Introduction

In the ever-evolving financial landscape, where savvy investors navigate a sea of opportunities, options trading stands out as a potent tool for discerning traders. Options empower individuals to amplify their returns, mitigate downside risks, and express complex investment strategies with precision. While the concept of options may seem intimidating at first, embracing it unlocks a realm of possibilities that can profoundly impact your financial trajectory.

Image: www.stockbrokers.com

This comprehensive guide will delve into the intricacies of option trading, focusing specifically on the intuitive platform provided by TD Ameritrade. We’ll shed light on fundamental concepts, explore the benefits and risks, and equip you with actionable insights to navigate the option trading scene with confidence. So, buckle up, dear reader, and prepare to embark on a transformative journey into the captivating world of options.

Delving into Options: Unraveling the Mechanisms of Option Trading

Picture this: you have a strong conviction about the future price movement of a particular stock or asset but lack the capital to purchase it outright. This is where options come into their own. Options are essentially contracts that grant you the right, but not the obligation, to buy (in the case of call options) or sell (in the case of put options) a specific asset at a set price (the strike price) on or before a predefined date (the expiration date).

Think of options as levers that amplify the potential impact of your capital. By purchasing an option, you gain the potential to profit from substantial price movements, without having to shell out the full amount of the underlying asset. However, this leverage is a double-edged sword, and it’s crucial to understand the risks involved before diving into options trading.

Types of Options: Navigating the Call-Put Divide

The options landscape encompasses two primary types of contracts: call options and put options. Call options convey the right to buy an asset at the strike price, while put options confer the right to sell an asset at the strike price. Which option you choose depends on your market outlook and investment strategy.

If you anticipate a rise in asset prices, call options offer the potential for significant returns. Conversely, if your crystal ball predicts a downward trend, put options provide a hedge against market volatility and the opportunity to profit from declining prices.

Mechanics of Option Trading: From Premium Payments to Exercise and Expiration

Embarking on the path of option trading requires a firm grasp of the mechanics involved. When you purchase an option, you pay a premium to the seller of the contract. This premium encapsulates the value of the option’s potential to profit from price movements.

Once you hold an option, you have the right to exercise it at any time up until the expiration date. Exercising a call option means buying the underlying asset at the strike price, while exercising a put option means selling the underlying asset at the strike price.

It’s important to note that you’re not obligated to exercise your options; they can expire worthless if the market doesn’t move in your favor. This highlights the importance of meticulous risk management and setting clear exit strategies.

