In today’s volatile and ever-changing financial landscape, options trading has emerged as a powerful tool for sophisticated investors seeking to enhance their returns. MATLAB, a versatile and widely-used programming language, offers a robust platform for developing advanced trading strategies and optimizing investment decisions. This article will unravel the intricacies of MATLAB options trading, empowering you with the knowledge and techniques to navigate this dynamic market effectively.

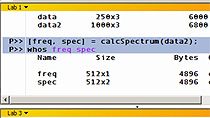

Image: hyperjes.weebly.com

Delving into Options Trading: A World of Possibilities

Options contracts are financial instruments that confer upon their holders the right, but not the obligation, to buy or sell an underlying asset, such as a stock or currency, at a predetermined price on or before a specified date. They provide investors with remarkable flexibility to adjust their risk tolerance and cater to varying market conditions. By trading options, investors can potentially enhance their returns, hedge against potential losses, and gain unique insights into market sentiment.

Unleashing the Power of MATLAB for Informed Trading

MATALB, renowned for its numerical computing capabilities, excels in handling complex financial calculations and data analysis. It provides a versatile environment within which traders can develop custom algorithms, conduct comprehensive simulations, and refine their investment strategies. With MATALB, the intricate world of options trading becomes accessible and manageable, empowering traders to monitor market movements, identify opportunities, and optimize their risk-reward ratio.

Core Concepts for Demystifying Options Trading

To master the art of options trading, let’s delve into its foundational concepts:

- Call Options: Convey the right to buy an underlying asset at a fixed price (strike price) on or before a specific date (expiration date).

- Put Options: Grant the right to sell an underlying asset at the strike price on or before the expiration date.

- Covered Calls: Involving selling a call option while simultaneously holding the underlying asset, aims to generate premium income while maintaining ownership.

- Protective Puts: Purchased to offset potential losses in underlying assets owned, akin to insurance against market downturns.

- Black-Scholes Model: A widely-accepted valuation method for options contracts, incorporating factors such as price, volatility, risk-free rate, and time to expiration.

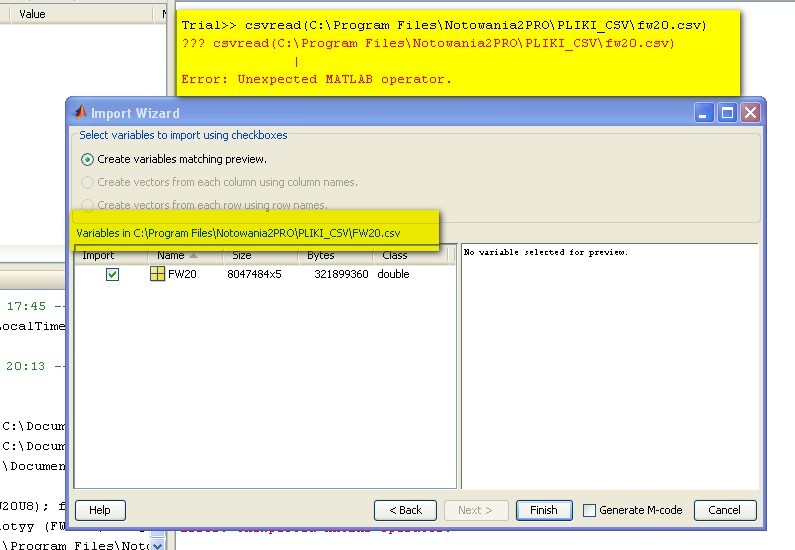

Image: www.mathworks.com

Embarking on an Options Trading Strategy

To embark on a successful options trading journey, consider the following steps:

- Define Investment Goals: Determine your financial objectives, risk tolerance, and investment horizon.

- Research Potential Assets: Thoroughly analyze the underlying assets of interest, considering market trends, financial health, and potential catalysts.

- Choose Option Type and Strategy: Select appropriate option contracts (calls or puts) based on your investment goals. Consider whether to employ single options or combine multiple strategies.

- Calculate Option Premiums: Determine appropriate premium pricing using valuation models or market data analysis.

- Manage Risk: Use methods such as position sizing, stop-loss orders, and hedging strategies to minimize potential losses and preserve capital.

- Monitor and Adjust: Continuously monitor market conditions, adjust positions as needed, and be prepared to exit strategies when necessary.

Advanced Techniques for Enhancing Your Edge

- Implied Volatility Analysis: Forecast market uncertainty and adjust option strategies accordingly.

- Greeks: Utilizing Greeks, such as Delta, Gamma, Theta, and Vega, to understand option behavior and make informed decisions.

- Statistical Arbitrage: Exploit price discrepancies between related financial instruments for profit opportunities.

- Quantitative Trading: Employ algorithmic strategies to automate trading decisions and enhance execution speed.

Matlab Options Trading

Image: www.traderslaboratory.com

Conclusion: Mastery in Options Trading with MATLAB

Embracing MATLAB options trading unlocks a world of possibilities for savvy investors. By harnessing the power of advanced analytics and tailored strategies, you can navigate the complexities of the market, mitigate risks, amplify returns, and gain a competitive edge in the financial arena. Remember, mastery comes through continuous learning, diligent research, and sound judgment. Engage with the wealth of resources available, seek mentorship from experienced traders, and let MATLAB empower you to shape your trading destiny with confidence and precision.