Stepping into the trading options game, I embarked on a journey brimming with excitement and uncertainty. Each trade felt like a roll of the dice, where fortune favored the calculated and the audacious.

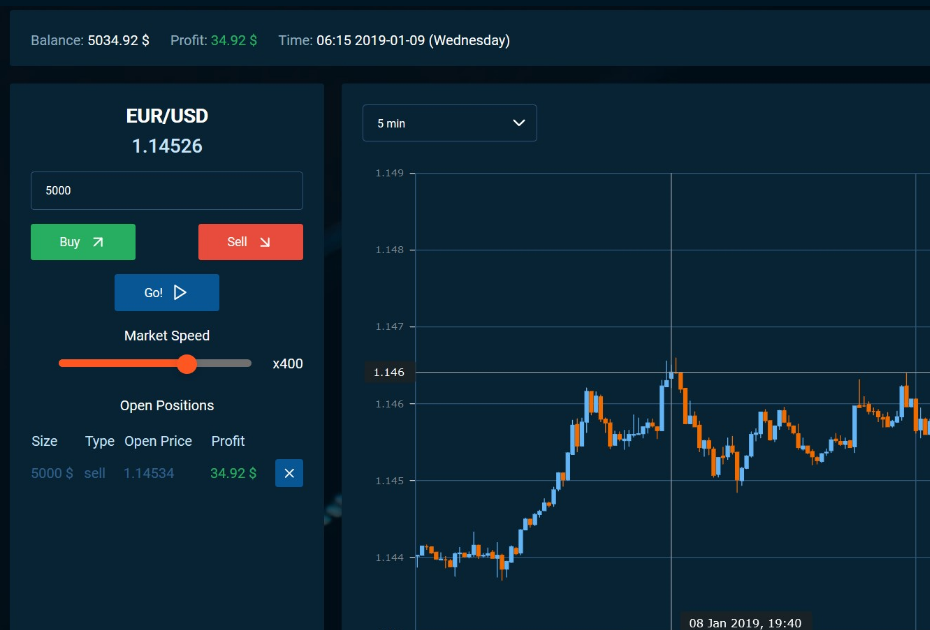

Image: forexgame.io

Options trading, a dynamic arena where the thrill of calculated risk-taking intersects with the allure of potential rewards, captivated me from the outset. It demanded a symbiotic blend of analytical prowess, an intimate understanding of market dynamics, and a keen eye for opportunity.

Navigating the Options Landscape

Options, financial instruments that grant the holder the right (but not the obligation) to buy or sell an underlying asset at a predetermined price and date, introduce a layer of complexity to the trading realm. Understanding the intricacies of call and put options, the significance of strike prices, and the mechanics of expiration dates became paramount.

Moreover, the dynamic nature of the options market, influenced by a myriad of factors such as underlying asset price movements, interest rate changes, and market sentiment, demanded constant monitoring and adaptive trading strategies. The ability to anticipate market shifts and make informed decisions in a fluid environment became crucial for success.

Strategies for Outsmarting the Market

To thrive in this exhilarating game, I delved into the wisdom shared by seasoned traders and market experts. Embracing a disciplined approach, I meticulously crafted trading strategies that sought to capitalize on market inefficiencies and exploit opportunities.

I mastered the art of combining technical analysis, deciphering price patterns and indicators, with fundamental analysis, assessing the underlying economic and sector-specific factors that shape market behavior. By employing a confluence of these techniques, I identified potential trading setups with greater precision.

Expert Insights for Trading Triumphs

As I navigated the ever-evolving options market, I sought the guidance of seasoned traders and industry thought leaders. Through webinars, workshops, and in-depth research, I absorbed their insights, learning from their experiences and adopting best practices.

Their advice ranged from the importance of managing risk through proper position sizing and the judicious use of stop-loss orders to the invaluable lessons gleaned from both successful and unsuccessful trades. By incorporating these expert perspectives into my trading approach, I honed my skills and enhanced my decision-making process.

Image: mobilestartupz.com

FAQs on Options Trading

- What is the difference between a call option and a put option?

- A call option gives the holder the right to buy the underlying asset, while a put option grants the right to sell the underlying asset at a predetermined price, known as the strike price.

- What is the role of the expiration date in options trading?

- The expiration date signifies the last day the option can be exercised. If not exercised or sold before this date, the option expires worthless.

- How can I determine the value of an option?

- Option value is influenced by several factors, including the underlying asset price, time remaining until expiration, volatility, and interest rates, and can be calculated using complex pricing models.

- What are the risks associated with options trading?

- Options trading involves significant risk due to the potential for large losses. It’s crucial to carefully consider the potential risks and have a comprehensive trading plan in place.

Trading Options Game

Conclusion: Seeking Excitement and Knowledge

The trading options game, a captivating pursuit that marries financial acumen with the thrill of calculated risk, continues to captivate my interest and challenge my trading prowess. Through tireless research, the guidance of expert traders, and the lessons learned from both successful and unsuccessful trades, I have gained invaluable experience and knowledge that fuels my passion for this dynamic arena.

The pursuit of success in options trading is an ongoing journey, one that requires a blend of intelligence, adaptability, and a fervent thirst for knowledge. Whether you’re a seasoned trader or just starting your options trading adventure, I encourage you to embrace the excitement, delve into the intricacies of the market, and seek the wisdom shared by those who have mastered this captivating game.

Are you ready to embark on the thrilling journey of options trading? Join the ranks of savvy traders and immerse yourself in the world of calculated risk and potential rewards.