Introduction:

Image: www.oreilly.com

In the labyrinthine world of finance, options trading stands as an enigmatic realm, tantalizing investors with the promise of extraordinary returns. Yet, it’s a path fraught with complexity and potential pitfalls. Enter Options Trading 101: an immersive journey designed to demystify the intricacies of this captivating field. From foundational concepts to practical applications, we’ll delve into the world of options trading, empowering you to navigate its complexities with confidence.

Options, in essence, are financial instruments that bestow upon their holders the right, but not the obligation, to buy or sell an underlying asset at a predetermined price within a specified timeframe. This flexibility opens up a spectrum of strategies, enabling traders to tailor their investments to suit their risk tolerance and market outlook.

Delving into the Options Trading Landscape:

The origins of options trading can be traced back centuries, with roots in the ancient practice of hedging. Today, options markets have mushroomed into a global phenomenon, catering to a vast array of financial institutions, professional traders, and individual investors alike.

At the heart of options trading lies the concept of options contracts, which stipulate the parameters of the underlying asset, the strike price (the predetermined price), the expiration date, and the premium (the cost of acquiring the option). Understanding these foundational elements is paramount to mastering the art of options trading.

Unveiling the Two Sides of Options Trading:

Options trading presents two distinct vantage points: buying and selling options. When buying an option, you’re essentially acquiring the right to execute a particular trade at a future date. This strategy, commonly employed to express a bullish or bearish view on the underlying asset, offers limited risk but also caps potential returns.

Conversely, selling options entails selling the right to execute a trade to another party. This strategy, often associated with a neutral or bearish market outlook, carries greater risk but also offers uncapped profit potential.

Navigating the Options Trading Strategies:

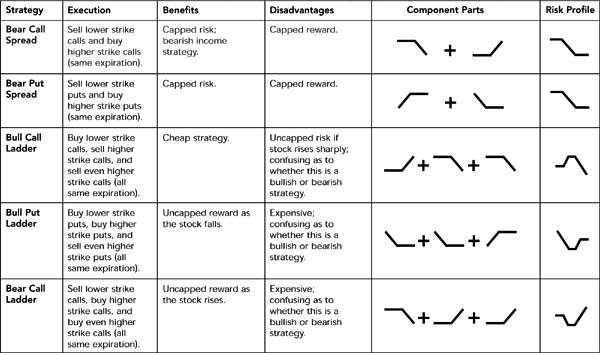

The realm of options trading encompasses a myriad of strategies, each tailored to specific market conditions and risk appetites. Covered calls, for instance, involve selling a call option against an underlying asset you own, while protective puts are designed to hedge against potential losses. Understanding these strategies and their applications is crucial for successful options trading.

Expert Insights and Practical Applications:

To illuminate the practical aspects of options trading, let’s delve into insights from industry veterans. “Options trading empowers investors with immense flexibility,” says seasoned trader Mark Douglas. “It allows them to customize their investments and potentially enhance their returns.”

Harnessing this flexibility requires a disciplined approach. “Risk management is paramount,” emphasizes financial educator Dr. Alexander Elder. “Thoroughly evaluate potential risks and tailor your strategies accordingly.”

Conclusion:

Options trading offers a captivating avenue for investors seeking to navigate the complexities of the financial markets. By grasping its foundational concepts, exploring various trading strategies, and heeding expert advice, you can unlock the power of options trading and potentially augment your financial endeavors. Remember, knowledge and responsible trading practices are the keys to unlocking the full potential of this dynamic financial instrument.

Image: ejizajif.web.fc2.com

Options Trading 101 From Theory To Application