Introduction

The coronavirus pandemic has sent shockwaves through the global economy, and the financial markets have been particularly hard hit. As a result, many investors are looking for ways to protect their portfolios and hedge their bets. One way to do this is by trading options, which can provide a degree of flexibility and leverage that is not available with other investment vehicles. In this article, we will discuss the basics of options trading and how it can be used in the context of the coronavirus pandemic.

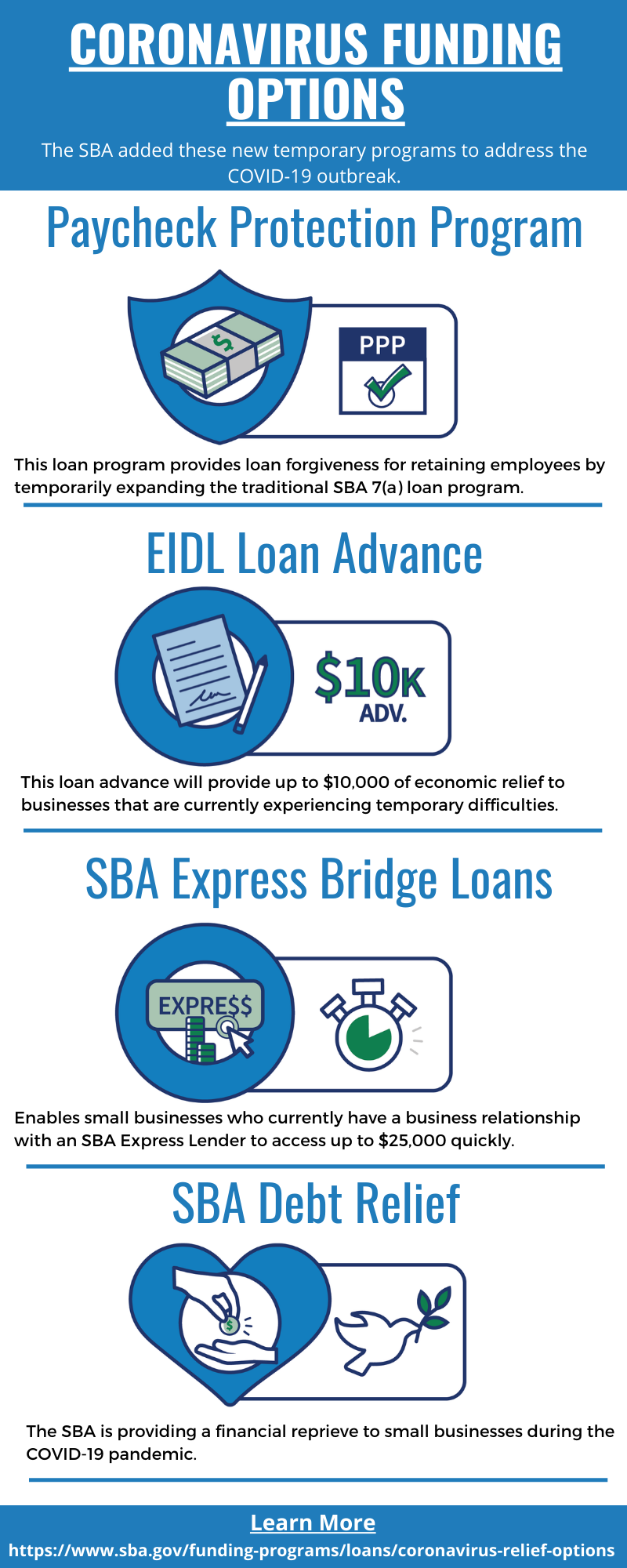

Image: stlpartnership.com

Options trading can be a complex and risky strategy, so it is important to do your research and understand the risks involved before you start trading. However, with a little bit of knowledge and effort, options trading can be a valuable tool for managing risk and generating income in volatile markets.

What Are Options?

An option is a contract that gives the buyer the right, but not the obligation, to buy or sell an underlying asset at a specified price on or before a certain date. The buyer of an option pays a premium to the seller of the option in exchange for this right. There are two main types of options: calls and puts.

- Call options give the buyer the right to buy the underlying asset.

- Put options give the buyer the right to sell the underlying asset.

How Are Options Used?

Options can be used for a variety of purposes, including:

- Hedging risk: Options can be used to hedge against the risk of a decline in the price of the underlying asset.

- Generating income: Options can be used to generate income by selling them to other investors.

- Speculating on price movements: Options can be used to speculate on the future price movements of the underlying asset.

Trading Options in the Context of the Coronavirus Pandemic

The coronavirus pandemic has created a great deal of uncertainty in the financial markets, and this uncertainty has made options trading a more attractive option for many investors. Options can be used to hedge against the risk of a decline in the stock market, to generate income in a down market, or to speculate on the future direction of the market.

For example, an investor who is concerned about the potential impact of the coronavirus on the stock market could buy a put option on the S&P 500 index. This option would give the investor the right to sell the S&P 500 index at a specified price on or before a certain date. If the market declines, the value of the put option will increase, and the investor will be able to sell it for a profit.

Image: theconversation.com

Trading Options Coronavirus

Image: www.businessinsider.com.au

Conclusion

Options trading can be a valuable tool for managing risk and generating income in volatile markets. However, it is important to remember that options trading can be complex and risky, so it is important to do your research and understand the risks involved before you start trading. If you are not comfortable with the risks involved, you should consult with a financial advisor before you start trading.