Embark on a Journey into Option Trading: Unlocking Market Potential

Are you an aspiring trader, eager to delve into the dynamic realm of options trading? Brace yourself for an exhilarating adventure brimming with potential rewards and calculated risks. Understand that the path to successful option trading lies not in unwavering expectations but in a nuanced appreciation of the market’s complexities.

Image: www.capitalchurch.com

Defined as a contract between two parties involving the option to buy or sell an underlying asset at a predetermined price on or before a specific date, options trading allows savvy traders to exploit market movements and seek profit while managing risk. As you embark on this trading journey, it’s crucial to establish realistic expectations grounded in a comprehensive understanding of market dynamics.

Defining the Realm of Option Trading: Strategies, Benefits, and Cautions

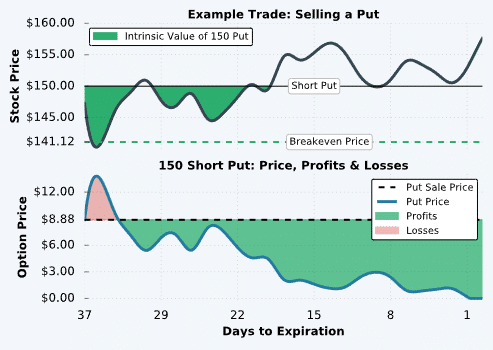

Options trading offers a versatile array of strategies catering to diverse risk appetites and trading objectives. From bullish strategies like call options, which grant the right to buy an underlying asset at a specific price, to bearish strategies like put options, which confer the right to sell an underlying asset at a specific price, traders can fine-tune their strategies based on market forecasts.

The potential benefits of option trading are equally compelling. Skilled traders can capitalize on market volatility, leverage gains with limited capital, and hedge against potential losses. However, it’s essential to approach option trading with a clear understanding of its inherent risks. As with any form of financial trading, market fluctuations can lead to losses, and traders must meticulously manage their risk exposure.

Unveiling a World of Option Strategies: Navigating Risk and Reward

To navigate the intricate world of option trading effectively, a thorough grasp of key strategies is indispensable. Covered calls, for instance, involve selling a call option while simultaneously owning the underlying asset, providing a conservative strategy to generate income while limiting risk. Conversely, protective puts, where a trader buys a put option while owning the underlying asset, offer downside protection against potential losses.

Advanced strategies like straddles and strangles, which involve buying both call and put options at the same strike price and expiration date, enable traders to profit from large price movements in either direction. However, these strategies come with increased risk and require a deep understanding of market dynamics and risk management techniques.

Deciphering Market Trends and Developments in Option Trading

Staying abreast of emerging trends and developments in the world of option trading is pivotal for successful navigation. Keep a keen eye on market news and geopolitical events that may influence underlying asset prices. Utilize technical analysis tools to identify potential trading opportunities and stay informed about regulatory changes that may impact option trading strategies.

Engage in active research and due diligence, continuously monitoring market dynamics and incorporating new insights into your trading approach. Join online forums and connect with experienced traders to gain valuable knowledge and perspectives. By embracing a proactive and informed approach, you can position yourself to make well-informed trading decisions.

Image: www.lap-publishing.com

Unlocking Success in Option Trading: Insights and Expert Advice

Mastery in option trading demands a commitment to continuous learning and refinement. Seek guidance from seasoned traders, attend workshops and seminars, and delve into educational resources to expand your knowledge base. By honing your trading skills and adopting a disciplined approach to risk management, you increase your chances of navigating market complexities and achieving trading success.

Remember, the path to becoming a successful option trader is paved with patience, perseverance, and a relentless pursuit of knowledge. Embrace the learning process, adapt to evolving market conditions, and refine your strategies over time. By embracing these principles, you can unlock the full potential that option trading has to offer.

Frequently Asked Questions on Option Trading: Unresolved Queries

Q: What is the minimum capital required for option trading?

A: While the minimum capital requirement varies based on the trading strategy and market conditions, it’s generally recommended to have a sufficient capital cushion to withstand potential losses and maintain a margin account.

Q: How do I determine the right option strategy for me?

A: Choosing the optimal option strategy depends on your risk tolerance, trading objectives, and market conditions. Consult with an experienced trader or financial advisor to determine the strategy that aligns with your individual circumstances.

Q: What are the key risks involved in option trading?

A: Options trading carries inherent risks, including the potential for substantial losses, market volatility, and unfavorable price movements. It’s crucial to carefully evaluate the risks and manage your exposure accordingly.

Option Trading Expectations

Image: www.projectfinance.com

Embracing the Challenges of Option Trading: A Call to Action

If the intricacies of option trading resonate with your curiosity and drive, embark on this exciting journey with an open mind and a willingness to embrace its complexities. Let this article serve as a guiding light as you navigate the uncharted territories of option trading, unlocking the potential for both financial rewards and invaluable lessons.

Are you enthralled by the prospect of unraveling the enigmatic world of option trading? Share your thoughts, queries, and aspirations in the comments section below. Let’s engage in a vibrant exchange of insights and experiences as we delve deeper into this fascinating realm of market opportunities.