In the realm of options trading, understanding the break-even price is essential for maximizing potential profits and minimizing risks. Whether you’re a seasoned trader or just starting, this guide will equip you with an in-depth understanding of break even prices and their significance.

Image: forexfilli.com

Defining the Options Trading Break Even Price

At its core, the options trading break even price is the stock price at which the option holder neither gains nor loses money on the trade, excluding commission and fees. This is predominantly determined by the option’s strike price, premium paid, and time to expiration. It serves as a benchmark against which you can evaluate the profitability of your options trading strategies.

Factors Influencing the Break Even Price

Several key factors influence the break even price:

1. Strike Price: The price at which the option can be exercised to buy or sell the underlying asset. Higher strike prices result in higher break even prices.

2. Premium Paid: The upfront cost of purchasing an option. Premiums increase with increasing strike prices and shorter times to expiration.

3. Time to Expiration: The duration until the option expires. Options with shorter times to expiration generally have higher premiums and break even prices.

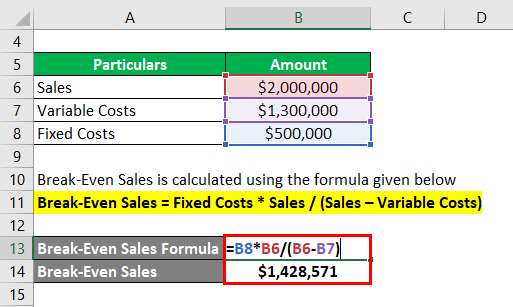

Calculating the Break Even Price

Calculating the break even price for different types of options contracts is straightforward:

1. Calls: Break Even Price = Strike Price + Premium Paid

2. Puts: Break Even Price = Strike Price – Premium Paid

Image: atozmarkets.com

Interpreting Break Even Prices

Break even prices provide insights into your options trading strategy:

- Prices Above Break Even: If the stock price exceeds the break even price by the expiration date, you have the potential to generate profits.

- Prices Below Break Even: If the stock price falls below the break even price, you face potential losses.

Strategies for Trading Near Break Even

Traders often develop specific strategies when stock prices are near the break even point:

- Selling the Option: If the stock price is approaching the break even price and you no longer expect it to move significantly, consider selling the option to recoup some of your investment.

- Adjusting Your Position: If the stock price is moving away from the break even price and you believe it will continue in that direction, you may consider adjusting your position by rolling the option or buying/selling an additional option with a different strike price.

Options Trading Break Even Price

Image: www.educba.com

Conclusion

Mastering the concept of the options trading break even price is crucial for informed decision-making. By thoroughly understanding the factors that influence break even prices and applying strategic approaches, you can optimize your options trading outcomes. Remember to conduct thorough research, consult with experienced professionals when needed, and always exercise caution in the volatile world of options trading.