The financial realm perpetually enchants with its multifaceted complexities, where the pursuit of profit spurs traders to explore the depths of innovative strategies. Among this formidable arsenal lies option gamma pin trading, an intricate technique that harnesses the power of gamma to maximize returns while minimizing risk. This comprehensive discourse seeks to unveil the secrets of this exceptional approach, empowering traders of all levels to harness its potent potential.

Image: www.projectfinance.com

Demystifying Option Gamma Pin Trading: A Calculus of Control

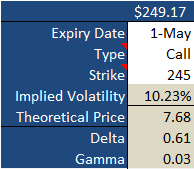

Option gamma quantifies the rate at which an option’s delta, or its sensitivity to changes in the underlying security’s price, changes with respect to changes in the underlying security’s price itself. Pin trading capitalizes on this phenomenon by engaging in tightly defined strikes, effectively neutralizing delta fluctuations and isolating gamma exposure. This pinpoint precision in strike selection enables traders to harvest gamma’s volatility-fueled rewards while safeguarding against potentially disastrous delta swings.

Historical Roots and Contemporary Relevance: Pin Trading through the Ages

The origins of pin trading can be traced back to the early 1990s, when options trading began its ascent to prominence. Initially confined to manual execution and rudimentary pricing models, this strategy gained mainstream acceptance with the advent of sophisticated trading platforms and advanced analytics. Today, pin trading stands as a staple in the arsenals of savvy traders seeking to navigate the ever-evolving financial landscape.

Essential Concepts: A Lexicon of Pin Trading Lingo

To embark on the path of pin trading mastery, a thorough understanding of its specialized terminology is paramount. Pin strikes are judiciously selected strikes that effectively neutralize delta, thereby isolating exposure to gamma. This meticulous strike selection aligns with the underlying security’s current price, ensuring maximum pin efficacy. Delta-neutral portfolios, comprising an assemblage of options with opposing deltas, form the cornerstone of pin trading strategies, facilitating the isolation of gamma exposure.

Image: www.bigtrends.com

Practical Applications: Unlocking the Power of Pin Trading

Harnessing the potential of pin trading requires a deft touch, guided by a thorough understanding of its practical applications. In essence, this strategy excels in environments characterized by high volatility, where the underlying security’s price is expected to fluctuate significantly. Traders adeptly craft pin trades during periods of heightened volatility, aiming to capture the substantial gamma gains that accompany such market conditions. Utilizing delta-neutral portfolios, traders neutralize the potentially adverse effects of delta, allowing them to focus solely on reaping the rewards of gamma exposure.

Real-World Examples: Unmasking Pin Trading in Action

To fully grasp the practicalities of pin trading, delving into real-world examples is imperative. Pin traders vigilantly monitor the underlying security’s price trajectory, identifying points of potential volatility. Upon pinpointing such opportune moments, they meticulously select pin strikes that closely align with the current market price. By employing delta-neutral portfolio construction, they effectively neutralize delta risk, allowing gamma exposure to flourish. Throughout the life of the pin trade, constant monitoring and adjustments are de rigueur to maintain optimal positioning and maximize profitability.

Latest Trends and Developments: The Evolving Landscape of Pin Trading

The realm of pin trading is in perpetual flux, with new insights and methodologies emerging regularly. Technological advancements have played a pivotal role in the strategy’s evolution, with sophisticated trading platforms and computational tools enabling more precise trade execution and risk management. The increasing availability of real-time data and advanced analytics has further empowered traders, providing them with a deeper understanding of market dynamics and enhanced decision-making capabilities.

Option Gamma Pin Trading

Image: www.youtube.com

Conclusion: Ascending the Pinnacle of Profit Maximization

Option gamma pin trading stands as a testament to the ingenuity and adaptability of financial traders. By mastering the delicate dance between delta and gamma, pin traders unlock the potential for exceptional returns while skillfully managing risk. This article has provided a comprehensive exploration of this intricate strategy, encompassing its history, essential concepts, practical applications, real-world examples, and contemporary evolutions. Equipping traders with this invaluable knowledge and guidance, we empower them to ascend the pinnacle of profit maximization and conquer the ever-changing financial landscape.