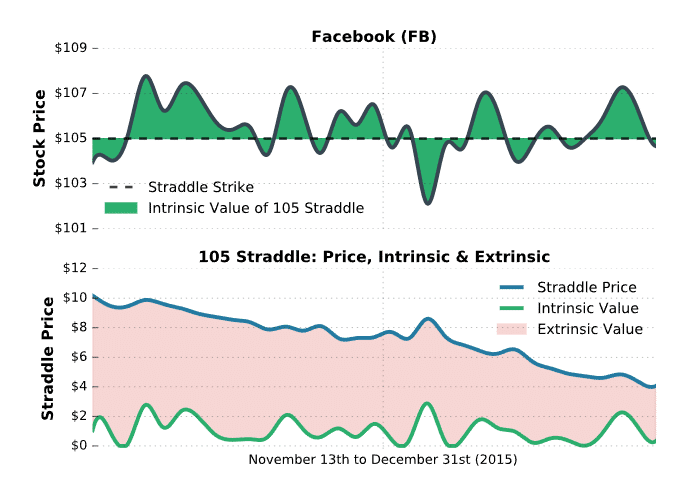

Image: www.projectfinance.com

Delving into the Mechanics of Time Decay

Time decay is an intrinsic characteristic of all options contracts. An option contract comprises a right but not an obligation to buy (call) or sell (put) an underlying asset at a specified price on or before a predetermined date (expiration date). As time marches forward, two key factors contribute to time decay:

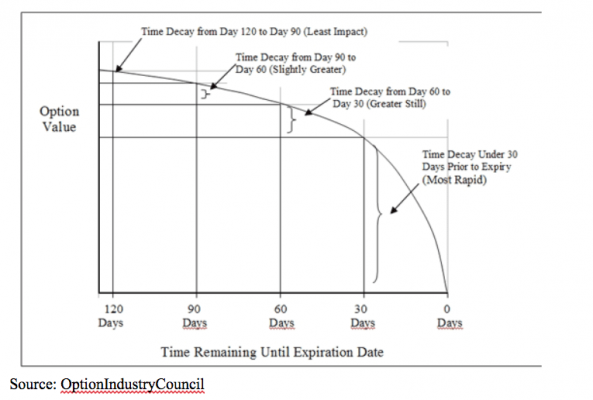

- Extrinsic Value Erosion: The extrinsic value of an option represents the potential profit it holds beyond its intrinsic value (the difference between the strike price and the current market price of the underlying asset). Time decay gradually erodes this extrinsic value, as the probability of the option reaching profitability dwindles with each passing day.

- Implied Volatility Contraction: Implied volatility measures the market’s perception of the future price range of the underlying asset. High implied volatility indicates expectations of significant price fluctuations, boosting option premiums. However, as time elapses, implied volatility tends to decrease, lowering option premiums and exacerbating time decay.

Day Trading Strategies to Counteract Time Decay

Time decay presents a unique challenge for day traders, who typically hold positions for short durations. To mitigate its effects and maximize profitability, consider these strategies:

- Trading In-the-Money (ITM) Options: ITM options have intrinsic value, which allows them to withstand time decay better than out-of-the-money (OTM) options. However, the premium paid for ITM options is typically higher.

- Scalping: Scalping involves entering and exiting positions within minutes or seconds, capturing small profit margins on rapid price movements. Time decay has less impact on short-term trades.

- Trading High-Volume Stocks: Options on stocks with high trading volume exhibit tighter bid-ask spreads, reducing trading costs and minimizing the impact of time decay.

- Utilizing Limit Orders: Placing limit orders helps traders control the price at which they enter and exit trades, allowing them to minimize losses and preserve capital.

Impact of Market Sentiment and Volatility

Market sentiment and volatility play a significant role in time decay. Positive market sentiment (bullishness) tends to drive up implied volatility, boosting option premiums and decelerating time decay. Conversely, negative market sentiment (bearishness) often leads to decreased volatility, accelerating time decay’s erosive effects.

Understanding the influence of market sentiment on time decay enables traders to make informed decisions and adjust their trading strategies accordingly. For instance, traders might favor buying calls during periods of bullish sentiment, as the positive market outlook can mitigate time decay and increase profit potential.

Image: stocknews.com

Time Decay Day Trading Options

Image: futuresoptionsetc.com

Navigating the Perils of Time Decay

Time decay is an unavoidable aspect of day trading options. However, by understanding its mechanisms and implementing effective countermeasures, traders can minimize its impact and enhance their trading performance. It is essential to embrace a disciplined approach, employing sound risk management principles and adapting strategies to the ever-changing market environment. Time decay may be an adversarial force, but it is one that can be outsmarted.