The Unforeseen Impact of COVID-19 on the Stock Market

The tumultuous events of 2020, marked by the global health crisis, have sent shockwaves through the financial landscape. As businesses grappled with unprecedented challenges, the stock market experienced an unprecedented rollercoaster ride. The rapid spread of the coronavirus triggered a wave of uncertainty, panic, and market volatility that challenged even the most seasoned investors.

Image: www.cnbc.com

Amidst the chaos, option traders found themselves at a crossroads. Option trading, a complex financial instrument, typically entails speculating on the future direction of a stock or index. However, the unpredictable nature of the coronavirus made traditional option trading strategies seem inadequate.

Navigating Market Volatility with Option Trading

Embracing Risk in Uncertain Times

Despite the inherent risks, option trading offered a potential lifeline for savvy investors. By understanding the intricate mechanics of option contracts and exercising strategic timing, traders could potentially exploit market fluctuations to their advantage. The ability to leverage both upside and downside potential through options enabled them to potentially mitigate downside risks and capture opportunities.

Hedging Against Market Swings

With the ongoing market volatility, investors sought ways to hedge against unpredictable movements. Options emerged as a valuable tool for risk management. By purchasing protective options, traders could create a safety net for their investments, reducing the potential for devastating losses.

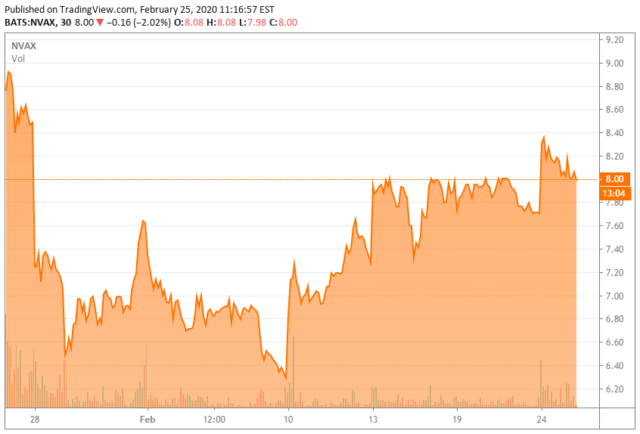

Image: seekingalpha.com

Identifying Opportunities Amidst Crisis

The coronavirus-induced market volatility also presented opportunities for savvy traders. By identifying underlying market trends and analyzing historical data, traders could potentially capitalize on market dislocations and profit from the wide price swings.

Option trading, however, is not without its risks. Thorough research, a deep understanding of market dynamics, and prudent risk management are crucial for minimizing potential losses.

Tips and Expert Advice for Option Traders in a Volatile Market

1. Stay Informed

Market volatility requires traders to stay abreast of the latest news, economic data, and market movements. Constant monitoring of market updates and news sources is essential for making informed trading decisions.

2. Understand the Underlying Trends

Successful option trading involves understanding the underlying trends shaping the market. Analyzing historical data, company fundamentals, and current market conditions can provide valuable insights into potential market directions.

3. Exercise Prudence in Risk Management

Managing risk is paramount in option trading, especially amid volatile markets. Traders should establish clear trading parameters, including entry and exit points, and adhere to their risk tolerance. Using stop-loss orders and understanding the Greeks—parameters that measure changes in option prices—can help protect against excessive losses.

FAQ on Option Trading in the Wake of Coronavirus

Q: Is option trading suitable for all investors?

No, option trading is not suitable for all investors. It is a complex financial instrument that requires a high level of understanding of its mechanics and the underlying markets.

Q: What are the risks involved in option trading?

There are several risks associated with option trading, including the risk of losing the entire investment, the risk of unpredictable price movements, and the risk of time decay, where an option’s value decreases over time.

Q: How can inexperienced investors mitigate risks in option trading?

Inexperienced investors should exercise prudence by learning about options trading before venturing into live trading. Starting with a virtual trading platform or using paper trading can provide invaluable practice without risking real capital.

Option Trading Coronavirus

Image: www.cnbc.com

Conclusion

The convergence of the coronavirus and option trading presents both challenges and opportunities for investors. Understanding the market dynamics, embracing risk management techniques, and capitalizing on informed trading strategies can yield potential rewards. However, it is crucial to approach option trading with a thorough understanding of its risks and rewards.

Call to Action: We encourage our readers to engage further with the topic of option trading during the coronavirus era. Share your insights, ask questions, and join the conversation by leaving a comment below.