Image: thewaverlyfl.com

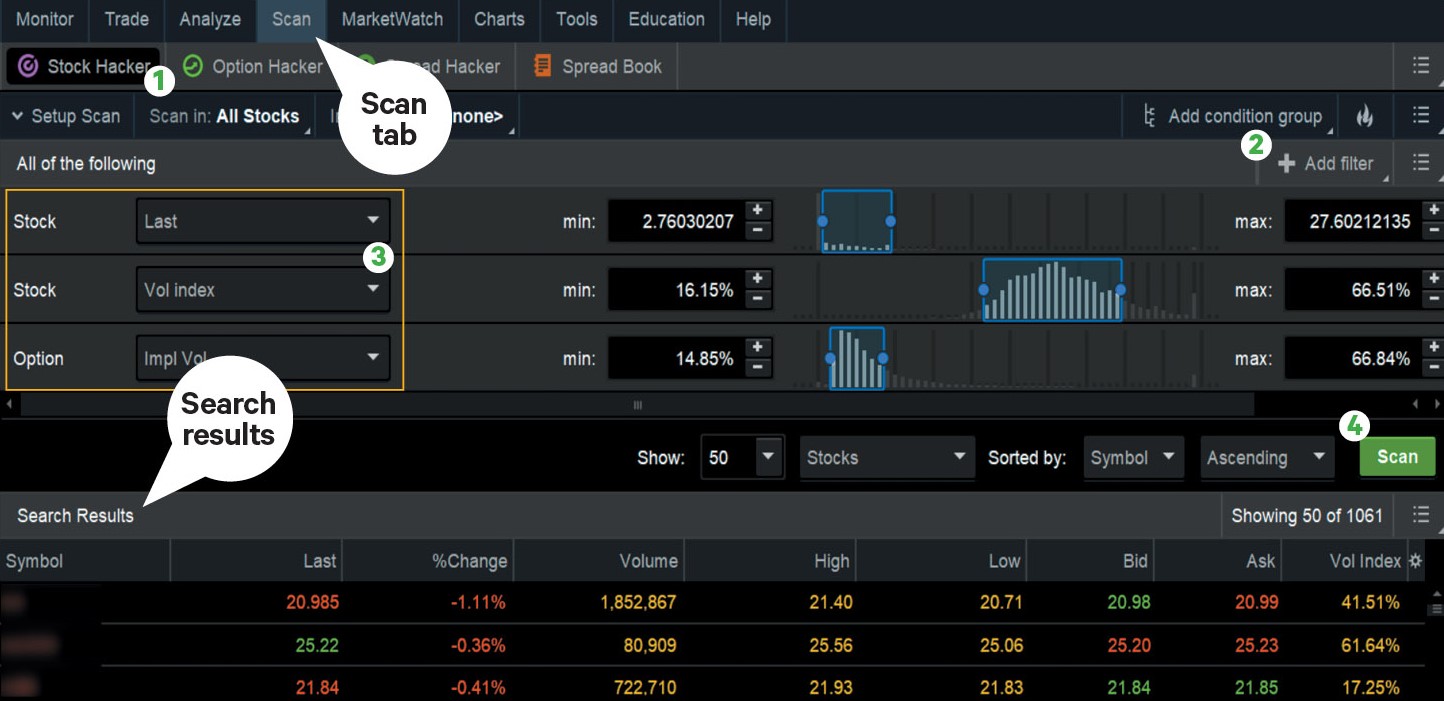

Options Trading with TD Ameritrade: A User-Friendly Interface and Powerful Tools

Navigating the options trading landscape with confidence requires a robust platform that caters to your needs. TD Ameritrade stands out as a premier choice, offering a user-friendly and feature-rich trading experience.

The TD Ameritrade platform provides intuitive tools that simplify option trading, including advanced charting capabilities, real-time market data, and sophisticated analysis tools. Their educational resources and dedicated support team further empower traders with the knowledge and guidance they need to succeed.

Benefits of Option Trading: Harnessing the Power of Risk and Return

The allure of option trading lies in its ability to unlock a range of benefits that can augment your investment prowess. Let’s explore some of the key advantages:

-

Leverage: Options amplify the potential impact of your capital, enabling you to potentially generate substantial returns on relatively small investments.

-

Asymmetric Payoffs: Options offer the possibility of asymmetric payoffs, where the potential upside far outweighs the potential downside. This risk-reward profile can be particularly appealing in volatile markets.

-

Hedging Strategies: Options provide versatile tools for risk management and hedging against adverse market conditions. Put options, for example, can serve as insurance against potential downturns.

Risks of Option Trading: Understanding the Potential Pitfalls

While options trading offers enticing rewards, it’s essential to be cognizant of the risks inherent in this endeavor. Options can be complex instruments, and misjudging market movements or failing to manage risk effectively can lead to significant financial losses.

The primary risks associated with option trading include:

-

Time Decay: Options have a finite lifespan, and their value erodes over time, regardless of market movements. This means that even if the market moves in your favor, you could still lose money if you don’t time your trade wisely.

-

Unlimited Risk: Unlike stocks, where the maximum loss is limited to the purchase price, options can expose you to unlimited losses. This is particularly true for naked options strategies.

-

Complexity: Options trading requires a comprehensive understanding of market dynamics, option pricing models, and risk management techniques. Without proper knowledge and experience, you may struggle to navigate the complexities of this market.

Getting Started with Option Trading: A Step-by-Step Guide

Embracing option trading can be a transformative experience, but it’s crucial to approach this endeavor with a plan and a thirst for knowledge. Here’s a step-by-step guide to get you started on your options trading journey:

-

Educate Yourself: Familiarize yourself with the fundamentals of option trading through books, online courses, and webinars. A solid understanding of option pricing, volatility, and risk management is paramount.

-

Open an Account: Choose a reputable broker like TD Ameritrade that aligns with your investment needs and offers a user-friendly options trading platform.

-

Start Small: Begin with small trades and gradually increase your position size as you gain experience and confidence. This approach helps you mitigate risk and refine your trading strategies.

-

Manage Your Risk: Establish clear risk management parameters, including stop-loss orders and position sizing guidelines, to protect your capital from excessive losses.

-

Monitor Your Trades: Keep a watchful eye on your open positions and adjust your strategy as market conditions evolve. Regular monitoring is essential to identify opportunities and manage risk effectively.

Option Trading Meaning In Td Ameritrade

Image: www.forexbrokers.com

Conclusion

The world of option trading is a gateway to enhanced financial agility and the potential for substantial returns. By understanding the mechanics of options, navigating the different types of contracts, and embracing the benefits and risks involved, you can harness the power of options to elevate your investment prowess.

Remember, embarking on this journey requires a commitment to education, smart risk management, and a disciplined trading approach. With the right knowledge and the support of a reliable broker like TD Ameritrade, you can confidently navigate the complexities of option trading and unlock the full potential of this dynamic market.

As the adage goes, “Fortune favors the bold.” So, embrace the world of options with a discerning eye, a resolute mind, and a willingness to conquer new financial frontiers.