As an options trader navigating the ever-shifting financial landscape, you know the struggle of staying organized and making informed decisions. Enter the option trading daily spreadsheet – your indispensable tool for tracking market movements, analyzing data, and maximizing your profit potential.

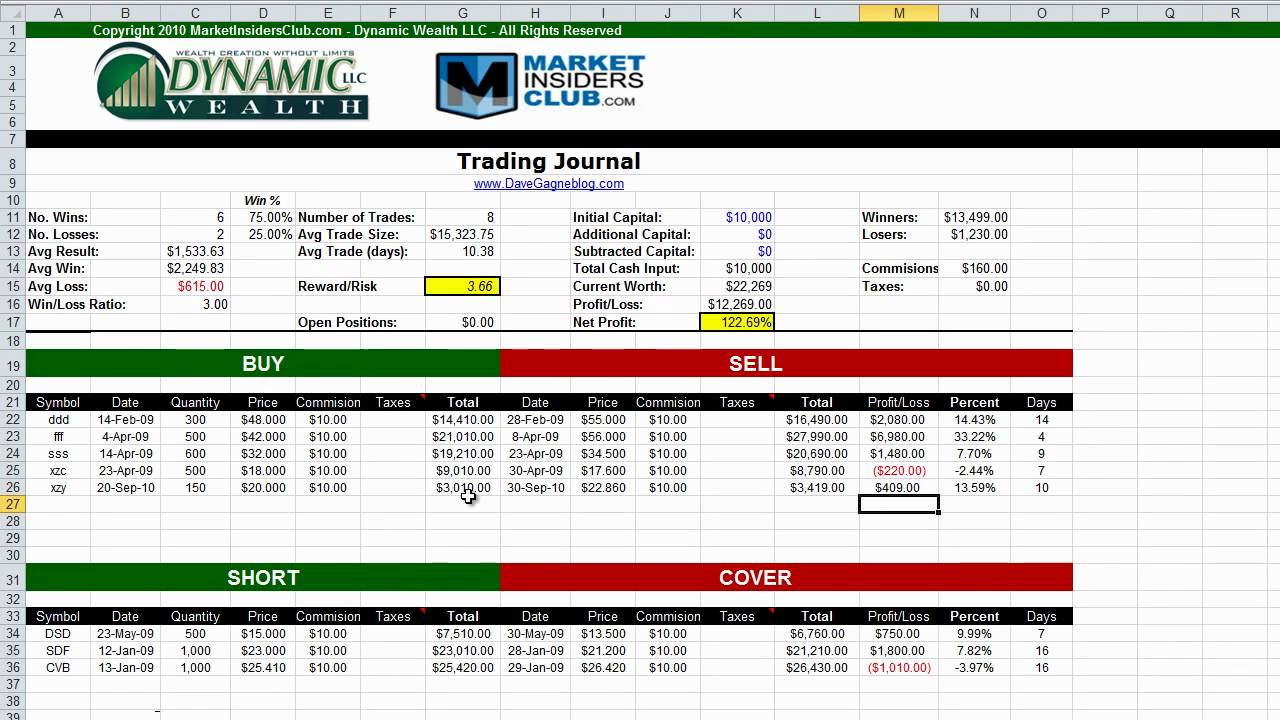

Image: db-excel.com

In this comprehensive guide, we’ll delve into the depths of using an option trading daily spreadsheet, unlocking its secrets and empowering you to trade with confidence and efficiency.

What is an Option Trading Daily Spreadsheet?

An option trading daily spreadsheet serves as a centralized hub for all your option trading activities. It’s a customizable tool that allows you to:

- Record option trades, including entry and exit dates, prices, and quantities.

- Track stock price fluctuations and Greeks (delta, theta, etc.) in real-time.

- Calculate profit and loss for each trade and your overall portfolio.

- Monitor option chain expirations and identify potential opportunities.

- Perform technical analysis and identify trading signals.

Essential Features of an Option Trading Daily Spreadsheet

- Data Entry Interface: Allows you to easily input trade data, such as symbol, expiration date, and strike price.

- Real-Time Data Extraction: Automatically pulls stock prices, Greeks, and other market data from data providers.

- Profit/Loss Tracking: Calculates unrealized P/L based on current market conditions and closed P/L for completed trades.

- Option Chain View: Displays option chains for specific underlying assets, enabling you to compare strikes and premiums.

