Introduction

In the labyrinthine world of finance, options trading stands out as an alluring tool for investors seeking alternative routes to market profits. Instinet, a renowned electronic trading platform, empowers traders with advanced capabilities for executing complex options strategies. This article delves into the intricate realm of Instinet options trading, exploring its history, concepts, and practical applications.

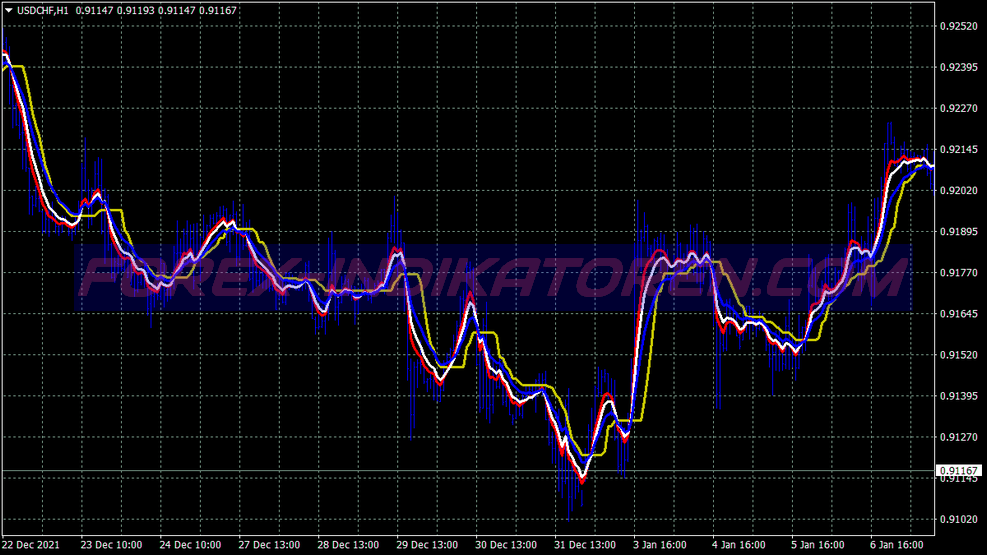

Image: www.forex-indikatoren.com

Instinet’s genesis lies in the 1960s, when a group of visionary entrepreneurs sought to revolutionize the fragmented brokerage industry. Their creation, Instinet, evolved into a pioneer of computerized trading, connecting institutional buy-side and sell-side firms directly. Over the years, Instinet has become synonymous with innovation, offering a comprehensive suite of trading services, including a robust platform for options trading.

Unveiling Instinet’s Options Trading Platform

Instinet’s options trading platform is a cutting-edge solution designed to meet the needs of discerning investors. It offers an array of features tailored to enhance execution efficiency, optimize risk management, and facilitate in-depth market analysis:

- Lightning-Fast Execution: Instinet’s proprietary technology ensures lightning-fast execution speeds, enabling traders to capitalize on rapidly changing market conditions.

- Intuitive Interface: The platform’s intuitive interface simplifies the complex world of options trading, making it accessible to both experienced and novice investors alike.

- Real-Time Market Data: Traders have access to real-time market data, empowering them to make informed decisions based on the most up-to-date information.

- Customization and Automation: Instinet’s platform allows users to customize their trading environment and automate repetitive tasks, saving time and minimizing errors.

- Advanced Analytics and Risk Management Tools: A suite of advanced analytics and risk management tools helps traders analyze market trends, identify opportunities, and manage risk.

Understanding Options Trading Strategies

Options trading involves the buying or selling of options, derivatives that grant the holder the right, but not the obligation, to buy or sell an underlying asset at a specified price on or before a certain date. Understanding the different types of options strategies is crucial for success:

- Covered Call: Involves selling a call option when owning the underlying stock, generating income while limiting potential upside.

- Protective Put: Buying a put option when owning the underlying stock to hedge against downside risk.

- Bull Call Spread: Buying a lower-priced call option and simultaneously selling a higher-priced call option to profit from a moderate rally.

- Bear Put Spread: Buying a higher-priced put option and simultaneously selling a lower-priced put option to profit from a moderate decline.

- Iron Condor: A more complex strategy involving buying and selling options with different strike prices to profit from a period of sideways trading.

Practical Applications of Institutional Options Trading

Institutional investors employ options trading for a variety of purposes, including:

- Hedging: Managing risk by offsetting exposure to adverse market movements.

- Income Generation: Selling options premiums to generate regular cash flow.

- Leveraging: Amplifying potential returns with the use of options leverage.

- Speculating: Utilizing options to wager on stock price movements.

- Volatility Management: Adjusting positions in response to changes in market volatility.

Image: www.sifma.org

Instinet Options Trading

Image: www.youtube.com

Conclusion

Instinet options trading empowers investors with sophisticated tools and strategies to navigate the complex financial landscape. Its advanced platform, intuitive interface, and robust features provide an exceptional trading environment. Whether seeking alternative income streams, enhanced risk management, or speculative opportunities, Instinet options trading offers a compelling solution for experienced and novice investors alike. Delving into this intricate realm can unlock new avenues for wealth creation while mitigating potential market risks.