Introduction

Are you a savvy trader seeking to capitalize on market movements beyond traditional trading hours? If so, after-hours trading options may be the key to unlocking hidden profit potential. TD Ameritrade, a leading online brokerage, offers a comprehensive suite of tools and services for traders seeking to navigate the after-hours market landscape.

In this extensive guide, we will explore the nuances of after-hours trading options with TD Ameritrade, providing a deep dive into concepts, strategies, and the advantages this unique trading opportunity offers. Whether you’re a seasoned pro or a curious novice, this article will equip you with the knowledge and insights to excel in the dynamic world of after-hours options trading.

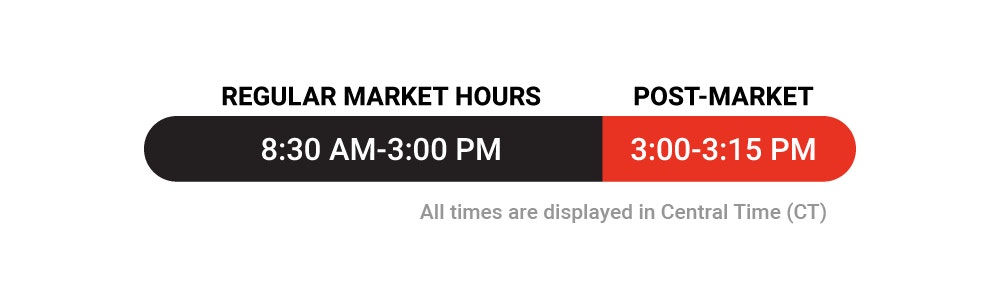

Image: tastytrade.com

Extended Market Access: A World Beyond Traditional Hours

After-hours trading, as the name suggests, refers to the trading of options that occurs outside the regular market hours of 9:30 AM to 4:00 PM ET. This extended trading session, which runs from 4:00 PM to 8:00 PM ET, provides traders with the opportunity to continue trading and potentially capitalize on price movements after the close of the regular market.

TD Ameritrade’s robust after-hours trading platform offers traders a wide range of options contracts, including standard, weekly, and monthly options. This diverse selection allows traders to tailor their trading strategies to their specific risk tolerance and time horizons.

Benefits of After-Hours Options Trading

Embracing after-hours options trading with TD Ameritrade opens doors to several compelling advantages that can enhance a trader’s profitability and overall trading experience:

· Extended Trading Window: After-hours trading extends the trading day, allowing traders to react to news and market events that may occur after the close of the regular session.

· Enhanced Liquidity: While after-hours trading volume may be lower than during regular hours, TD Ameritrade’s platform ensures sufficient liquidity for traders to execute trades efficiently.

· Volatility: Extended trading hours often coincide with periods of increased market volatility, providing traders with potential opportunities for quick profits.

· Risk Management: The extended trading session allows traders to adjust their positions or exit trades based on evolving market conditions.

· Trade Flexibility: TD Ameritrade’s advanced trading tools enable traders to place a variety of orders, including limit orders and stop orders, outside of regular market hours.

Strategies for After-Hours Options Trading

After-hours options trading presents a unique set of challenges and opportunities. Traders can employ various strategies to navigate this extended trading session:

· News-Driven Trading: Monitoring late-breaking news and announcements can provide valuable insights for making informed trading decisions during after-hours trading.

· Chart Pattern Analysis: Technical analysis techniques can be applied to after-hours price charts to identify potential trading opportunities.

· Volatility Trading: Traders can leverage options strategies that take advantage of increased market volatility during extended trading hours.

· Pairs Trading: After-hours options trading can be used to implement pairs trading strategies that seek to exploit price discrepancies between related assets.

· Short-Term Trading: The limited trading hours of the after-hours session are well-suited for short-term trading strategies.

Image: www.beatstockpromoters.com

Tools and Resources for After-Hours Success

TD Ameritrade empowers traders with a comprehensive suite of tools and resources to enhance their after-hours options trading experience:

· Thinkorswim Platform: TD Ameritrade’s proprietary platform offers advanced charting, trading tools, and real-time market data for informed decision-making.

· Advanced Research: TD Ameritrade provides in-depth research reports, company analysis, and market news to keep traders well-informed.

· PaperMoney Simulator: Traders can hone their skills and test strategies in a risk-free environment using TD Ameritrade’s PaperMoney simulator.

· educational resources: TD Ameritrade offers a wealth of educational materials, including webinars, seminars, and articles, to help traders navigate the complexities of after-hours trading.

After Hours Trading Options Tdameritrade

Conclusion

After-hours trading options with TD Ameritrade offer a unique and potentially lucrative opportunity for traders seeking to extend their trading horizons. By harnessing the extended trading hours, embracing volatility, and employing appropriate strategies, traders can harness the power of this after-hours market to enhance their profitability and achieve their financial goals. Whether you’re a seasoned options trader or just starting your trading journey, TD Ameritrade provides the tools, resources, and expertise to guide you toward success in the dynamic world of after-hours options trading.