Introduction:

In the ever-evolving world of finance, broker trading options have emerged as a transformative tool for investors in Indonesia. As a nation brimming with economic potential, Indonesia offers a fertile ground for individuals eager to explore the intricacies of trading options. This comprehensive guide delves into the realm of broker trading options in Indonesia, providing insights into its history, fundamental principles, and latest developments.

Image: seputarkerja.id

History of Broker Trading Option Indonesia

The Indonesian stock market, Bursa Efek Indonesia (BEI), has been at the forefront of financial innovation for decades. The introduction of option trading in 1997 marked a watershed moment, opening up a dynamic new avenue for investors. Since then, the market has witnessed a steady growth in the volume of option transactions.

Demystifying Options Trading

An option refers to a derivative contract that grants the holder the right, but not the obligation, to buy or sell an underlying asset at a predetermined price within a specified timeframe. In the case of Indonesia, options are primarily traded on the Jakarta Composite Index (JCI) futures contract.

There are two main types of options: calls and puts. Call options convey the right to buy the underlying asset, while put options grant the right to sell. The underlying asset can be stocks, exchange-traded funds (ETFs), indices, or even commodities like gold or oil.

Benefits of Broker Trading Option

Image: www.seputarforex.com

1. Unlimited Profit Potential:

Unlike traditional stock trading where profits are capped at the price of the asset, option trading offers unlimited profit potential. This is because options are leveraged instruments, which allow investors to control a significant number of shares with a relatively small investment.

2. Risk Management:

Options can be utilized as a risk management tool. By buying an option on an asset you own, you can hedge against potential losses in the underlying asset.

3. Market Exposure:

Options provide investors with the opportunity to gain exposure to a specific market or sector without having to purchase the underlying asset directly.

How to Choose a Broker for Option Trading

Selecting a reputable and experienced broker is crucial for successful option trading. Key factors to consider include:

1. Regulation:

Ensure that the broker is licensed and regulated by a recognized regulatory body such as the Financial Services Authority (OJK) in Indonesia.

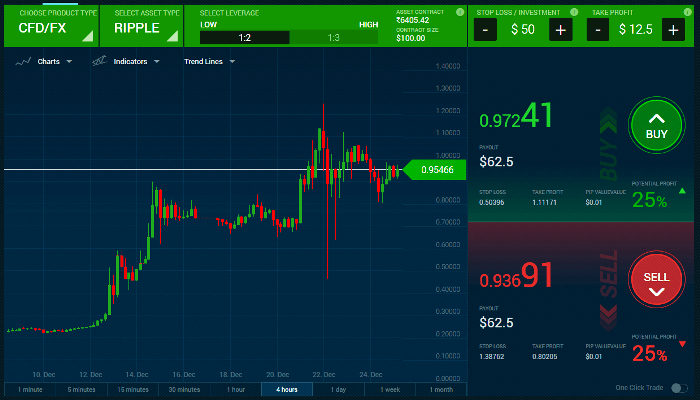

2. Trading Platform:

The broker’s trading platform should be user-friendly, intuitive, and equipped with the necessary tools for option trading.

3. Fees and Commissions:

Compare the fees and commissions charged by different brokers to avoid excessive trading costs.

Emerging Trends in Broker Trading Option Indonesia

The broker trading option landscape in Indonesia is constantly evolving. Here are some notable trends:

1. Technology Enhancements:

Advancements in technology have led to the development of automated trading systems and sophisticated analytics tools, making it easier for investors to trade options.

2. Growing Investor Interest:

As financial literacy improves in Indonesia, more individuals are exploring the potential of option trading. This has resulted in an increase in demand for broker trading services.

3. Regulatory Framework:

The OJK has been proactive in regulating the option trading market to ensure transparency and investor protection.

Broker Trading Option Indonesia

Image: androclue.com

Conclusion:

Broker trading options in Indonesia has transformed the financial landscape, offering investors an array of opportunities. By understanding the basics of option trading, carefully selecting a broker, and embracing emerging trends, individuals can harness the power of this instrument to achieve their financial goals. Whether you are a seasoned trader or a novice just starting out, the world of broker trading options in Indonesia is ripe with possibilities, waiting to be explored.