In options trading, timing is of the essence. The Moving Average Convergence Divergence (MACD) indicator is a powerful tool that can help traders identify potential trading opportunities by measuring the momentum of a stock or index.

Image: forexwot.com

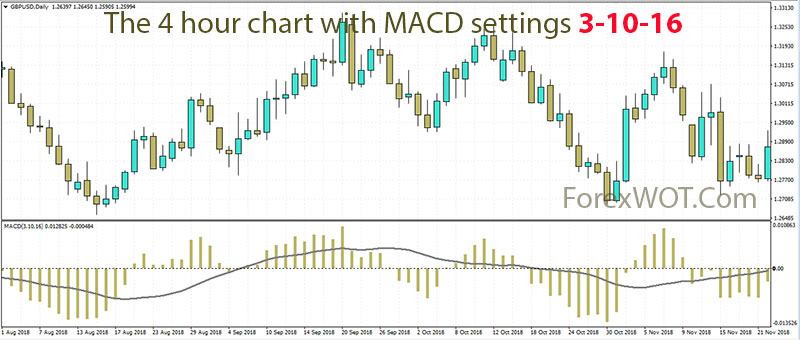

While there are countless ways to use the MACD, one of the most popular is to look for bullish or bearish crossovers. A bullish crossover occurs when the MACD line crosses above the signal line, while a bearish crossover is just the opposite.

MACD Settings for Options Trading

Customizing the MACD settings can help traders maximize its effectiveness for specific trading strategies. Here’s a breakdown of the common MACD settings and how they affect the indicator’s performance:

MACD Line: The MACD line measures the difference between the MACD line and the signal line, providing a visual representation of the trend momentum.

Signal Line: The signal line is used to identify trend reversals. The default setting for the signal line is 9 periods.

Histogram: The MACD histogram is a vertical representation of the difference between the MACD line and the signal line. It is used to identify bullish and bearish divergences.

Default MACD Settings

The default settings for the MACD are:

- MACD Line: 12 periods

- Signal Line: 9 periods

- Histogram: 9 periods

While these default settings are suitable for various markets, traders may adjust them depending on the chart timeframe and stock volatility. For example, shorter timeframes may require using smaller period settings, while longer timeframes can accommodate higher period settings.

Alternative MACD Settings

Here are some alternative MACD settings to consider:

- MACD Line: 5 periods

- Signal Line: 3 periods

- Histogram: 3 periods

These settings are recommended for fast-moving markets due to the shorter periods, making the indicator more responsive to price changes.

- MACD Line: 20 periods

- Signal Line: 15 periods

- Histogram: 15 periods

These settings work well for slower-moving markets. The longer periods help filter price noise and provide a smoother trend representation.

Image: forexwot.com

Tips and Expert Advice

Besides adjusting the MACD settings, here are a few additional tips and expert advice for using the MACD effectively in options trading:

Confirmation from Other Indicators: While the MACD is a robust indicator, combining it with other indicators like volume, moving averages, or Ichimoku Cloud can enhance trade signals.

Trading with the Trend: The MACD is most effective when used to identify and trade with the prevailing trend. Trading against the trend can increase your risk and reduce potential profitability.

FAQs on MACD Settings

Q: How do I choose the right MACD settings for my trading strategy?

A: The optimal MACD settings depend on the market conditions and your trading style. Experiment with different settings to find what works best for you.

Q: What are some common mistakes to avoid when using MACD?

A: Trading against the trend, using too many indicators, or relying solely on MACD signals are common mistakes that can lead to losses.

Q: Can I use MACD for day trading?

A: Yes, MACD can be an effective tool for day trading, especially when used with shorter period settings. However, verify the settings and the market conditions to match your strategy.

Macd Settings For Options Trading

Image: www.cacaoavila.com

Conclusion

Customizing the MACD settings for options trading can significantly improve the trading performance, especially with the default, alternative, and additional tips and expert advice provided. Remember, the most potent MACD settings will align with your trading style and the market conditions.

Is this article helpful to you? Are you interested in learning more about MACD settings for options trading?