The Tailspin and the Surge: Understanding the Impact of COVID-19 on the Options Market

As the coronavirus pandemic cast a long shadow over global economies, the options market found itself in uncharted territory. The initial market sell-off triggered an unprecedented surge in volatility, reminiscent of the 2008 financial crisis. VIX, the so-called “fear index” that measures volatility, skyrocketed to historical highs, as investors sought refuge in defensive assets.

Image: russellinvestments.com

Amidst this initial pandemonium, the options market offered opportunities for astute traders. Equity options, which grant the buyer the right to buy or sell an underlying stock at a set price, saw heightened demand as investors hedged against further market declines. Call options, which allow holders to purchase stocks at a specified price, witnessed a surge in volume as investors anticipated a market rebound.

Navigating the Rollercoaster: Strategies for Options Trading During the Pandemic

With the options market experiencing extreme fluctuations, it became imperative for traders to adapt their strategies to the new reality. Covered calls emerged as a defensive strategy for investors looking to generate income while limiting downside risk. Selling puts, on the other hand, allowed traders to capitalize on falling prices, albeit with limited profit potential.

Iron condors, a neutral strategy that involves selling both call and put options at different strike prices, grew in popularity as a way to profit from low volatility. For those seeking speculative gains, bullish butterfly spreads, which involve buying a call option and two put options, captured the upside potential of the market.

Post-Pandemic Options Landscape: Reshaped Market Dynamics

As the pandemic subsided and economies gradually reopened, the options market evolved to reflect the changing landscape. Volatility, while still elevated compared to pre-pandemic levels, moderated as investor uncertainty diminished. The demand for defensive options strategies eased, while the pursuit of speculative strategies gained traction.

The post-pandemic market presented new opportunities for option traders. With low interest rates remaining the order of the day, dividend-paying stocks became increasingly attractive. Investors employed covered calls on dividend-paying stocks to generate additional income, while hedging against downside risk.

Image: www.warriortrading.com

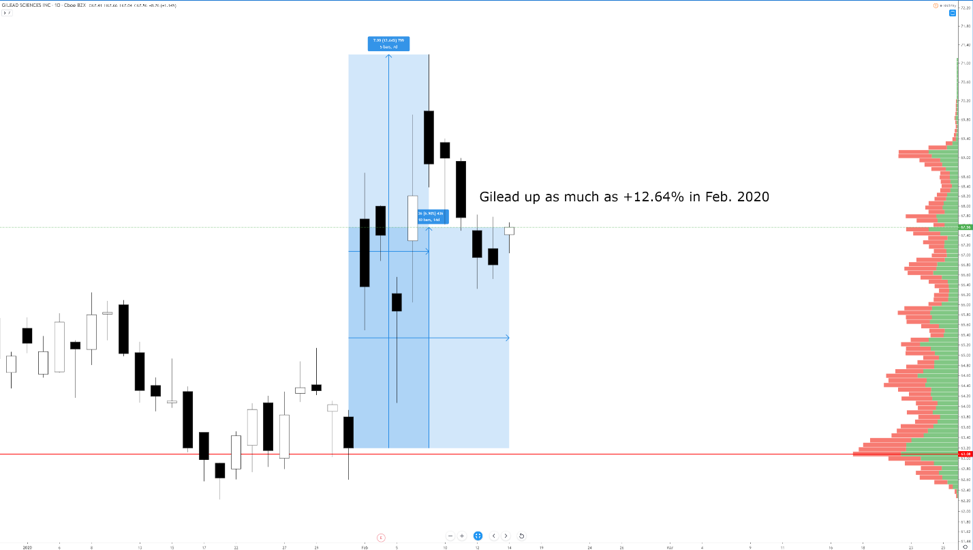

Options Trading During Coronavirus

Image: www.markettradingessentials.com

Conclusion: Embracing Options Trading’s Potential in the Uncertain Era

Options trading during the coronavirus pandemic provided valuable lessons for investors. Amidst market volatility, option strategies proved to be indispensable risk management tools, allowing traders to navigate uncertainty and capture opportunities. As the world navigates new economic and market paradigms, options trading will undoubtedly continue to play a crucial role in financial portfolios.

By staying abreast of market dynamics, understanding the appropriate strategies, and exercising prudence, investors can harness the power of options trading to mitigate risk, capitalize on market movements, and achieve optimal financial outcomes in uncertain times.