Stepping into the exhilarating world of options trading is akin to venturing into a labyrinth of calculated risks and potential rewards. Options, powerful financial instruments, offer traders the opportunity to navigate market fluctuations with remarkable precision. But beneath the alluring façade lies a complex tapestry of strategies, methodologies, and unwavering discipline.

Image: www.valckrie.com

In essence, options are financial contracts that grant buyers the right, but not the obligation, to buy or sell an underlying asset at a predetermined price on a specific date. These highly versatile instruments encompass an array of possibilities, ranging from straightforward speculation to sophisticated hedging strategies. As traders master the intricacies of options trading, they embark on a journey of exploring both the potential profits and inherent risks associated with this compelling financial domain.

Unveiling the Core Concepts of Options Trading

To fully grasp the mechanics of options trading, let us delve into its fundamental building blocks. Primarily, there exist two distinct types of options: calls and puts. Call options embody the right to buy an underlying asset, while put options confer the right to sell it. The price at which this right can be exercised is known as the strike price.

Traders engage in options trading by purchasing or selling these contracts from market makers or other traders. When purchasing an option, the buyer pays a premium to the seller in exchange for acquiring the right to buy or sell the underlying asset. Conversely, when selling an option, the seller receives a premium from the buyer and assumes the obligation to fulfill the contract if it is exercised.

Mastering Options Trading Strategies

The realm of options trading encompasses a diverse spectrum of strategies, each tailored to specific market conditions and risk appetites. Among the most prevalent strategies are covered calls, protective puts, and bullish and bearish spreads. By meticulously combining these strategies, traders can construct intricate trading plans that align with their investment goals and risk tolerance.

Covered calls involve selling a call option on an underlying asset that the trader already owns. This strategy is employed when the trader anticipates a moderate rise in the asset’s price, seeking to generate premium while potentially profiting from a modest appreciation. Protective puts, on the other hand, involve buying a put option on an underlying asset that the trader currently owns. This strategy is intended to mitigate downside risk by providing the trader with the right to sell the asset at a pre-determined price, albeit at the cost of the premium paid for the put option.

Bullish and bearish spreads encompass more complex strategies that involve the simultaneous purchase and sale of options with different strike prices and expiration dates. Bullish spreads are adopted when the trader anticipates an upswing in the underlying asset’s price, while bearish spreads are crafted when the trader expects a decline. These strategies offer a nuanced approach to risk management, allowing traders to tailor their positions to specific market scenarios.

Unveiling the Latest Trends and Developments in Options Trading

The dynamic landscape of options trading is perpetually evolving, with novel instruments and methodologies emerging to meet the evolving needs of traders. One such innovation is the advent of exchange-traded funds (ETFs) that track the performance of options strategies. These ETFs provide investors with convenient and diversified exposure to the options market, enabling them to participate in sophisticated trading strategies without the complexities of direct options trading.

Furthermore, the rise of algorithmic trading has brought automation and efficiency to the options trading arena. Algorithmic trading platforms employ sophisticated algorithms to scan vast amounts of market data, identify trading opportunities, and execute trades at lightning-fast speeds. These cutting-edge technologies empower traders to optimize their strategies, reduce human error, and potentially enhance their profitability.

