In the fast-paced world of options trading, understanding the dynamic interplay between gamma and theta is crucial for maximizing profits and minimizing losses. These concepts, often shrouded in mathematical complexity, are essential pillars that shape the very foundation of options pricing and risk management.

Artboard 1.jpg)

Image: www.analyticssteps.com

Demystifying Gamma: The Price Sensitivity of Delta

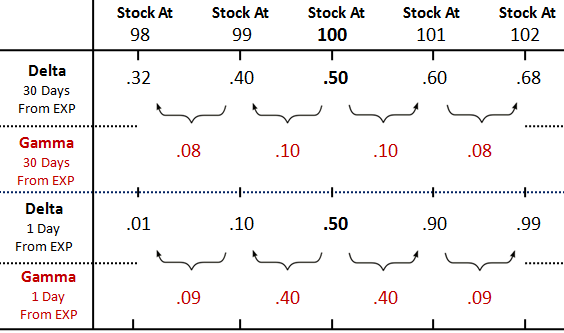

Imagine the delta of an option as a measure of its price sensitivity to underlying asset price changes. Gamma, in essence, quantifies the rate of change in delta. A high gamma indicates a significant shift in delta with respect to underlying price changes, while a low gamma implies a more stable delta.

Theta: Unveiling Time’s Impact on Option Value

Time is a relentless force in options trading, and theta captures the inexorable decay of an option’s value as time passes. This phenomenon, known as time decay, is primarily driven by the reduced probability of the underlying asset reaching the strike price as the expiration date approaches. Theta has an inverse relationship with time to expiration, meaning the closer an option gets to its expiration date, the faster its value erodes.

Unraveling the Intertwined Dance of Gamma and Theta

The interconnected relationship between gamma and theta forms the backbone of options pricing and risk management strategies. When gamma is positive, an increase in underlying asset price leads to a more favorable delta, enhancing the potential for profit. However, a negative gamma indicates a diminishing delta, resulting in a reduced profit outlook.

Theta, the ever-present time decay factor, plays a pivotal role in determining the overall impact of gamma on option value. A high gamma with a short time to expiration can amplify profit potential but also expose the trader to greater risk due to the accelerated time decay. Conversely, a high gamma with a long time to expiration provides cushion against rapid value erosion, offering more breathing room for market fluctuations.

Image: unygeduc.web.fc2.com

Strategies to Harness Gamma and Theta

Understanding gamma and theta empowers traders to devise effective strategies that leverage these parameters. For instance, traders seeking to capitalize on rapid price movements may consider options with high gamma and a shorter time to expiration, albeit with a cautious approach to manage potential losses. Those prioritizing risk management may opt for options with lower gamma and a longer time to expiration, sacrificing some upside potential for stability.

Options Trading Gamma Theta

Image: www.aimarrow.com

Conclusion: Empowering Option Traders with Gamma and Theta Mastery

In the ever-evolving landscape of options trading, mastering the concepts of gamma and theta is a game-changer. By comprehending these parameters and their intricate relationship, traders gain the upper hand in navigating market complexities and maximizing their profit-generating prowess. Whether seeking to tame volatility or harness the power of time, understanding gamma and theta empowers traders with the knowledge to make informed decisions and navigate the treacherous waters of options trading with confidence.