In the ever-evolving world of trading, option strategies have emerged as formidable tools for discerning investors seeking to manage risk and enhance returns. Delving into this realm, Amibroker stands out as a trusted platform that empowers traders with robust analysis and execution capabilities.

Image: tradingtuitions.com

For the uninitiated, option trading involves buying or selling contracts that confer the right, but not the obligation, to buy or sell an underlying asset at a predetermined price on a specified date. Options offer versatility, allowing traders to customize their positions based on market outlook and risk tolerance.

Amibroker: An Arsenal of Options Trading Tools

Amibroker has carved a niche as a comprehensive software suite that equips traders with advanced tools for option analysis. Its user-friendly interface and customizable modules unlock the potential for comprehensive market analysis, strategy backtesting, and automated trading.

Indicators and Analysis: Amibroker boasts a vast library of technical indicators specifically designed for options trading. From Greeks analysis to volatility measurements, traders can gauge market trends and identify trading opportunities with precision.

Step-by-Step Guide to Option Trading with Amibroker

To embark on your option trading journey with Amibroker, follow these key steps:

- Select Underlying Asset: Identify the stock, index, or commodity you wish to trade options on.

- Determine Contract Type and Expiration Date: Choose between calls (right to buy) or puts (right to sell) and select the expiration date that aligns with your trading horizon.

- Calculate Option Premium: Employ Amibroker’s pricing models to assess the fair value of the option contract based on prevailing market conditions.

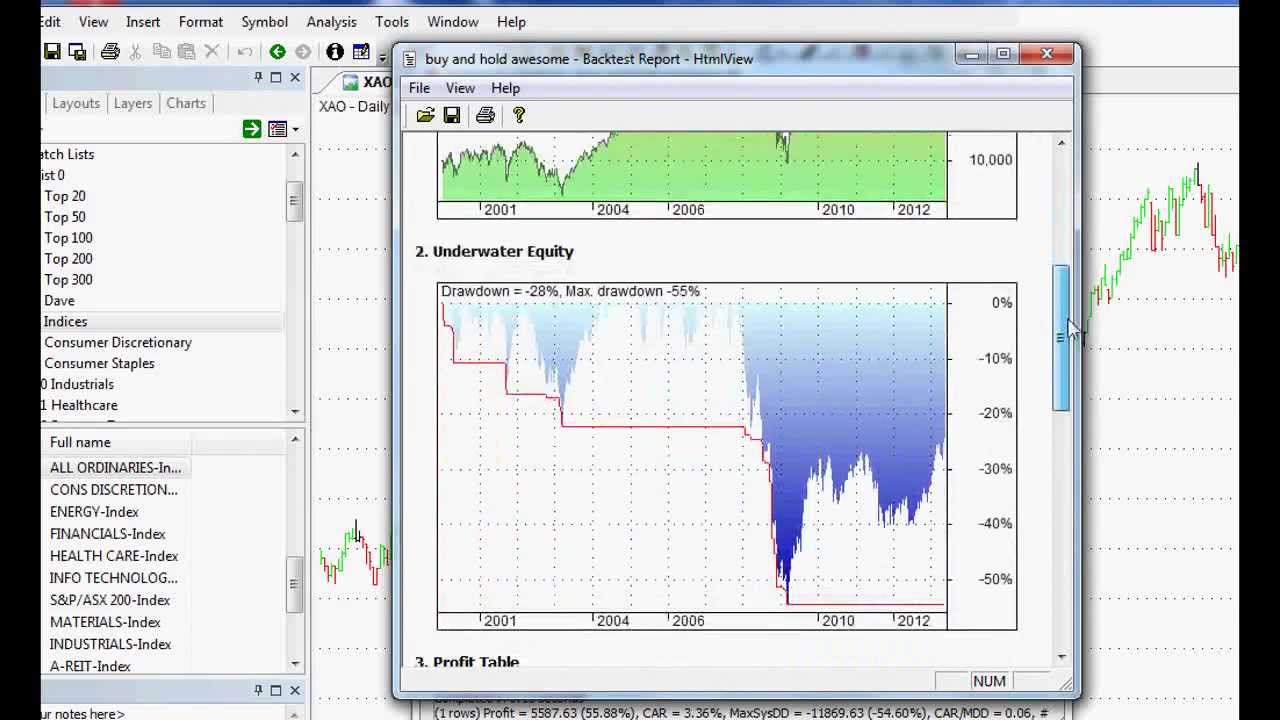

- Evaluate Trade Strategy: Backtest your trading strategy using Amibroker’s simulation capabilities to assess its effectiveness and optimize parameters.

- Place Order: Once satisfied, utilize Amibroker’s integrated trading capabilities to execute your trade seamlessly.

Tips and Expert Advice for Enhanced Option Trading

From seasoned professionals, heed these invaluable tips for maximizing your option trading acumen:

- Manage Risk: Embrace a comprehensive risk management strategy that encompasses position sizing, stop-loss orders, and hedging techniques.

- Study Market Trends: Stay abreast of economic and industry news that may influence the underlying asset’s price action.

- Practice Discipline: Exercise emotional control and adhere to pre-determined trading plans to avoid impulsive decisions.

- Continuously Educate: Embrace an ongoing learning mindset, attending webinars, reading industry publications, and seeking mentorship.

Image: www.youtube.com

Option Trading In Amibroker

Image: www.youtube.com

FAQs on Option Trading with Amibroker

To delve deeper into this fascinating topic, consider these frequently asked questions:

- What is the role of Amibroker in option trading?

Amibroker serves as an advanced platform for option analysis, strategy backtesting, optimization, and automated execution.

- What are Call and Put Options?

Call options grant the right to buy an underlying asset at a specified price, while Put options confer the right to sell.

- How are option premiums calculated?

Option premiums are determined by a formula that considers factors such as underlying asset price, time to expiration, interest rates, and volatility.

- What are Greeks in option trading?

Greeks are sensitivity measures that quantify the impact of changing market conditions on option prices.

Closing Thoughts:

Harnessing the power of Amibroker unlocks a world of possibilities in option trading. Embracing a data-driven approach, traders can gain a competitive edge, navigate market complexities, and pursue informed trading decisions. Whether you’re a seasoned veteran or a novice explorer, welcome the opportunity to explore the depths of option trading with Amibroker as your trusted guide.

Are you ready to embark on your journey into the realm of option trading with Amibroker? Let the adventure begin!