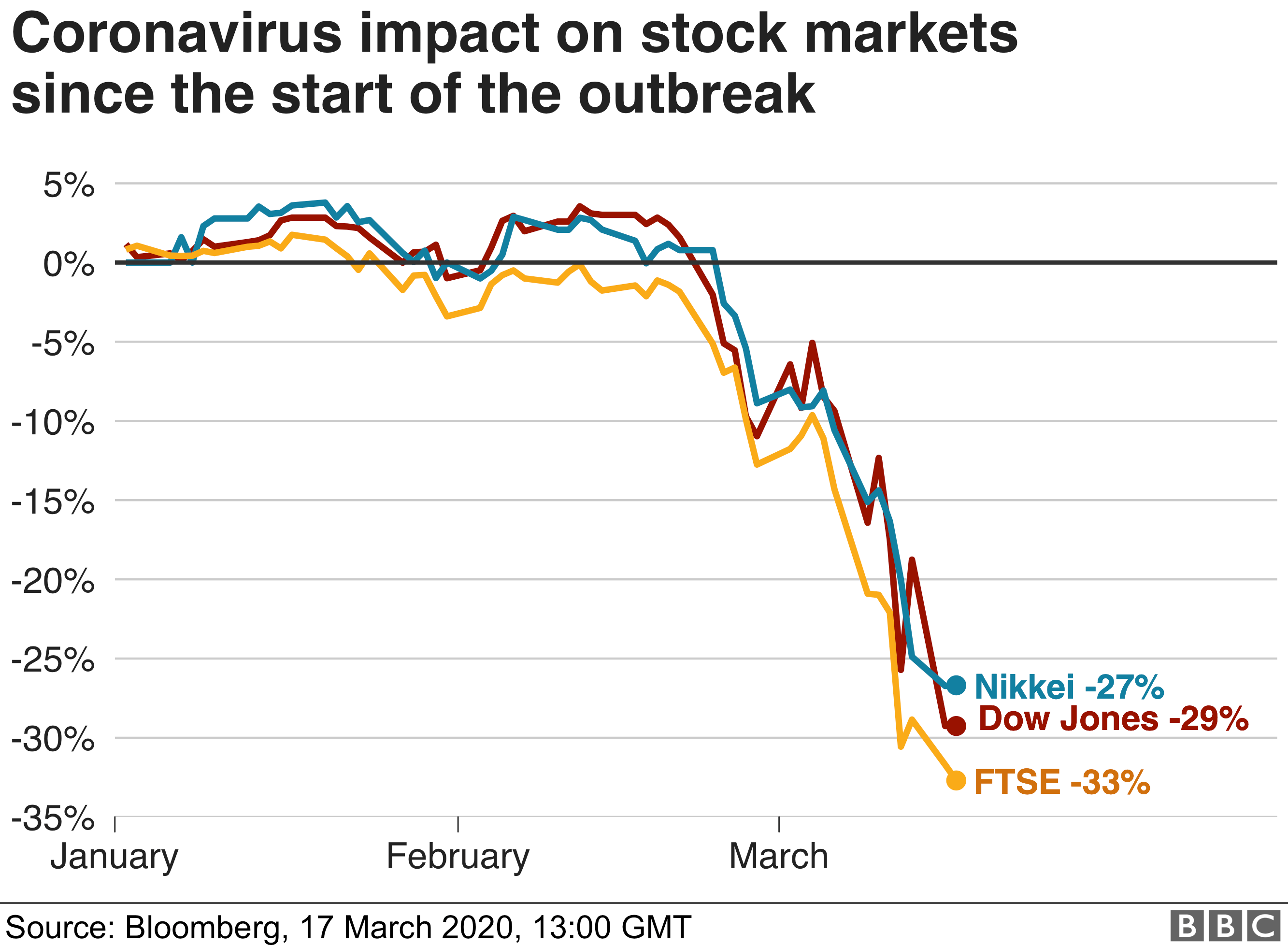

The unprecedented outbreak of the coronavirus (COVID-19) has sent shockwaves through the global economy, triggering unprecedented market volatility. Amid this uncertainty, options trading has emerged as a potential tool for experienced investors to navigate the financial landscape. However, navigating this complex and potentially risky market requires a deep understanding of coronavirus options trading strategies.

Image: www.11alive.com

Understanding the Dynamics of Coronavirus Options Trading

Options are financial instruments that provide the buyer (holder) with the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset, such as a stock, at a predefined price (strike price) on or before a specified date (expiration date).

Strategies in Coronavirus Options Trading

- Long Call Options:

- Buy a call option, expecting the underlying asset price to rise.

- Profit from a significant rise in the asset’s value, exceeding the premium paid for the option.

- Short Call Options:

- Sell a call option, expecting the asset price to not rise significantly.

- Collect the option premium as income if the price remains below the strike price.

- Long Put Options:

- Buy a put option, anticipating the asset price to decline.

- Profit if the asset’s value falls below the strike price, minus the premium paid.

- Short Put Options:

- Sell a put option, projecting the asset price to hold or increase.

- Earn the option premium by covering your obligation to buy the asset at the strike price.

Expert Insights

According to Dr. Mark A. Mikkelsen, an economics professor at the University of North Carolina, “Options provide a flexible way to express a directional view on an underlying asset in a volatile market.” He emphasizes the importance of thorough research and understanding of the strategies involved.

Actionable Tips

- Consider your risk tolerance: Do not trade options if you are not comfortable with the potential for losses.

- Set realistic expectations: Options trading has risks and rewards, and understanding the probabilities is crucial.

- Educate yourself: Thoroughly research options trading strategies and consult credible sources.

- Seek professional advice: Consider consulting a financial advisor for personalized guidance and risk management.

Compelling Conclusion

The intricate dynamics of coronavirus options trading offer investors both potential rewards and risks. By delving into the different strategies, understanding the nuances, and leveraging expert insights, experienced investors can make informed decisions while navigating the turbulent financial waters during this pandemic. Always remember that options trading requires careful consideration, risk management, and a deep understanding of the underlying market dynamics. By adhering to these principles, investors can harness the power of options trading to enhance their portfolio’s performance and achieve their financial goals.

Image: www.bbc.com

Coronavirus Options Trading

Image: howmuch.net