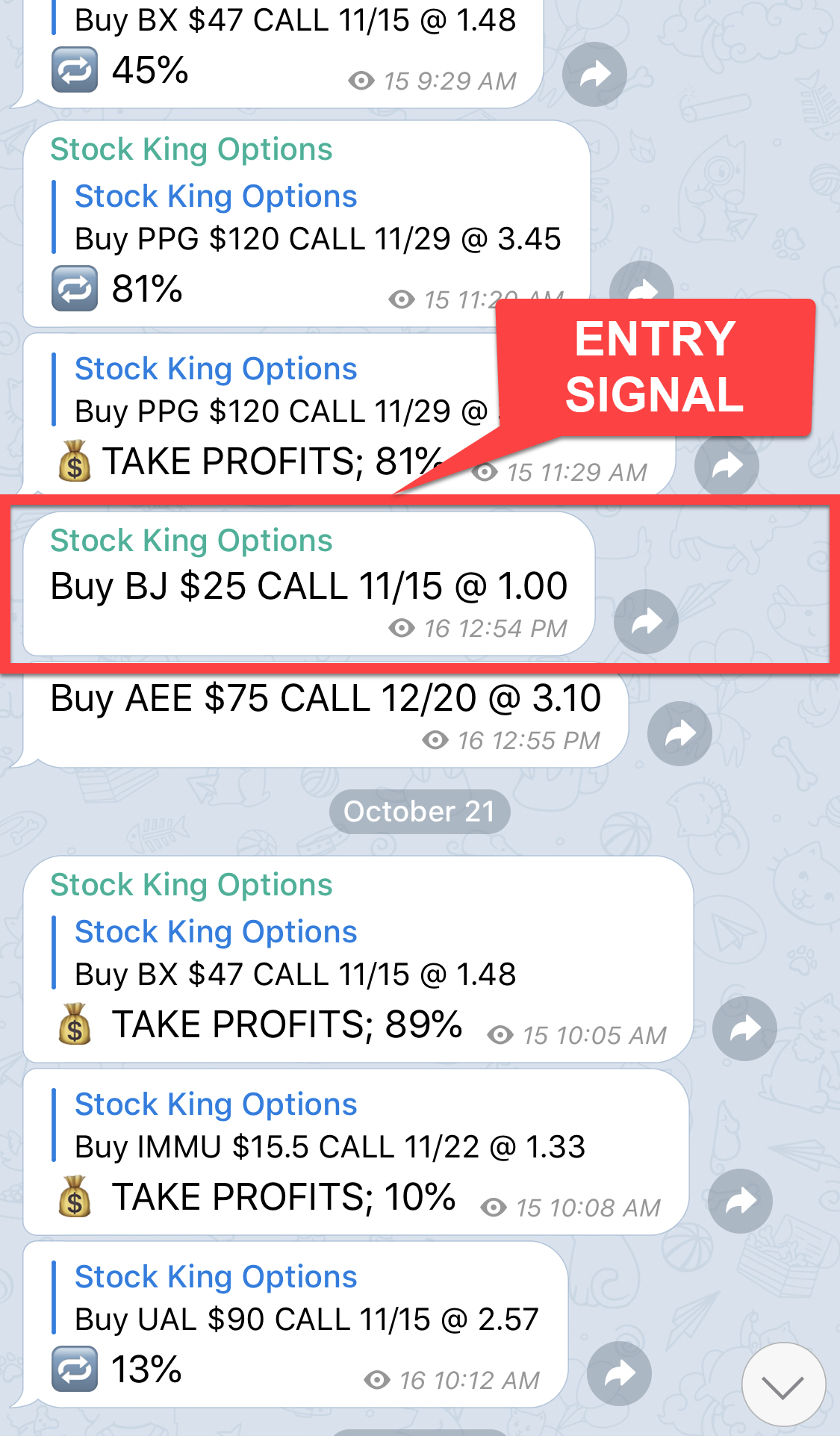

Image: stockkingoptions.com

Options Trading Room

Conclusion: Embracing Options Trading with Knowledge and Discipline

Venturing into the world of options trading unveils a realm of limitless possibilities and potentially lucrative opportunities. However, it is imperative to approach this complex marketplace with a solid foundation of knowledge, unwavering discipline, and a comprehensive understanding of risk management principles.

For those eager to embark on this exhilarating journey, thorough research, diligent practice, and an unwavering commitment to continuous learning are paramount. By immersing themselves in the intricacies of options trading and embracing the evolving trends that shape this dynamic marketplace, aspiring traders can unlock the potential for exceptional returns while navigating the inherent risks with confidence and precision.