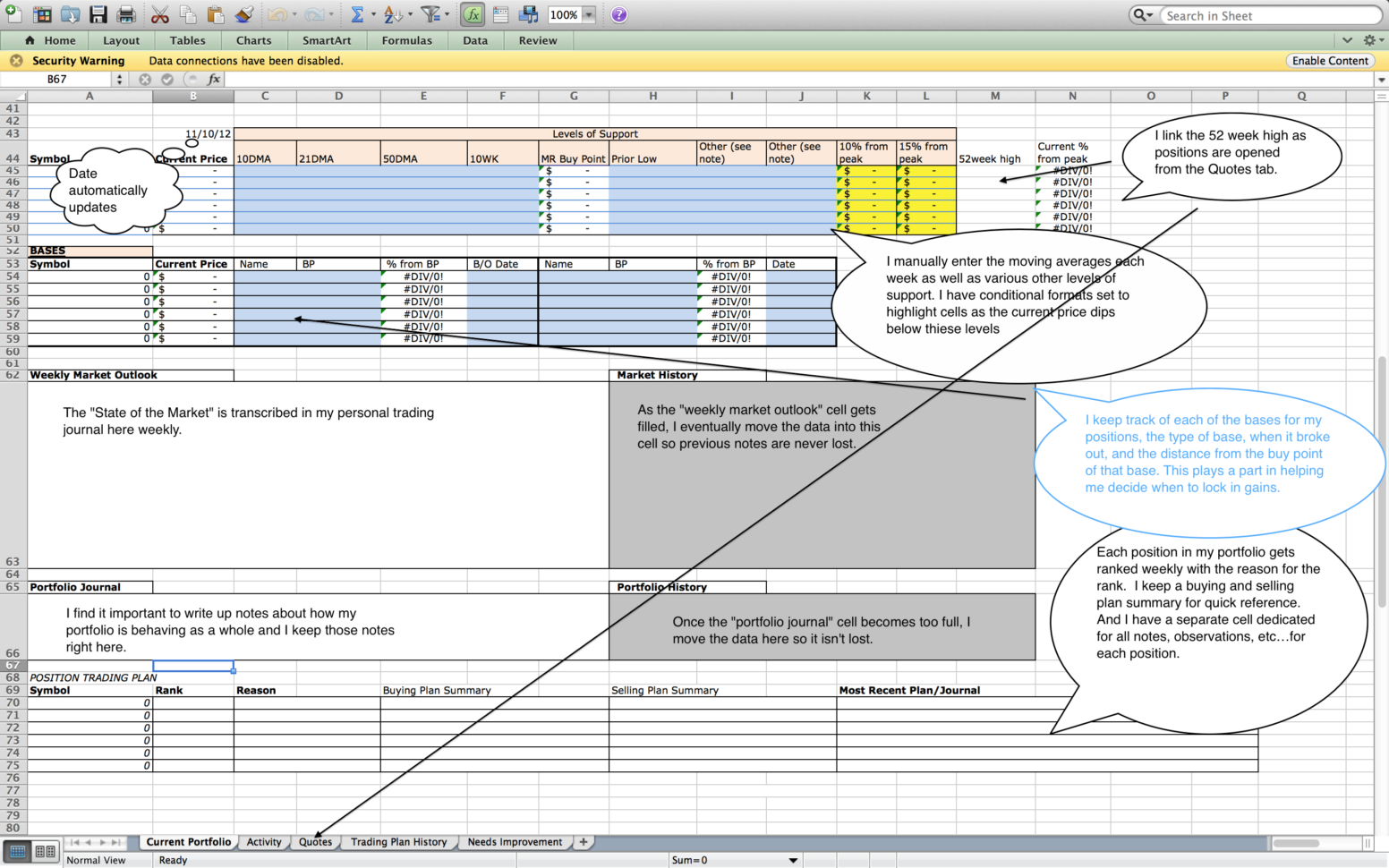

- Technical Analysis Tools: Incorporates charts and indicators for trend analysis, such as moving averages, Bollinger Bands, and RSI.

Steps to Creating an Option Trading Daily Spreadsheet

- Choose a Spreadsheet Platform: Select a user-friendly spreadsheet software like Microsoft Excel, Google Sheets, or OpenOffice.

- Set Up the Basic Structure: Create columns for trade details, market data, and calculations.

- Customize the Data Entry: Design data entry templates that match your trading style and information requirements.

- Automate Data Extraction: Use formulas or plugins to automatically pull market data from data providers.

- Add Calculations: Implement formulas for P/L calculations, delta adjustment, and other analysis.

Image: fadinafeesah.blogspot.com

Expert Insights for Using an Option Trading Daily Spreadsheet

- Mark Minervini (Author, “Think and Trade Like a Champion”): “A good trading journal is like a doctor’s chart that tracks your trading progress, allows you to review your mistakes, and helps you identify areas where you can improve.”

- Tom Sosnoff (Founder, tastytrade): “A daily spreadsheet should be your constant companion, enabling you to track your trades, manage your risk, and identify patterns that can lead to profitable opportunities.”

Actionable Tips for Maximizing Results

- Maintain Consistency: Update your spreadsheet regularly to ensure accurate data and insights.

- Use Color Coding: Highlight trades based on profitability, strategy, or other parameters for easy visual analysis.

- Integrate Risk Management Tools: Include stop-loss levels and position sizing formulas to manage risk and protect your capital.

- Review and Analyze Performance: Regularly assess your trades to identify strengths, weaknesses, and areas for improvement.

- Seek Professional Guidance: Consult with experienced traders or financial advisors if you need help with spreadsheet setup or analysis.

Option Trading Daily Spreadsheet

Image: db-excel.com

Conclusion

An option trading daily spreadsheet is an indispensable tool that empowers option traders to make informed decisions, optimize their strategies, and maximize their trading potential. By incorporating the insights and tips outlined in this guide, you can leverage this valuable tool to refine your approach, achieve better outcomes, and ultimately become a more successful trader. Remember, knowledge is power, and a well-maintained daily spreadsheet is the key to unlocking that power in the world of options trading.